Air Asia’s Ongoing Troubles

AirAsia X Bhd (AAX) has been hit with a US$22.98 million (RM95.33 million) suit in the UK for alleged breach of contract. BOCA alleges that AAX Leasing Two had breached its obligations under the lease agreements. There were also breaches under the leases’ respective guarantees, dated Dec 28, 2018, it claims. Shares in AAX finished unchanged at 6.5 sen, valuing the company at RM269.36 million. The counter saw 11.95 million shares traded. — The Edge (Link)

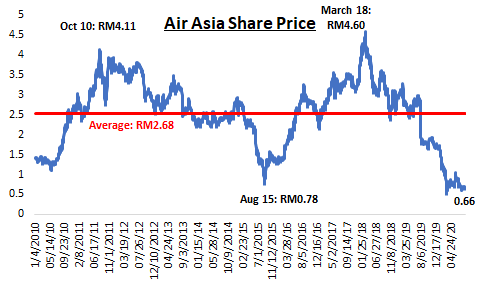

Air Asia’s woes continue, and it isn’t looking pretty. Weak global economy and a crash in tourism, have threw a spanner into the works for the world’s best low cost airlines. Its share price have declined from its peak of RM4.60 in Mar 2018 to RM0.66 currently, representing a decline of over 86%.

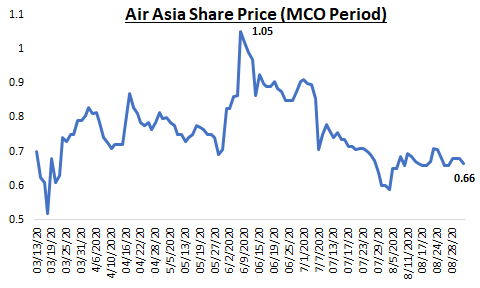

Back in Jun 2020 when Air Asia was “recovering” in terms of share price, I didn’t buy it. Share price went all the way up from RM0.52 until RM1.05, boosted by many reckless buying up of stocks from investors. Back then, most investors did not take into account the horrendously bad 2Q, as 2Q results will only be out in Aug 2020. Fast forward to today, Air Asia is making RM1.0bn in losses in 2Q, driving them further into a ditch. At this point, I feel bad for investors who entered during the RM1.00 mark.

K-Shaped Recovery

As the US economy struggles to shake off the pandemic effects, worries are growing that the recovery could look like a K. It’s a scenario where big-box retail and Wall Street banks benefit and mom-and-pop shops and restaurants and other service profession workers lag. The uneven benefits of the recovery pose longer-term risks for the national economic health — CNBC (Link)

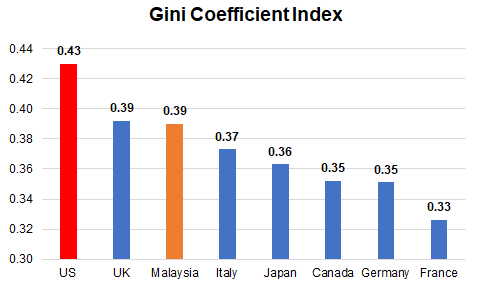

Wow, economists and markets love to come up with weird letters huh? K-shaped recovery? For the ordinary people, this just means that the recovery is uneven, in that the rich is recovering much faster, while others are still struggling. This has much to do with the Gini Coefficient which measures the inequality of countries (the higher, the more inequality), where the United States are one of the most unequal countries in the world (For more information on Gini, please refer to this link). Surprisingly also, Malaysia is quite high up in terms of inequality.

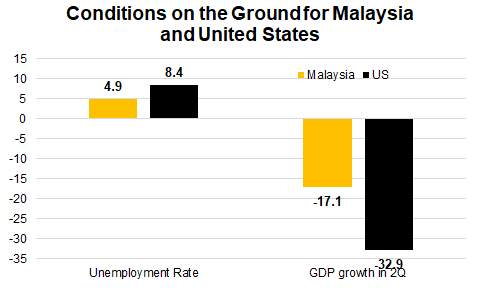

I am sure we have seen how crazy the stock market has been this year, with sky high valuations. The Dow Jones is currently trading at 29,000 levels, which is historically record high. About 52% of the stock market is owned by the top 1% of US earners (CNBC). The 1% have been reaping enormous benefits from the bullish stock market, while conditions on the ground are dire with 8.4% of the population out of a job currently and GDP contracting by 9.1% in 2Q 2020. We also see a similar trend happening in Malaysia. The KLCI index was on an uptrend until its peak of 1611 level in July 2020, defying rational expectations on the ground. GDP declined by 17.1% in 2Q 2020, with about 4.9% of Malaysians out of a job.