Disclaimer: This research should be used purely for informational purposes and is my own personal opinion. I bear no responsibility to whatever investment decisions taken by anyone with regards to this research.

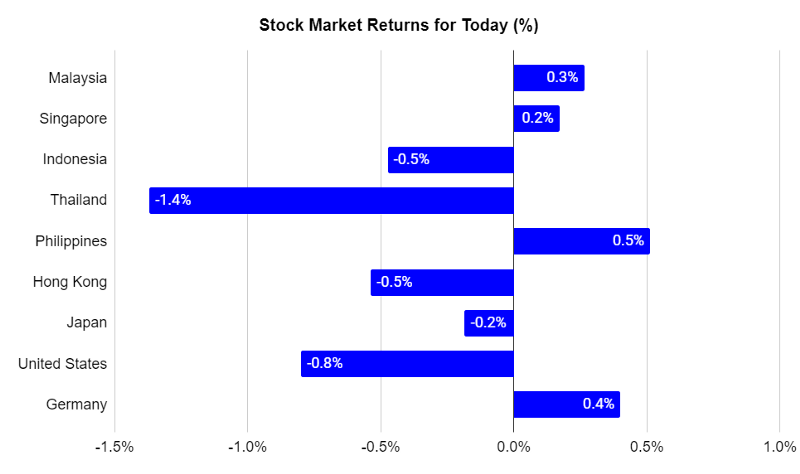

Market Performance: KLCI rose slightly while global markets registered mixed performances.

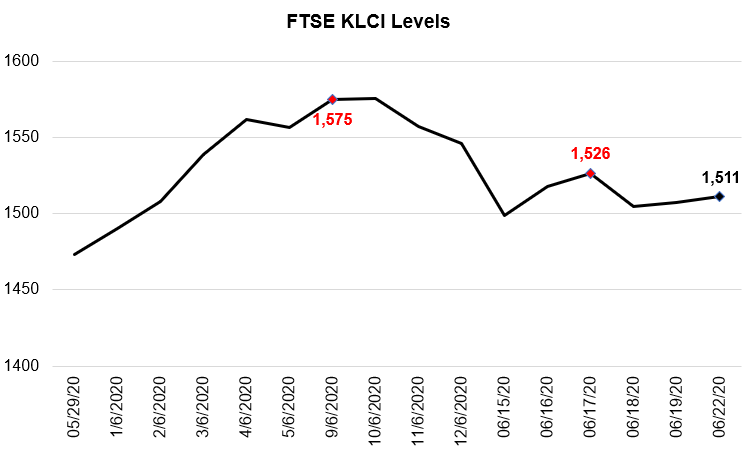

- The Kuala Lumpur Composite Index (KLCI) today rose slightly by 0.3% to settle at 1,511 points. The market has recovered past the 1,500 psychological level but has remained at this level from the last week.

- Global markets were mixed as each market processed the escalating Covid-19 situation, with their own unique domestic conditions. Thailand is noteworthy in this case, as it declined the most at 1.4% due to its tourism sector highly plugged in to the global economy.

- Thailand suffered the most today due to its heavy reliance on tourism revenue for its economy, and the escalation of Covid-19 cases in the world.

Market Outlook: More pullback from investors in the markets as Covid-19 cases escalate

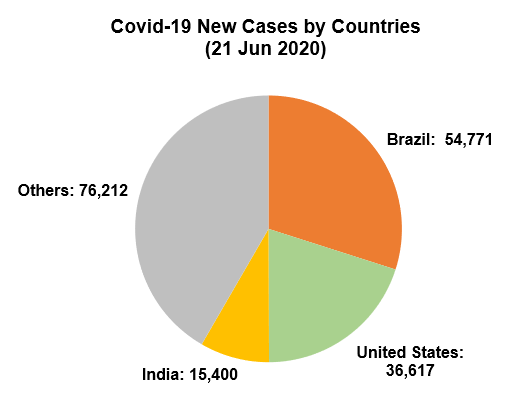

- The world recorded the largest single day increase in Covid-19 cases on Sunday.

The World Health Organisation reported the highest single day increase of 183,000 Covid-19 cases on Sunday, led by Brazil, United States and India. It seems very likely that the second wave of Covid-19 is already here, and is expected to be bearish on markets in the near future.

Portfolio Performance: Portfolio returns improved and remained higher than KLCI returns

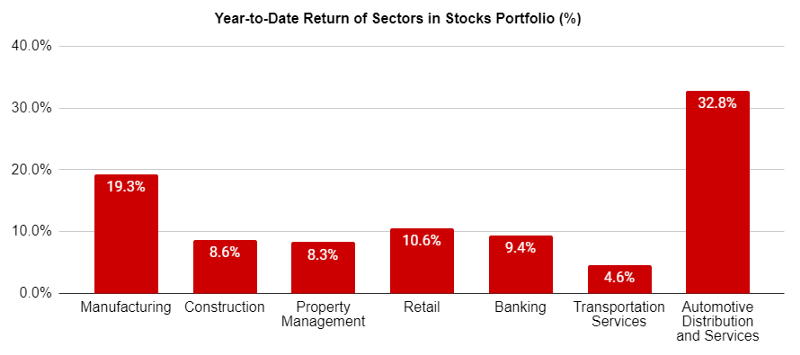

- To date, portfolio returns improved to 11.1% return (15 Jun 2020: 9.7%), outperforming the KLCI index at 10.3%.

- This indicates an alpha of +0.8% for today (15 Jun 2020: +0.3%). (Note: Alpha is a measure of how much higher or lower the portfolio performs against the market. A positive alpha indicates that the portfolio outperforms the market and vice versa).

- From a sectoral viewpoint, Automotive sector continues to outperform the other sectors in the portfolio.

As the market has settled at the 1500 level, I am aiming to accumulate more blue chip stocks especially in manufacturing and auto sectors. Right now, investors are moving to economic sensitive stocks and are betting on a recovery down the line. I am planning to position my portfolio for the long term, but I do not expect a recovery anytime soon.

Note: You can have a look at the companies I am keeping track on in the Google Excel sheet here