Disclaimer: This research should be used purely for informational purposes and is my own personal opinion. I bear no responsibility to whatever investment decisions taken by anyone with regards to this research.

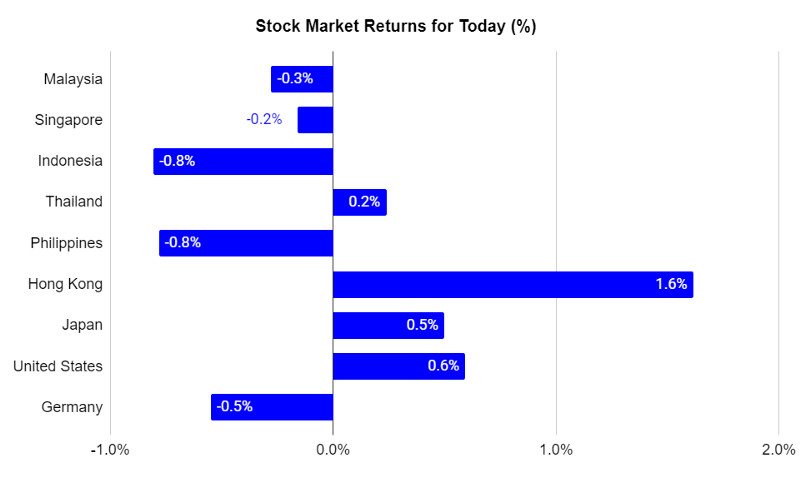

Market Performance: KLCI declined today as news about the US-China trade deal rattle markets momentarily.

- The Kuala Lumpur Composite Index (KLCI) today declined by 0.3% to settle at 1,507 points.

- Markets in the Asia region were mostly down with the exception of Hong Kong who gained 1.6% today. The United States market continued its recovery path, breaching the 26,000 level today.

- The Hong Kong market gained the most today due to the confirmation by Trump that the US-China trade deal is still intact, and the potential listings of more Chinese firms in the Hong Kong market.

Market Outlook: Mixed sentiments as an earlier scare from the Trump administration rattled markets, but was offset by positive economic news from the Eurozone.

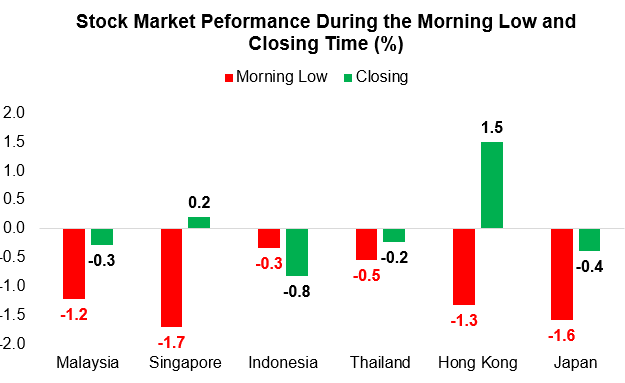

- Markets recover after an initial scare by US on the trade deal.

Earlier in the day, markets were rattled by a comment by one of Trump’s advisor that the US-China trade deal is over. Later, Trump clarified that the trade deal is still intact, boosting markets after the intra-day. Most markets recovered from their lows in the morning to end up higher during closing.

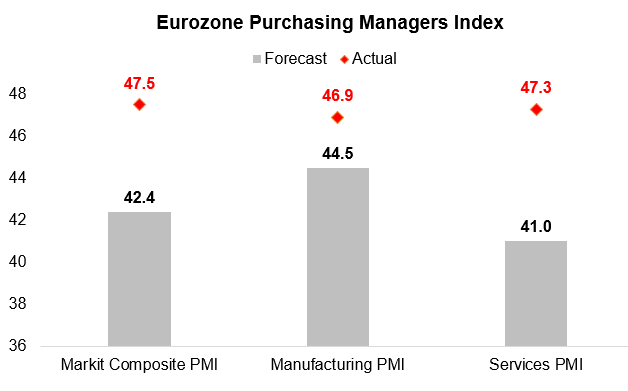

- Economic data out of the Eurozone indicates recovery trend moving forward.

Purchasing Managers Index for the Eurozone were better-than-expected for Jun 2020, and were all higher than May 2020. These indicators point towards companies’ views on production moving forward, and a reading below 50 indicates weaker production. However, while most managers still expect production to be weak moving forward, most of them are more optimistic about prospects this month.

Portfolio Performance: Portfolio returns were steady and remained higher than KLCI returns.

- To date, portfolio returns improved to 11.0% return (22 Jun 2020: 11.1%), outperforming the KLCI index at 10.3%.

- This indicates an alpha of +1.0% for today (23 Jun 2020: +0.8%). (Note: Alpha is a measure of how much higher or lower the portfolio performs against the market. A positive alpha indicates that the portfolio outperforms the market and vice versa).

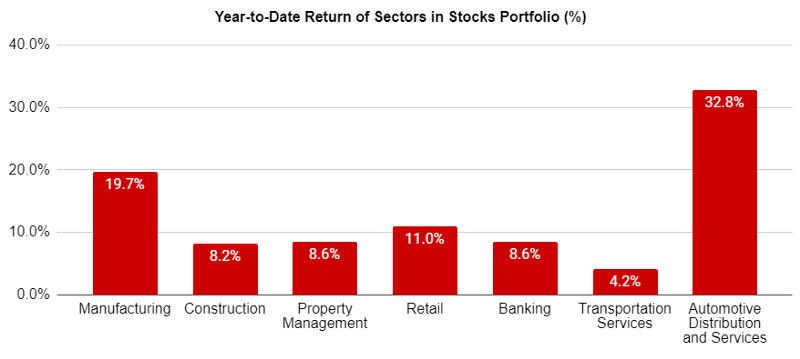

- From a sectoral viewpoint, Automotive sector continues to outperform the other sectors in the portfolio.

As the market has settled at the 1500 level, I am aiming to accumulate more blue chip stocks especially in manufacturing and auto sectors. Right now, investors are moving to economic sensitive stocks and are betting on a recovery down the line. I am planning to position my portfolio for the long term, but I do not expect a recovery anytime soon.

Note: You can have a look at the companies I am keeping track on in the Google Excel sheet here