Ekovest Berhad, the company involved in the Bandar Malaysia project, is trying to buy RM85.8m of shares and warrants of PLS Plantations Berhad. With this transaction, Ekovest will have 57.3% of PLS, and control the company board. Ekovest constructs and manages roads and properties, while PLS Plantations mainly plants and sells palm oil and durians. This research will try to understand the rationale behind the deal and what it means for both companies.

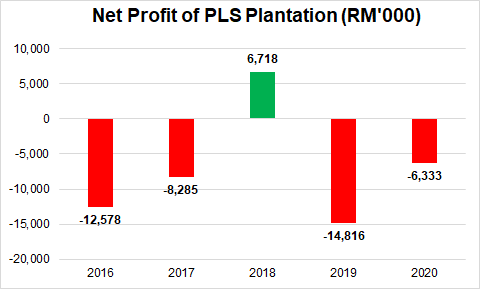

PLS Plantation could be Profitable Consistently Moving Forward

PLS has been consistently making losses for the last 5 years, with only 2018 being profitable. While PLS has blamed the poor performances on a myriad of factors such as wild animals intrusion, low CPO prices, and tough operating environment, it is plain to see that it’s not operating efficiently.

With Ekovest in charge, its fortunes might be changed as Ekovest will have enough funding to invest in projects that can improve how the company operates. We are looking at more machines and equipment that will make it cheaper and faster to collect and process palm oil and durians. However, I am concerned that Ekovest is primarily a construction company with little expertise in the palm oil business. As Ekovest wants to maintain the listing status of PLS, the success is conditional upon Ekovest putting the right kind of people and investment into PLS. This actually brings me to the next point on another consideration Ekovest might have for the long term.

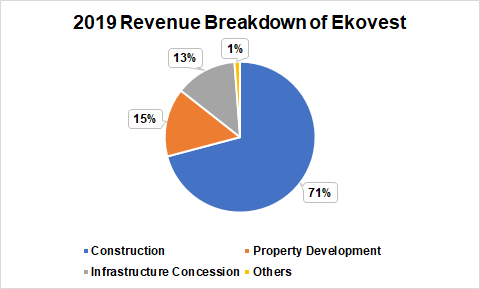

Ekovest Wants to Diversify, but Maybe not for the Reason We are Thinking Of

Ekovest explicitly has stated that it wants to diversify its business with the purchase of PLS shares. Currently, construction encompasses the majority of its business at 71% of revenue, followed by property development and Infrastructure Concession/Management.

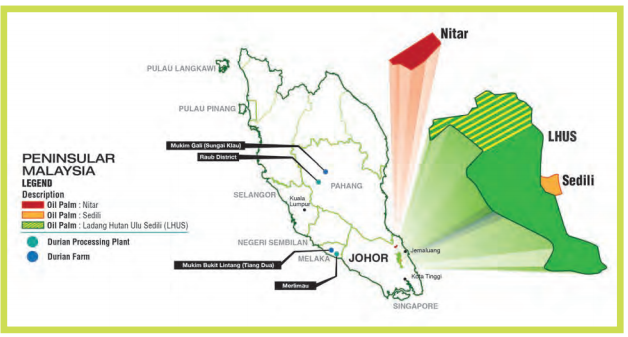

If Ekovest is to focus on increasing its plantation business, it will be …. focusing on 1% of its business now, which is a long shot or the start of a very long diversification process. So what does PLS have as a plantation company? Land. PLS has land, and 12,346 hectares of it.

I foresee that this might be a long term play for Ekovest in accumulating a large land bank for future property development projects. As land becomes more scarce in Malaysia, more and more companies are turning to agriculture companies having land. The land in Johor in particular is near to the Desaru Development spearheaded by Khazanah Nasional Berhad, and could have property developmental value in the future.