Author Notes: I am looking to continually reinvent how investment content is being consumed by everyone. It is my passion to enable everyone to understand how to invest in stocks and companies, and I realise the past formats I have been doing may be too technical and “unfriendly” to people. Hence, I have been experimenting on how to make these type of content more interesting and reader-friendly. That said, I would appreciate it if you can drop me a comment or two on how to make these content more interesting.

Let’s begin, Genting Malaysia has been one of my first investment content that I put out and it has remained one of the most popular one among the readers. I did not provide an update for it last year due to the Covid-19 pandemic and I know it will just be updating on how bad things are for it. Hence, I chose to wait until things recover, to update on the realistic prospects for Genting moving forward. I have chosen to change the format of the content by highlighting 5 important things you should know about it (and more infographics), rather than go one by one on the company like last time. Hopefully, this will make it easier to read for you all.

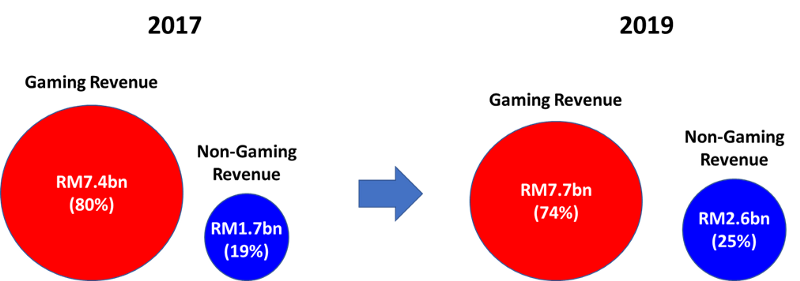

Non-gambling related businesses continue to grow in its process of diversification, but gambling business remain dominant

Genting Malaysia’s businesses can be divided into 2 critical segments, Gaming (casino and gambling) and non-gaming operations (hotel, food and beverages, transportation). In the past, Genting Malaysia relied heavily on gaming activities to generate most of its revenue and realises that this is not a sustainable strategy moving forward as the amount spend by the visitors to its casinos will be limited.

Hence, it embarked on the Genting Integrated Tourism Plan (GITP) to increase the value of its development surrounding its flagship development in Genting Highlands. The redevelopment of the theme park and the new Genting Outlet park sought to increase the amount that is spent by visitors. The increased contribution of non-gaming business segment to revenue represents this strategy. Non-gaming revenue percentage increased from 19% in 2017 to 25% in 2019. Gaming revenue percentage in turn declined from 80% in 2017 to 74% in 2019. The breakdown by business segment is still not available for 2020 as a whole, but it should indicate a continued diversification into non-gaming related businesses.

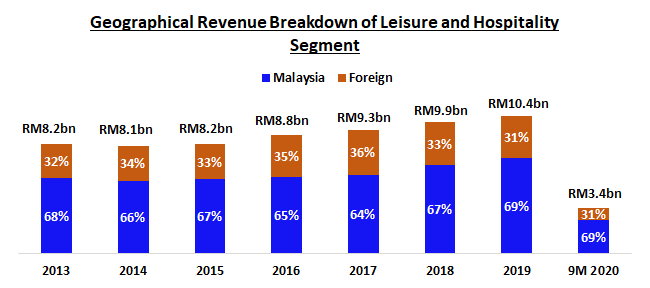

Briefly, Genting Malaysia Berhad still derives most of its revenue from its Malaysian operations, with the contribution of Malaysia increasing from 63% in 2017 to 74% in 2020. This shouldn’t come as a surprise as the GITP has started to contribute to the company’s revenue and that there are some complications with the United States front on developing a new gaming resort there.

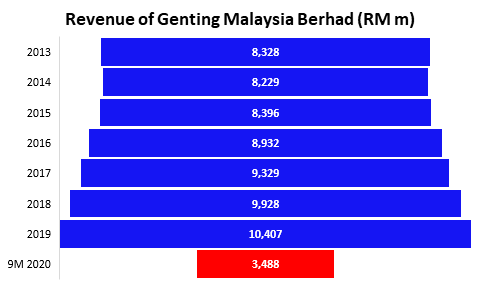

Revenue growth was steady in 2019 before Covid-19, but deteriorated sharply during Covid-19, with worsening financials also.

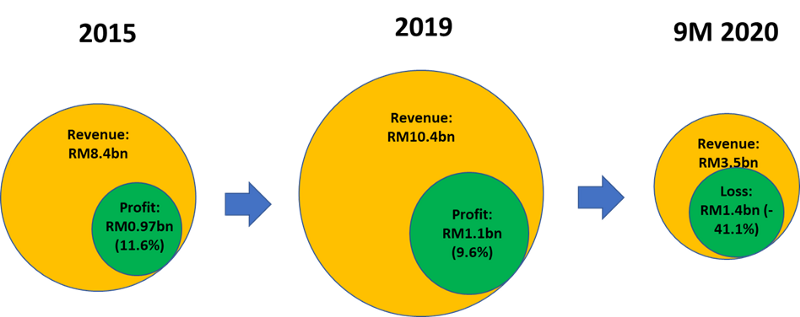

Genting Malaysia’s revenue was growing steadily before Covid-19 recession last year, growing from RM8.4bn in 2015 to RM10.4bn in 2019, a full RM2bn increase in 4 years time. However, in line with every companies in 2020, its revenue deteriorated sharply to RM3.5bn for the first 9 months of 2020, with 2Q 2020 only generating around RM115million in revenue.

Its net profit margins without unusual expenses and income, stands at 9.6% in 2019, declining from 15.8% in 2018. However, this profit margin is pretty much in line with its historical average of 11.2% from 2015 to 2017. It should be noted that this is to be expected considering the ongoing implementation of the GITP which eats up cost and money but will provide more revenue in the coming years. With the Covid-19 recession, Genting Malaysia is now generating a loss of RM1.4bn for the first 9 months of 2020, where things are not expected to improve that quickly considering the trend of Covid-19 cases currently.

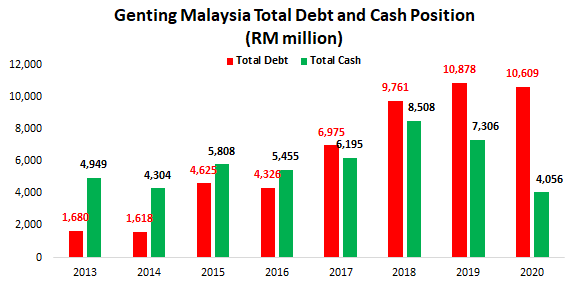

Genting Malaysia has been bleeding cash in 2020 to survive the recession, and raises some concerns over its debts

To counter the Covid-19 recession, Genting Malaysia has been spending a lot of existing cash to pay for its operating costs. Its cash position declined from RM7.3bn in 2019 to RM4.1bn in 2020. While borrowings actually decreased slightly from RM10.9bn in 2019 to RM10.6bn in 2020, most of its cash was used to pay for operating costs and not for repayment of debts. This meant that the capability of Genting Malaysia to repay its debts has declined significantly with cash to debt ratio (Cash/Debt) decreasing from 0.67 in 2019 to 0.38 in 2020. Considering also that Genting Malaysia might not be making any profit again this year, this situation is concerning as its GITP still requires quite a lot of commitments from its current cash balances.

Genting Malaysia’s prospects will be dependent on the trend of Covid-19 cases, with higher cases meaning lower financial performance

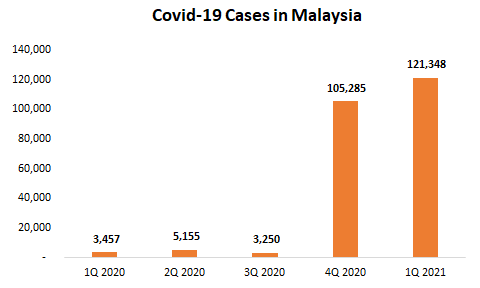

When total Covid-19 new cases increased from 3,457 in 1Q 2020 to 5,155 in 2Q 2020, Genting Malaysia’s revenue declined from RM1.95bn to only RM115m. The strict movement control restrictions that was in place, meant that noone was able to visit Genting Highlands for any trips. Even though this restriction was lifted eventually in the middle of May 2020, the damage has already been done. Meanwhile, the removal of MCO and the decrease in Covid-19 cases in 3Q 2020, helped Genting Malaysia improved its revenue to RM1.4bn and it seems like the economy was back on track.

However, the state election in Sabah without proper SOPs, increased the amount of Covid-19 cases and that effect has been felt till today. Total cases increased from a mediocre 3,250 new cases in 3Q 2020 to 105,285 cases in 4Q 2020. Various forms of MCO was re-imposed which will have a detrimental effect again on Genting Malaysia. 4Q 2020 numbers are not looking good for Genting Malaysia. This situation is further compounded by the ongoing high cases of Covid-19 Malaysia. It has only been 1 month into 1Q 2021, and cases have already exceeded 4Q 2020 numbers (105,285 cases) at 121,348 cases. This is certainly not looking good for Genting Malaysia’s prospects.

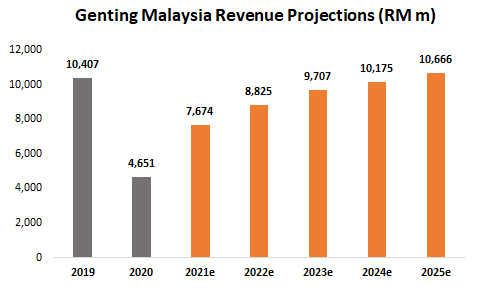

Genting Malaysia is valued at around RM3.01, indicating that it is currently undervalued, but has many risks that could affect it

Genting Malaysia is valued at RM3.01, indicating that it is currently undervalued with current share price trading at RM2.66. Most analysts out there are forecasting an average share price of RM2.85, which is not that far from my valuation. My valuation is considered quite bullish despite the fact that the revenue I forecasted for 2021 is smaller than most analysts out there but I did forecast that Genting Malaysia will have a 10% Earnings Before Interest and Tax margin for 2021 which is on the high side.