This is the continuation from the Part 1 of How I use the Price Earnings Ratio, where I mainly wrote about how I used the ratio in normal times to value companies. Part 2 here will encapsulate what happens when conditions aren’t normal and out of whack. More specifically, I will be using the gloves stock craze to illustrate what happens when emotions and sentiments are out of control and how we can tell from the price earnings ratio.

Movement Control Order encouraged more and more people into the stock market, especially into the gloves companies

I am sure this point will be familiar to most of us who got into the stock market during the MCO period starting March 2020. That period was difficult for everyone as we were all forced to stay at home to prevent the further spread of Covid-19 pandemic. The stock market became attractive for us during that time as we were also incentivised by our circumstances :

- Uncertainty about our jobs and income during the pandemic

- Most of our work requires physical presence in the office

- More time spent online at home

- Promises of quick and high returns from friends, colleagues, investment gurus

- Easier access to buying stocks from online platforms (Rakuten, CIMB, Kenanga, etc)

To many of us during this period, the stock market became our new haven of exciting investment opportunities and brought out our gambling tendencies. The Edge here reported that the volume of stocks traded in the Malaysia market reached a record peak of 27.8bn securities worth RM7.8bn on 11 Aug 2020.

Most of the activities in the stock market were focused on the gloves companies. There are a couple of reasons why these stocks became so hot to everyone during this period.

- Gloves are part of the personal protective equipment (PPE) needed to protect us from the pandemic

- Malaysia’s stock market has some of the biggest gloves companies in the world

- Every Tom, Dick and Harry had FOMO syndrome on gloves stocks

- Every research houses were bullish on gloves, pushing up interest in the companies

Everyone drove share prices of gloves companies up, and price earnings ratio rose to irrational levels

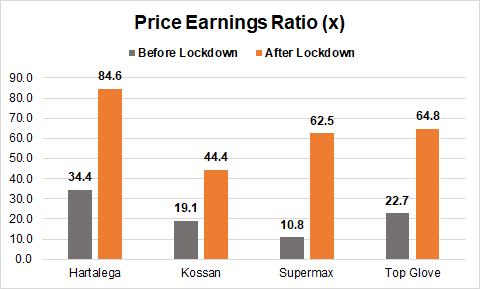

From part 1 here, I explained how the price earnings ratio is computed and interpreted. The buying up of glove companies reached irrational level, when gloves stock price earnings ratio reached the 100x level. For context, most companies normally trade at about 15x.

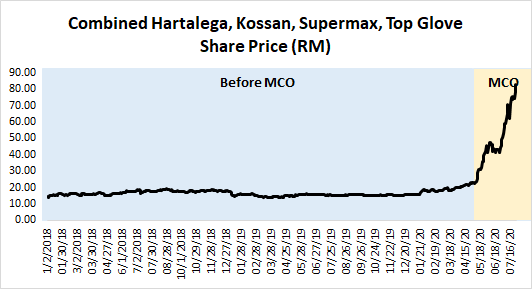

The graph below shows how the 4 companies of Hartalega, Kossan Rubbers, Supermax and Top Gloves fared before and after the MCO lockdown. The companies’ price earnings ratio rose to astronomical valuations making them highly speculative in nature.

While there are fundamental reasons for why gloves are hot now, these valuations are over the top and is more similar to gambling in Genting. When I plot the share prices of these companies before and after MCO, it is obvious that they are increasingly volatile today. Prices were very steady before the MCO but increasingly had more volatile trends of up and down during the MCO.

When price earnings ratio is very high and your relatives and friends talk excitedly about shares, its probably gambling and speculation

I have nothing against my relatives and friends regarding this and I am not saying that they don’t know anything about stocks. But if all you hear everyday are people talking about buying gloves cause “Very easy to make money”, “Must buy, or not you miss out”, “Why you so negative”, then I would like to suggest that we really take a hard look at our emotions and behaviours when we are buying them.

Are we unreasonably happy when we buy shares? Do we get a thrill when we look at our trading screen to see prices go up and down? Do we think the world is coming to an end when our investment is losing money?

If you answer yes, then you are not prepared to invest and trade in the market. The market is a cruel place, and it leaves no survivors. The thrill that you are getting is the same thrill you get from putting money into the slot machines in Genting.