Greetings, everyone! It has been sometime since I last wrote here. I have been quite busy doing my masters and I have recently finished my final exams (fingers crossed I will pass!). I figure the best way to get back is to review how the Malaysian economy performed in 2020 in simple and straightforward points, so that everyone can understand. Let’s get to it.

Malaysia underwent a severe recession in 2020, with the second quarter being the worst in living memory

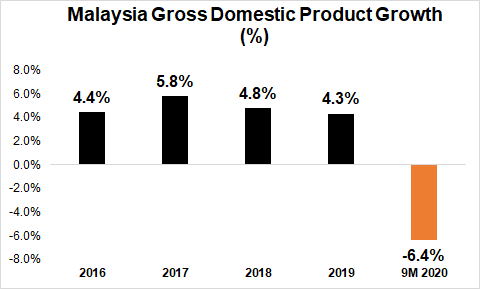

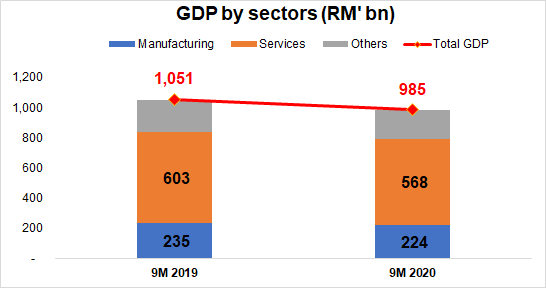

The Malaysia economy declined by 6.4% in 2020, for the first 9 months of the year. In simpler terms, the Malaysian economy generated RM985bn in economic activity from Jan 2020 to Sep 2020 compared to RM1,051bn from Jan 2019 to Sep 2019. Compared to the previous 5 years, this is the only time that Malaysia has contracted, where the economy grew at an average of 4.8% before this.

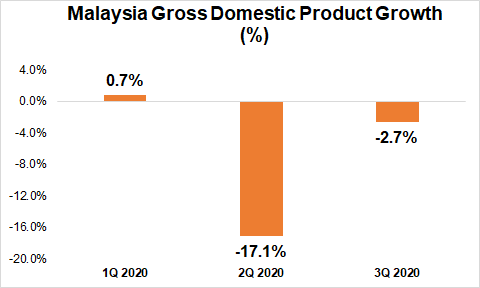

In terms of the trend in 2020 itself, 2Q 2020 was the quarter where economic activities really took a nosedive with the strict movement control restrictions. It contracted by 17.1%, marking the lowest point in recent memory for the economy, before recovering to a contraction of 2.7% in 3Q 2020.

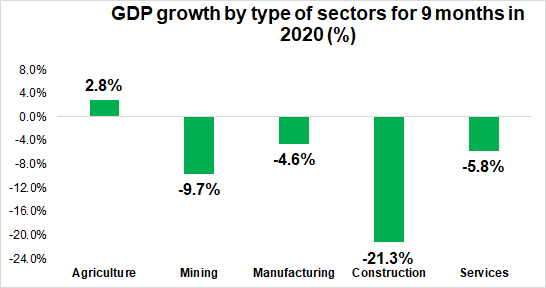

Almost all sectors were heavily affected with the exception of agriculture, while services and manufacturing contributed mostly to the decline.

Most economic sectors in Malaysia contracted with the biggest impact coming from the mining and construction sectors. Think of mining sectors as consisting mainly of finding oil and gas in East Malaysia and the east coast of peninsular Malaysia, and construction sector as the building of properties and civil engineering projects like roads, rail and hydroelectric dams. Both these sectors experienced a steep contraction in activities compared to the other sectors.

However, in terms of contribution the economy, both services and manufacturing sectors contributed to the most to the decline of the Malaysian economy. This is because these sectors encompass close to 80% of the entire Malaysian economy. Think of services sector as the services offered to you in terms of restaurants, shops, banking, and many others more. Manufacturing is the production of products in factory like conditions and places.

Government money seems to have prevented a total collapse of the economy, but its debt is increasingly worrying.

To prevent a total collapse of economic activities and people losing their jobs, the government initiated a big spending program called PENJANA. The program costs RM35bn and includes a multitude of benefits to ordinary households and businesses to survive and continue operating. While it may be hard to see its impact on the ground to consumers and businesses, rest assured that the government did do the right thing in increasing its spending on the economy and helping people on the ground.

When the economy is undergoing a recession, the private sector (people like me and you) will cut back on spending and businesses will not invest that much. Where does the recovery come from then? Government’s role here will be to support the economy while the private sector is weak.

However, there is a worrying trend that the current government might not cut back on its government spending and programs when the economy is on a firmer footing. After all, for all the criticism it has received about the government debt levels, no one is complaining now even when debt to GDP ratio is at an all time high of 60.7% as of Nov 2020. The government swiftly approved the notion to increase its government debt issuance from 55% to 60% to enable increased government debt issuance.

Recession has hit all workers hard in 2020, with a sizeable amount of people losing their jobs.

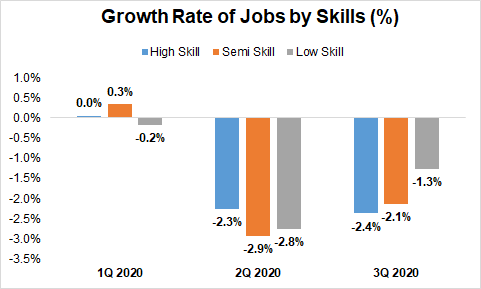

The Covid-19 recession has actually cause an overall decline in jobs for all workers regardless of skills. Total jobs declined by 1.5% in the first 9 months of 2020 compared to last year, losing about 133,000 jobs. Semi-skilled jobs lead the way, declining by 1.6%, followed by high skilled jobs at -1.5%, and lastly, low skilled jobs at -1.4%.

This is one of the biggest drop in total jobs which has resulted in unemployment to increase to as high as 5.4% in May 2020, and currently stands at 4.8% as of Nov 2020. For some context, this is even higher than the Asian Financial Crisis in 1997 and 1998, and the Great Financial Crisis in 2007 and 2008. This is worrying indeed as it has big repercussions to the state of the economy if people remain unemployed for longer. The logic is that the longer someone does not work, the harder it is for them to get a job. Companies will look at them and question why were they unemployed for so long and would not take a risk. There is a danger that prolonged high levels of unemployment might create long term unemployment in the economy, similar to the experience of the US and EU after the Great Financial Crisis.