Disclaimer: I take no responsibility for anyone’s investment decision. This is just for informational purposes.

Greetings all, please find the investment update on IOI Properties Group (IOIPG). There are 5 key points that you should take away from IOIPG in 2021 if you are looking to invest in it. For people who want to know what is the current target price for IOIPG,

Target Price: RM1.32 (17 Feb 2020)

Just some update and disclosure, I exited IOIPG at RM1.68 in Nov 2020, with a purchase price of RM1.17 in Dec 2019. This represent a 43.6% profit for a years worth of holding on to IOIPG. I got lucky and managed to exit the investment when there were some uncertainties in IOIPG.

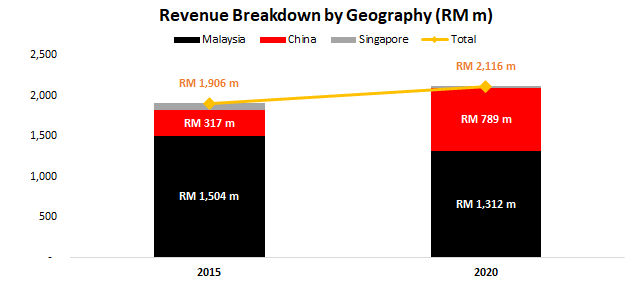

Most of IOIPG’s business is concentrated in Malaysia still, but China’s projects have increasingly contributed to its revenue

Most of IOIPG’s revenue still comes from the Malaysia segment with about 62.0% of revenue, but that proportion has been decreasing since 2015 where it as about 78.9%. China on the other hand, with the IOI Palm City in Xiamen, has been contributing more and more revenue to IOIPG with about 37.3% of revenue in 2020, an increase from 16.6% in 2015.

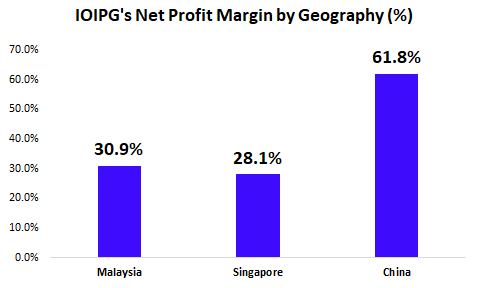

You should keep a close tab on IOIPG’s China business segment as the projects are maturing and are providing the most efficient profit margin compared to the other regions. China’s projects are generating net profit margin of 61.8% currently, making it the highest compared to other business segments.

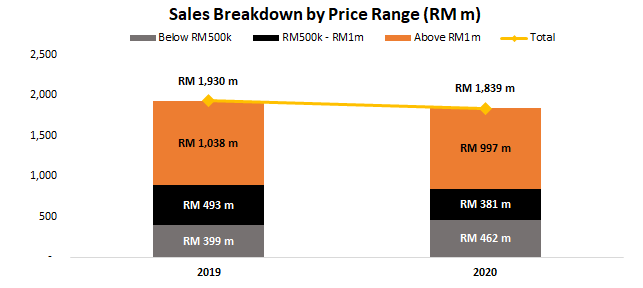

IOIPG’s business strategy is centered around selling high-end properties, and using commercial developments to increase value

One thing you need to be wary about IOIPG’s business strategy is that it mainly sells properties priced above RM1m, which places it as more of a high end developer. In 2020, 54.2% of its property sales came from properties priced above RM1m. In the mid tier section (RM500k to RM1m), sales encompass about 20.7%, while the low tier section (below RM500k) consist of 25.1% of sales. Is this good? Maybe, but in current depressed conditions in the property market, selling high end properties might prove to be difficult as households cut back on spending.

However, part of the strategy that I like about IOIPG is that they consider township planning in their property development strategies. They don’t just build houses, but they plan the development around them with commercial properties such as shopping complexes, offices, and shoplots to create a township on its own.

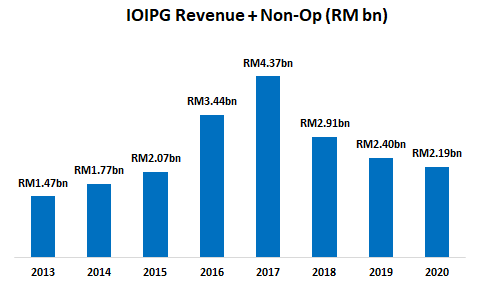

Revenue has been declining as IOIPG is coming off the maturation of its Singapore projects, with net profit declining also.

Revenue has been declining since its high of RM4.4bn in 2017 to RM2.19bn currently. Covid-19 has not been kind also as its China projects experienced some setbacks due to the lockdowns and the decrease in demand also. Moving forward, it remains to be seen how much will its China projects contribute towards revenue.

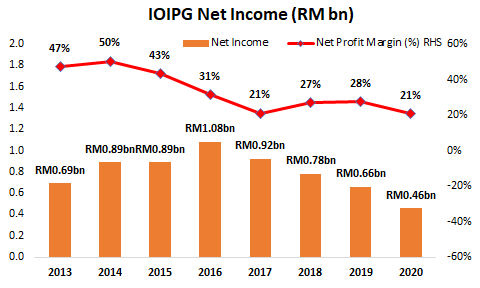

Net profits also experienced significant declines from its peak of RM1.1bn in 2016 to RM0.5bn currently. Profit margins did recover after 2017, but have deteriorated back to its low in 2020 due to the Covid-19 pandemic. We would have to monitor IOIPG’s financial performance in 2021 to assess whether they can recover back to their previous performance.

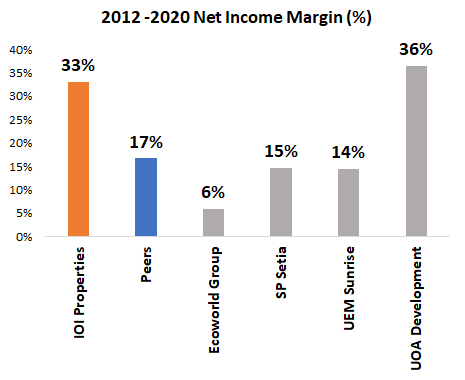

IOIPG remains one of the most efficient and profitable property development company among its peers

IOIPG is still one of the best property development company among its peers of Ecoworld Group, SP Setia, UEM Sunshine and UOA Development, with a net profit margin of 33% compared to its peers average of 17%. It only lacks behind UOA Development who has a net profit margin of 36%. In spite of the declining profitability in recent years, it still performs relatively well in the market in terms of getting its cost structure in place.

IOIPG is valued at RM1.32 currently, in line with most analyst target prices with upside coming from its China projects.

IOIPG is valued at RM1.32 per share compared to analyst target prices of RM1.44. This represents a downgrade from my previous target price of RM1.43 back in 2019. Its current share price of RM1.45 indicate that it is slightly overvalued but doesn’t suggest that share price is out of whack.