20 and 40 sen for Online Transactions

The Communications and Multimedia Ministry is planning to impose an additional charge of 20 sen for purchases between RM200 and RM1,000 on online platforms, said its deputy minister Datuk Zahidi Zainul Abidin. “So, the additional charge will be like the service charge, and if the purchase exceeds RM1,000, the additional charge will be 40 sen,” He said no additional charge would be imposed on purchases below RM200 while an additional 20 sen would be charged for the next RM1,000 worth of purchase. — The Edge (Link)

20 sens for any online transactions valued between RM200 to RM1000, and 40 sens for transactions above RM1000. In general, I am not in favour of taxes imposed on any goods and services, but I do understand the “need to get money from us” mentality of the government. Oil revenue is down, GST will have a hard time being reimposed in this current political climate, and online marketplaces are big tax revenue sources moving forward.

While I understand the rationale in applying these taxes (Government whether Barisan Nasional or Pakatan Harapan will inevitably squander them away and justify them as “necessary investments”), I do disagree the way this is being implemented, particularly the tax structure.

The issue I have is why are transactions worth below RM200 not subjected to the tax. Taxing transactions above RM200, have more impact on industries that have higher priced products. Consumers will be more incentivised to purchase products priced below RM200, and conduct multiple transactions to escape the taxes. If you need to tax, tax everything.

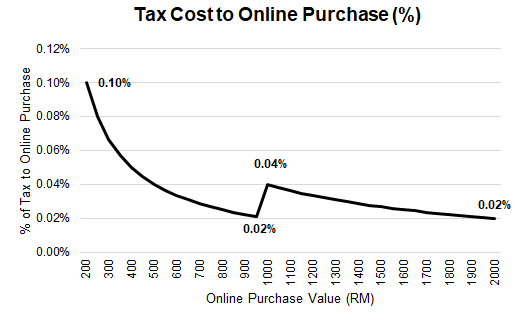

However, in the bigger scheme of things, what is 20 and 40 sens? The cost to consumers are capped at 0.1% of the total value. However, there is something interesting happening at the RM1,000 level. Cost to tax % increases from 0.02% to 0.04%, incentivising consumers to either keep purchases below RM1,000 or go all the way to RM1,900 to obtain 0.02%. These kind of fixed taxes have always had a disproportionate impact on consumer decisions.

An ordinary buyer will just brush them off and say they are too low to make a difference. However, that applies to consumers that are well-off. The lower income bracket will feel this more than anything. This is fundamentally different from taxing lower income less and higher income more.

ECRL Realignment Again

The Ministry of Transport said it is looking at reverting the East Coast Rail Link (ECRL)’s alignment to the original route planned under the previous Barisan Nasional (BN) regime, confirming a report by The Edge Malaysia. In a written response to a question from Senator Datuk Ismail Ibrahim, Transport Minister Datuk Seri Wee Ka Siong said the government is in the midst of reviewing Section C of the alignment, which is the stretch from Mentakab to Port Klang, in respect of the original alignment which goes through Bentong and Gombak — The Edge (Link)

ECRL alignment is being changed… again. When Pakatan Harapan took over in 2018, they changed the alignment for ECRL, and that delayed the implementation of ECRL. They also revealed the “real cost” of the project that was higher than advertised, and the hanky panky that went on behind the scenes. In my opinion, it was used mainly for political purposes by the then government. Everyone understood that. So why in the world is ECRL changed again? When I covered the infrastructure sector in my previous job, backtracking and uncertainties were so common that the joke was that the Minister will first say what he or she wants, then his team will correct it later, and then the Minister will say things have changed. STOP CHANGING PROJECTS UNTIL YOU HAVE CONFIRM THAT YOU ARE GOING TO.

Grab’s New Funding Round

Southeast Asia’s Grab is in advanced talks with Prudential PLC, AIA Group Ltd and others as it seeks US$300 million to US$500 million in investment for its financial services unit. They said Grab Financial Group’s pre-money valuation — the value of an unlisted startup before its next funding round — has been estimated at about US$2 billion — The Edge (Link)

Ah, Grab. The perpetual boy who keeps asking for money from people. I do acknowledge its dominant position in Southeast Asia, but I have always wondered when will it grow up. This fresh round of funding for its financial arm (GrabPay, GrabRewards, etc) will be important to support its Grab Rewards program in my opinion. But when will Grab eventually tell us “Hey guys, we don’t need seed funding anymore, we are ready to grow up and give you your returns”? I am still waiting for that day.