I am trying to create some new content on what you should look out for in terms of the key events that are happening for the week. Previously, I found that updating events on a daily basis was unsustainable as I was just reporting on the news and was not offering any significant value add. Hopefully, this will be better in terms of informing you on what to expect for the week and you can adjust your investments accordingly.

The contraction of GDP in 4Q 2020 is not expected to hit the market that badly

Quite simply, the Malaysian economy contracted by 3.4% in 4Q 2020, lower than 3Q 2020 growth of -2.7%. This implies that 2020 as a whole contracted by 5.6%. For context, this is the biggest contraction since the Asian Financial Crisis 1997/1998, a full 22 years after that. However, the KLCI market is not expected to be impacted that significantly, because of these 3 reasons

- Investors are not pricing in most of the economic conditions on the ground, rather the expectations of the recovery that is coming due to the rollout of Covid-19 vaccines.

- The contraction of 3.4% in 4Q 2020 is not that severe as 2Q 2020 contracted by 17.1%.

- This is the new normal for the Malaysian economy until at least the end of 2021.

While the KLCI did close earlier on Thursday on the day of the announcement of 4Q 2020 GDP, the KLCI market actually advanced by 21 points before that to settle at 1599. This showed that there wasn’t any adverse impact of the GDP numbers on the market.

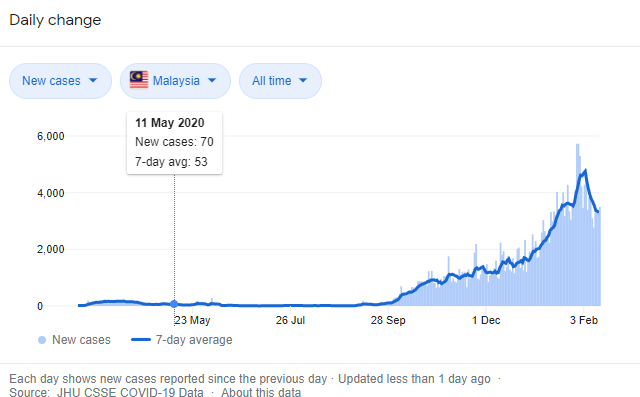

Eyes will be on whether MCO will be extended with continued high cases, but authorities might lean towards relaxing restrictions

Despite the strict lockdown imposed again, Covid-19 cases still remained high. As of last week, about 121,348 new cases have emerged in 1Q 2021, far exceeding the 105,285 cases in 4Q 2020. With the vaccine rollout far out in the horizon, the only effective way to combat this would be to flatten the infection curve. But that involves plunging the Malaysian economy further down into a recession. Many investors will be looking towards the vaccine rollout plan on this Tuesday for clues on how effective the program will be. The MCO officially will end on 18 Feb 2020.

Earnings season with companies releasing their 4Q 20 results. Volume might increase, offering day trading and investment opportunities.

Many companies will be announcing their 4Q 2020 results which would inform us the full 2020 year result also. This presents an interesting opportunity to decide whether to enter or exit your investments after getting a good view on how companies handled the 2020 recession. According to Trading View, there will be 58 companies announcing their results next week with notable companies such as Public Bank, Maxis, Petronas Gas, MISC and Kuala Lumpur Kepong.

Europe’s GDP numbers will be coming out, which will inform us on the economic conditions in Europe.

There are a couple of key indicators that are coming out next week for Europe, with the main two indicators being Industrial Production and Gross Domestic Product. Most investors are expecting that GDP will contract by 5.1% in 4Q 2020 in Europe which would mean a continued recession for the region. Results will be released on Tuesday (16 Feb 2021).

Europe will also be announcing its monetary policy meeting which many would be keeping a close eye on. A shift in tone of the ECB will signal that it might start to normalise its monetary policy stance and raise interest rates which we have to be aware of.

The United States will also be releasing important indicators on consumption activities for Jan 2021

The United States will be releasing the retail sales data for Jan 2021 on Wednesday (17 Feb 2021), with most expecting a recovery of retail sales in Jan 2021 at 0.7%. For context, retail sales declined by 0.7% in Dec 2020. Ths will be highly looked at as its recovery will point towards to the positive sentiments from the recovery of the US economy.