I have frequently used the price earnings ratio in all my analysis and valuations because it provides the easiest way to analyse a company. What is price earnings ratio? How do we use it to analyse a company? What are its strengths and weaknesses? This guide will attempt to inform you on the takeaway points about the price earnings ratio and how to use them as simple as possible.

- Part 1 will primarily talk about how price earnings ratio is used in normal market conditions and rationally.

- Part 2 will go into the irrationality of investors in the market, and how disastrous it can be for ordinary investors.

Price Earnings Ratio is How Much You are Willing To Pay for One Ringgit/Dollar of Profit

To put it simply, think of the price earnings ratio as the amount of money you would spend to buy a ringgit of profit of a company. Now, I know what you are thinking. Isn’t one ringgit of profit of a company worth one ringgit? Not exactly. Before proceeding, it is worthwhile to mathematically show what is the price earnings ratio. Price earnings ratio is Share Price divided by Profit per Share.

When we buy a share for a price earnings ratio of 10.0x, we are spending RM10 to buy the right for one ringgit of profit of the company FOR AS LONG AS THE COMPANY IS IN OPERATIONS. This statement has 2 implications that we need to understand

- If the company is still in business 10 years from now and makes the same amount of profit every year, you own the right to a total of RM10 profit of the company. If its still in business for 15 years, you own the right to a total of RM15 profit.

- If the price earnings ratio is 15.0x, you are using RM15 to buy RM1 of profit, which means its more expensive to own that RM1 of profit than 10.0x price earnings ratio.

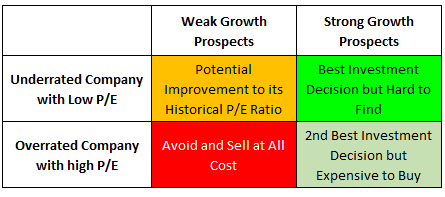

Normally, Low Price Earnings Ratio Indicate Underrated Companies, and High Price Earnings Ratio Indicate Overrated Companies …. normally.

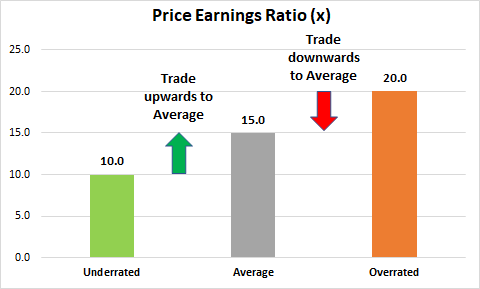

Recall back to the previous point on the 10.0x and 15.0x price earnings ratio, you need RM10 and RM15 respectively to purchase the right to RM1 profit of the company. 15.0x is more expensive because you spend more to buy RM1 profit. The observation on underrated and overrated companies can be inferred from looking at the price earnings ratio of companies.

As a rule of thumb, 15.0x is the average price earnings ratio companies typically trade at. This means that a company that has a 10.0x price earnings ratio is underrated and should trade to an average of 15.0x to be considered “fair”. If the company trades at 20.0x, it is considered overrated, and should trade back to 15.0x.

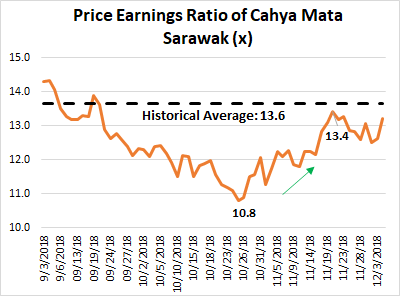

The most simple and straightforward strategy is to just buy underrated companies with price earnings ratio that are lower than 15.0x or their historical average, and wait for them to trade back upwards. This is exactly the same investment philosophy that Warren Buffet had in his early career and now — save up cash and buy companies when they are underrated. For example, Cahya Mata Sarawak in 2018 displayed such an investment strategy of buying at a low price earnings ratio (10.8x, underrated) and selling at the historical average price earnings ratio (13.6x).

However, sometimes it works, sometimes it doesn’t. Not all cases of low and high price earnings ratio indicate underrated and overrated companies. There are other reasons why some companies trade at lower or higher price earnings ratio and stay that way.

Companies which are Expected to Grow Strongly in the Future, Trades at Higher Price Earnings Ratio and Vice Versa.

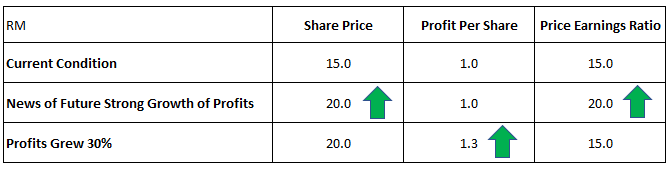

There are some companies who trade at higher price earnings ratio, and stay that way for a while. This is because investors expect that the company’s profits will grow strongly in the future and hence, buy more and more shares of the company, driving prices up. The price earnings ratio will then increase as the share price increase with its current profits per share remaining the same. Remember the Price Earnings Ratio above, but share price will increase with the current profits per share remaining the same.

So when a company trades at consistently high price earnings ratio, there is a possibility that investors are expecting that the company’s profits are due to grow strongly in the future. And when a company trades at low price earnings ratio, investors expect profits to be worse in the future.

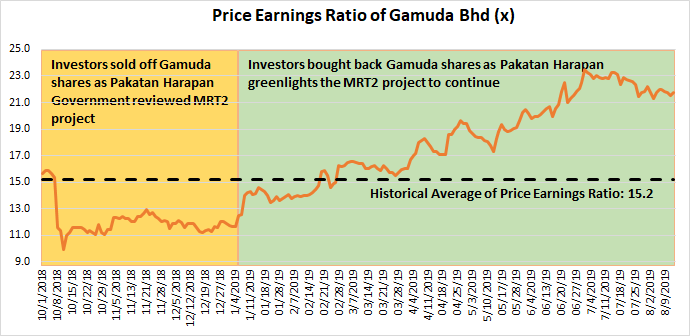

For example, in the case of Gamuda in 2018 and 2019, it followed a pattern of expectations of declining future profits and subsequently increasing future profits.

- Gamuda initially traded at below its historical price earnings ratio of 15.2x towards the 2nd half of 2018 due to Pakatan Harapan’s review/potential cancellation of the MRT2 project. Investors quickly sold off Gamuda shares (driving share price down, and also price earnings ratio) as they view that profits might decline in the future if Pakatan Harapan cancelled MRT2.

- MRT2 project review eventually turned positive as Pakatan Harapan decided that the project can proceed, and will still be under Gamuda. Investors flock back to Gamuda, driving up the share price and price earnings ratio, expecting that future profits will now increase significantly.

So, in simple terms, if we expect the company to grow strongly in the future, we will buy its shares, increase its share price and price earnings ratio and vice versa.

Buy Underrated Companies with Strong Future Profits

This is important. The best kind of investments are companies that are underrated with low price earnings ratio (cheap to buy) and strong future growth prospects. However, these companies are difficult to find as research into such companies require substantial amount of research and luck. The next best thing would be to buy companies that have high price earnings ratio and also strong growth prospects. This will be easier to find as these companies are more visible to most investors.