It has been 9 months since the Covid-19 outbreak in January 2020. Much has changed since then. The way the stock markets around the world have behaved defied any kind of investment logics. It feels like the wild wild west again in 2020.

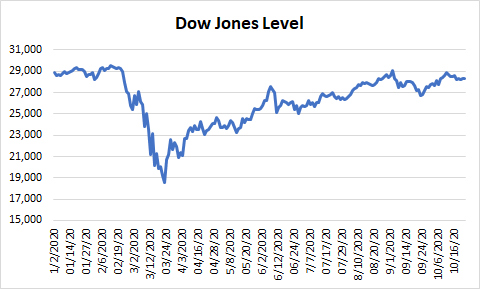

While I expected that the Dow Jones will trade around the 22,000 to 23,000 level in 2020, it certainly has not done so as it increased back to its pre-crisis levels.

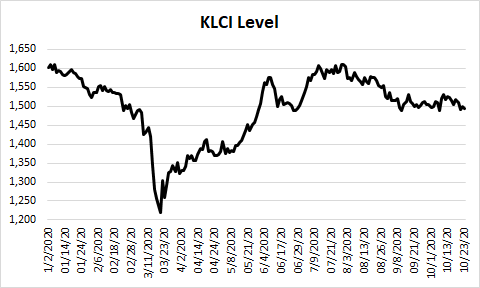

I predicted the same thing would happen to the Malaysian stock market, KLCI, that it will not be able to maintain its high valuations after recovering back to the 1,600 level in July 2020. It did decline back to the 1,500 level subsequently, after most of the 2Q company results came back worse-than-expected.

In light of these conditions in the stock market, I have rethought my investment strategies in the KLCI market and hopefully I will be able to implement them effectively.

Conserve Cash for Cheap Opportunities in the Banking Industry

I still think the KLCI at this point is a bit overvalued and I am waiting to see whether it will decline down to the 1,450 level. I have sold some of my positions since entering in Apr 2020, and is aiming to conserve cash for any opportunities in the banking companies.

There are primarily 3 reasons why I am looking at banking companies now:

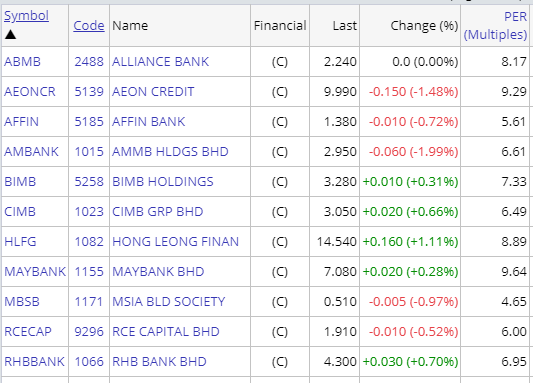

- They are becoming cheaper in terms of valuation to buy

Due to the Covid-19 pandemic, Bank Negara Malaysia has reduced the interest rates for the banking sector to help stimulate the economy. Combined with the loan moratorium also, it has significantly impacted the profitability of banks and were oversold by most of the investors. Most of the banks are now trading at price earnings ratio of below 10x, which makes them attractive to buy.

- Banking companies are good long term investments, with steady cash flows and dividends

Banks are still going to be around no matter whether it’s boom times or recessions. In economics, banks are deemed critical companies that the government has to support no matter what. This is because all of our savings are in them, and the banks have a key role in financing all economic activities. Without them, the economy will cease to function and we will be going back to the stone age where we need to barter with each other. - There might be an opportunity to enter if Bank Negara Malaysia lowers interest rates again

Bank Negara will decide whether to maintain or lower interest rates at their next monetary policy meeting on 3 Nov 2020. The chances are high that they will reduce it as the risk of Covid-19 is endangering economic activities once again. If it is so, I will be looking to purchase banking stocks as there will be a selldown of the banking sector.

Not Touching Gloves and Technology Stocks as They are too Speculative and Volatile Now

I have highlighted that gloves companies are now trading at irrational valuations here, and I stand by my stance that I will not be entering any positions that have anything to do with gloves. The same can be said for Technology stocks where the valuations have also been sky high.

I have no interest in participating in the casino, and I believed that the MCO period has made the gambling on stocks more rampant and unpredictable. I do want to acknowledge that there are some fundamental drivers to the performance of gloves and tech companies but I believe that they have been overbought and subsequently overvalued.