Increasing Risk of Trade War Again

Semiconductor Manufacturing International Corp. retreated to a four-month low in Hong Kong after the U.S. imposed export restrictions on China’s largest chipmaker. The shares slumped as much as 7.9% on Monday, adding to their 25% loss for the month. Also listed in Shanghai, SMIC’s stock there retreated as much as 5.8% to the lowest level since its July debut. U.S. firms must now apply for a license to export certain products to the chipmaker, the Commerce Dept. said in a letter dated Sept. 25, reviewed by Bloomberg News. SMIC and its subsidiaries present “an unacceptable risk of diversion to a military end use,” the department’s Bureau of Industry and Security wrote. — The Edge (Link)

You know, I am really worried about the current trajectory of relations between United States and China. I thought Trump’s antics were just that — antics. These restrictions once again remind me of the 2018 and 2019 period where both United States and China engaged in a very damaging trade war. In Bank Negara’s publication, it estimated that the trade war could have cost a decline of 0.5% to 0.8% to Malaysia’s export growth in 2019.

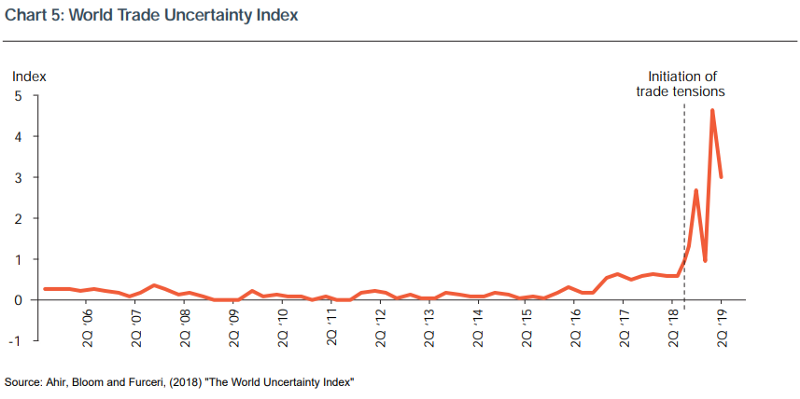

The uncertainty from the trade tensions increased risks to all investors around the world as the World Trade Uncertainty Index spiked.

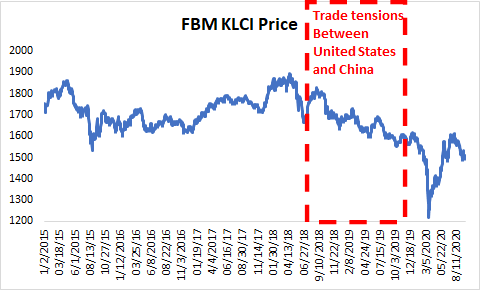

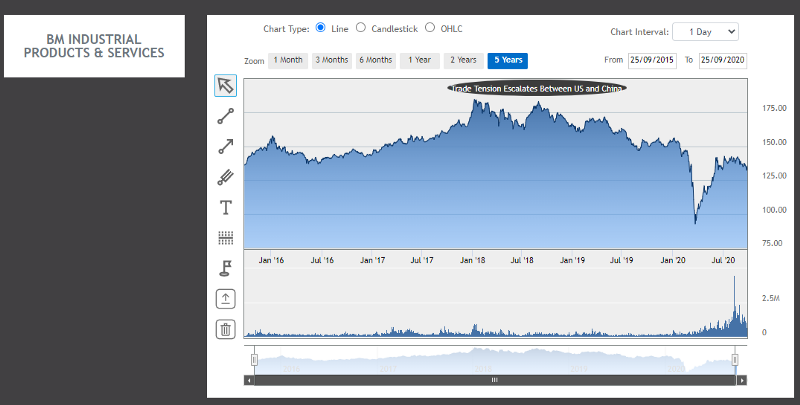

The stock market index back in 2018 and 2019 suffered from the trade tensions dragging the KLCI down. The manufacturing sector in particular which exported most of its products worldwide were affected considerably. The Bursa Malaysia Industrial Products and Services which is a proxy to the manufacturing sector declined gradually throughout 2018 and 2019.

While we are not seeing the impact from the Trump’s anti-China rhetorics this year, we have to be really careful if Trump is reelected again. It will just be back to the days of bashing China at the expense of the world economy and markets.