Disclaimer: This research should be used purely for informational purposes and is my own personal opinion. I bear no responsibility to whatever investment decisions taken by anyone with regards to this research.

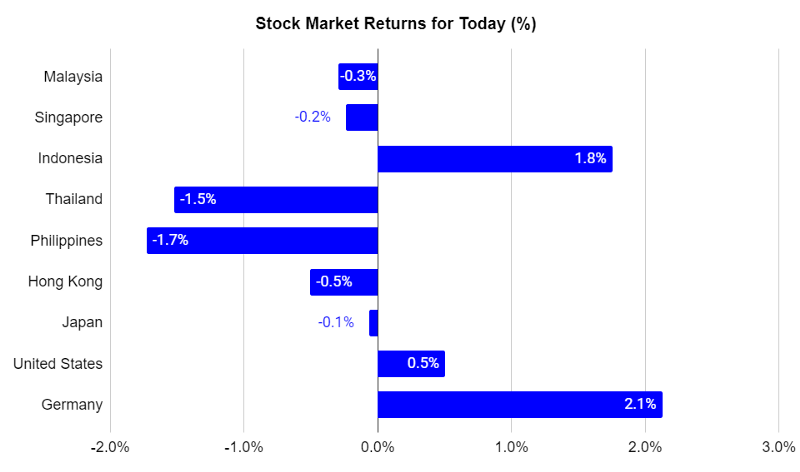

Market Performance: KLCI continued its decline today as most markets were down in the region

- The Kuala Lumpur Composite Index (KLCI) today declined by 0.3% to settle at 1,503 points.

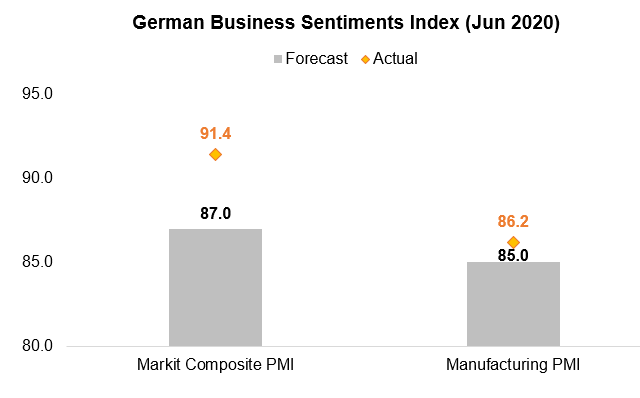

- Markets in the Asia region were mostly down with the exception of Indonesia, with losses lead mainly by Thailand and Philippines. The German market was up significantly as purchasing managers data yesterday indicated an improving economic situation.

- The Indonesian market stood out among the Asian stock markets today as the sole gainer, due to the authorisation of $1bn loan by the Asian Infrastructure Investment Bank (AIIB) to Indonesia.

- Both the Thailand and Philippines stock market declined sharply today due to the downgrade of economic growth and worsening budget deficit respectively.

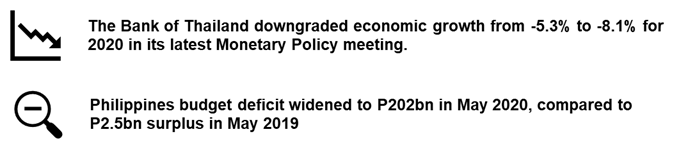

Market Outlook: Positive sentiments continue to come out from both the United States and Europe.

- Positive data out of United States and Europe, indicating an economic recovery.

I highlighted yesterday that the purchasing managers indexes (PMI) for Europe were better-than-expected, and today is no different for the US. US’s Manufacturing and Services PMI were better-than-expected in Jun 2020. While in Europe, both business expectations and business climate were all better-than-expected. These data indicated an improving economic conditions on the ground, and pushed markets higher.

Portfolio Performance: Portfolio returns improved and remained higher than KLCI returns.

- To date, portfolio returns improved to 11.3% return (23 Jun 2020: 11.0%), outperforming the KLCI index at 9.7%.

- This indicates an alpha of +1.6% for today (24 Jun 2020: +1.0%). (Note: Alpha is a measure of how much higher or lower the portfolio performs against the market. A positive alpha indicates that the portfolio outperforms the market and vice versa).

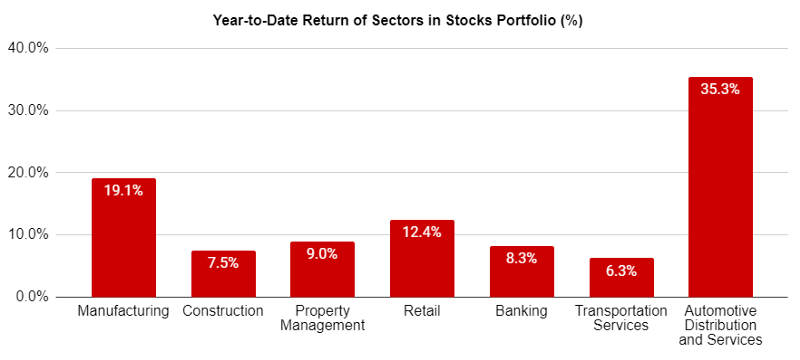

- From a sectoral viewpoint, Automotive sector continues to outperform the other sectors in the portfolio.

Note: You can have a look at the companies I am keeping track on in the Google Excel sheet here