A couple of weeks ago, I wrote about whether Mr DIY is a good investment opportunity here and here. I felt that its offer price of RM1.60 is fair, meaning it is neither overvalued nor undervalued. This is a follow up to how Mr DIY fared for its first week of trading on the market. We will be taking a look at its share price performance and the volume that was traded for the week.

Mr. DIY traded higher than its offer price but was reasonable.

Mr. DIY did not tank on the first day of its trading, which is good news for the company. It means that investors were satisfied with its valuation of RM1.60 per share and its bullish business prospects moving forward. The worry was that the valuation was too expensive for investors as its price earnings ratio was 31.6 times. A typical company trades at 15.0 times, so a ratio of 31.6 times implies that the company has bullish prospects moving forward.

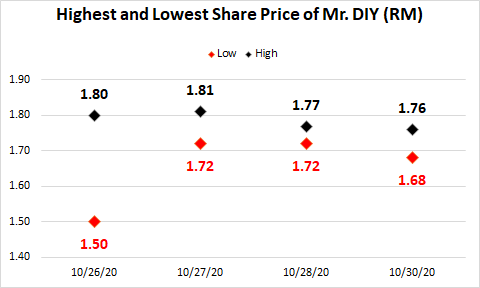

Mr. DIY saw lots of buying activities on the first day with about 410m shares exchanged, where share price ended at RM1.75. Subsequently, it maintained its trading range around RM1.70 to RM1.80, and it last traded at RM1.75 on 30 Oct 2020. I think at this level, Mr. DIY is trading fairly and reasonably which is good news. It means that there are no speculative activities in the stock, that have plagued other stocks in the market.

Mr. DIY could see some downward pressure on its share price next week.

Based purely on this week’s share price performance, Mr. DIY’s trading activities indicate that there are more selling pressure. Its trading range has been moving downwards with the minimum trade price declining. This indicate that more and more investors are selling Mr. DIY stocks at lower prices, pushing stock price down.

There will be 2 significant events happening next week and the week after that. Firstly, Bank Negara will be announcing whether interest rates will be changing next Tuesday. Secondly, Department of Statistics Malaysia will be announcing 3Q 2020 Gross Domestic Product results on 13 Nov 2020. Considering the state of the economy now with rising Covid-19 cases, Bank Negara is expected to announce a lowering of interest rates, which could mean that the economic outlook is expected to worsen.

As Mr. DIY does depend on consumer demand, this might be negative news for them. However, its impact is not expected to be that big as it has proven to be resilient during the current recession.