1. Federal Reserve’s Possible New Inflation Target

The Fed is expected to use the annual Jackson Hole symposium this year to change the way it addresses inflation. Powell is expected to discuss a policy of allowing inflation to range on both sides of a target, letting it rise more than the Fed might normally do to help keep the economy from being trapped in low growth. — CNBC (Link)

Let me start by just stating my point of view on this. I think the Fed should do it, let inflation range on both sides of a target.

Firstly, the Fed has always targeted a 2% inflation target, but the conventional policy of using interest rates to bring inflation to 2% has proven inadequate to stimulate the economy. The Bernanke-led Fed in the early 2010s, took more drastic measures in that they reduced interest rates to record low (0% to 0.25%) and also purchasing a wider range of financial assets (Fed normally just purchases short term government bonds) from commercial banks and financial institutions. In recent times, the Fed has expanded its purchase to include junk bonds which was unprecedented. The decision to indirectly raise inflation target through a range at 2%, will no doubt bring inflation expectations higher for market participants.

Secondly, the higher inflation expectations will boost consumption and investment. Take for example, if John expects inflation to increase from 1.0% this year to 2.5% next year, John will buy more things now as prices will increase next year. The same case applies for a company looking to buy equipment. The expectations of higher prices will encourage people to spend more and companies to invest more, in turn boosting economic activities.

2. Rise of Retail Investors in Malaysia

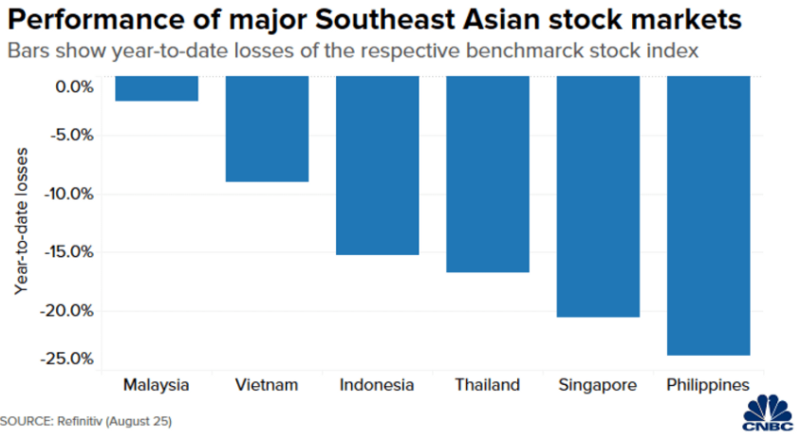

The increase in retail investor participation has helped the benchmark Malaysian stock index — the FTSE Bursa Malaysia KLCI Index — to recoup almost all of its losses from a sell-off in March. Participation by Malaysian retail investors has hit a record high this year, while foreign funds retreated from several stock markets around Asia — CNBC (Link)

I stand by my opinion that the KLCI should be trading at lower levels (about 1500) compared to the levels now (1560). That said, I am guilty also as a retail investors in pouring into the stock market during the MCO period. I accumulated stocks at low prices that I wanted to hold for the long term, but I didn’t touch any of the gloves stocks that were the center of attention of everyone.

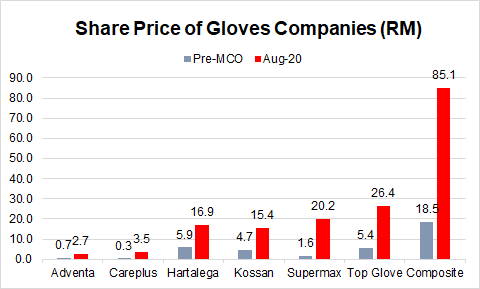

It is fair to say that much of the upwards performance of the Malaysian stock market was due to everyone piling onto gloves stocks. Gloves companies gained almost 359% since the MCO, aided by the retail frenzy for glove companies. Even less established glove companies who were penny stocks (Adventa, Careplus), are now trading like they are big boys in the market.

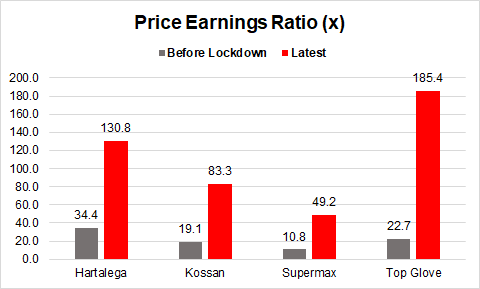

I have always said that gloves companies at this point belong to the cowboy territories and is overvalued. They are perfect for me to day trade as there are so much volatility and its valuations are just at nonsense territory. They are all trading 3–4 times above their historical price earnings ratio, meaning they have to grow 3–4 times their current size, which seems unrealistic to me.

3. Tik Tok CEO Quiting

TikTok chief executive officer (CEO) Kevin Mayer has left the Chinese-owned video-app firm just three months since joining. The resignation comes at a tricky time for superfast growing TikTok as it tries to persuade both the United States and India that it is not a security threat, while at the same time holding discussions with prospective buyers following a second US order demanding the sale of its US operations. — The Edge (Link)

In the latest saga of Trump bashing on Tik Tok, cause of China, this is really an unwelcome development. We all know why Trump is doing this. Election is near and his approvals are low. Bash China, make his electoral happy. Right now, both Orcacle and Microsoft are in talks to acquire some stakes in Tik Tok’s operations in US, Australia and New Zealand.

I am actually supportive of these transactions as it is a win-win especially for ByteDance (Tik Tok) and Microsoft. One, Tik Tok currently only have 2 ways of monetisation, and is having difficulties in monetising. Creators can stream for donations, and a dedicated $200m fund is established to support creators who create good content. Other than that, there really are no other forms of revenue for Tik Tok. For Microsoft, it has struggled to establish a social media or streaming base for itself. The closure of Mixer, its streaming platform, serves as an important lesson for Microsoft that it currently does have the expertise to run social media and streaming platforms. This deal will provide a way for ByteDance to take some money off the table and for Microsoft to establish its social media presence. This partnership also provides synergies for potential monetisation channels for Tik Tok as Microsoft has a well-established business and sales divisions that spans the globe.