Disclaimer: This research should be used purely for informational purposes and is my own personal opinion. I bear no responsibility to whatever investment decisions taken by anyone with regards to this research.

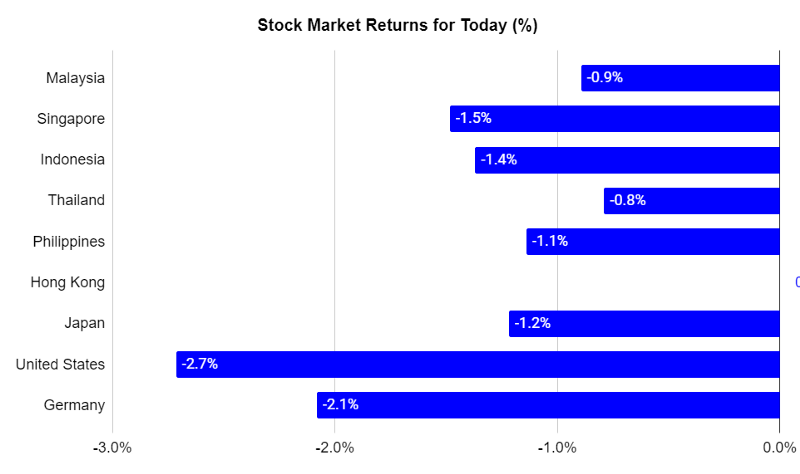

Market Performance: KLCI continued its decline today as all markets were down due to Covid-19 negative sentiments.

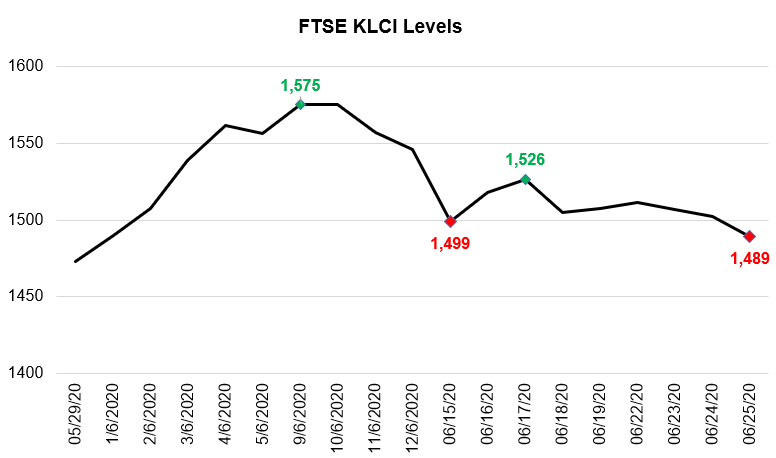

- The Kuala Lumpur Composite Index (KLCI) today declined by 0.9% to settle at 1,489 points, breaching the psychological support level of 1,500. This marks the second time the KLCI has dropped below this level since the beginning of the month.

- Global markets were all down, with the largest losers in the United States and German markets. Both of these markets grappled with increasing Covid-19 cases, rattling investor confidence.

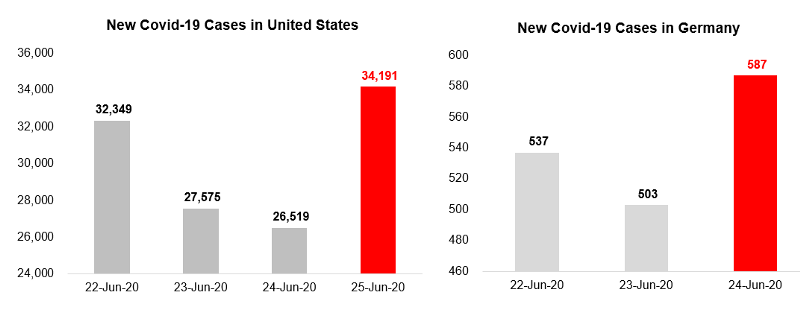

- Both the United States and German markets suffered from sharp increases in Covid-19 cases in their country. In the US, states such as Arizona, Massachusetts, Florida, and Texas have seen significant jumps in cases and their healthcare systems are struggling to cope. In Germany, authorities are struggling to contain outbreaks in meat processing plants in Gutersloha and Lower Saxony.

Market Outlook: Markets grapple with downgrades of economic growth from World Bank and IMF, while the Malaysian economy’s growth was also downgraded.

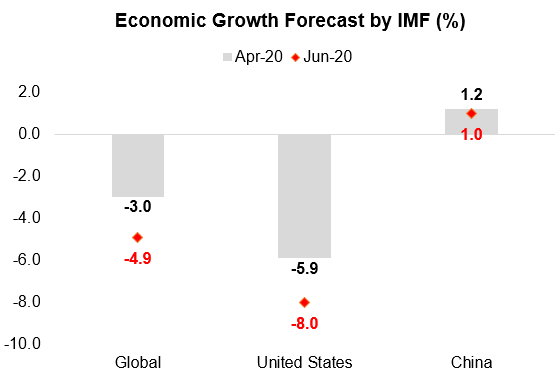

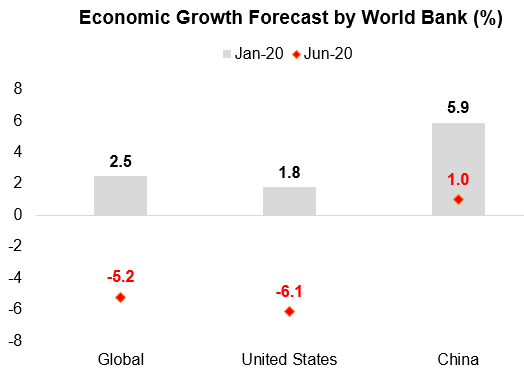

- Global economic growth has been downgraded by the IMF and World Bank, due to deeper impact of the Covid-19 pandemic.

Both the IMF and World Bank have downgraded economic growth down significantly due to ongoing concerns about Covid-19 and numerous lockdowns in the global economies. World Bank projects that this will be the deepest recession in decades while IMF opines that this will imperil the significant progress made in reducing poverty over the last decade.

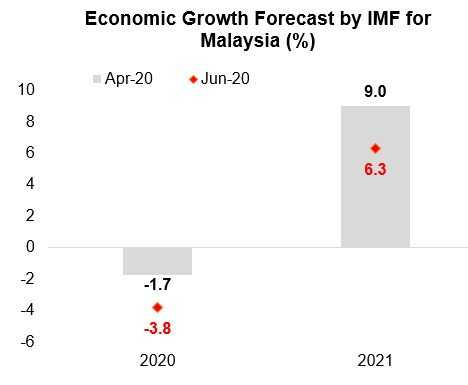

- In Malaysia, the IMF had also downgraded the economic growth in 2020 and 2021

Growth was downgraded significantly to account for the lower global growth, and Malaysia’s aggressive stance towards locking down the economy. Of noteworthy, even 2021 growth has been revised downwards signifying that the recovery might not be as strong as expected.

Portfolio Performance: Portfolio returns moderated but remained higher than KLCI returns.

- To date, portfolio returns improved to 10.0% return (24 Jun 2020: 11.3%), outperforming the KLCI index at 9.7%.

- This indicates an alpha of +1.3% for today (24 Jun 2020: +1.6%). (Note: Alpha is a measure of how much higher or lower the portfolio performs against the market. A positive alpha indicates that the portfolio outperforms the market and vice versa).

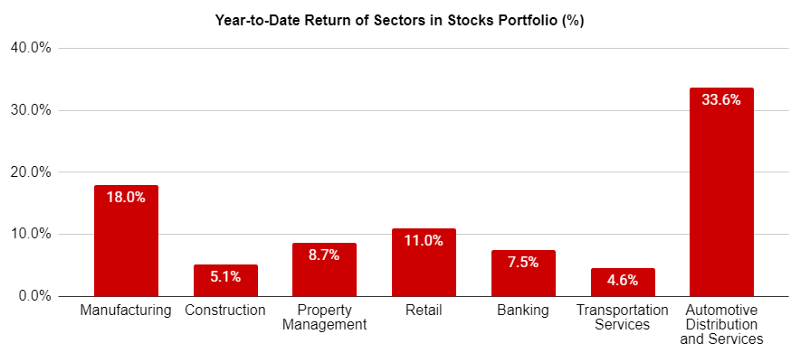

- From a sectoral viewpoint, Automotive sector continues to outperform the other sectors in the portfolio.

Note: You can have a look at the companies I am keeping track on in the Google Excel sheet here