Admittedly, the Malaysian property market has been through a rough patch in the past few years with unaffordable prices and a general oversupply situation in both the housing and commercial markets. It was hit especially hard in 2020 during the Covid-19 pandemic, where almost all economic sectors suffered the same fate.

This research here will detail the extent of the impact on both the housing and commercial markets, and try to contextualise the markets’ prospects moving forward. For consistency sake, housing market here will refer to ordinary houses being sold and bought in the market, while commercial will refer mainly to offices, shoplots and shopping complexes.

The residential (housing) and non-residential (commercial) sectors contracted significantly in 2020

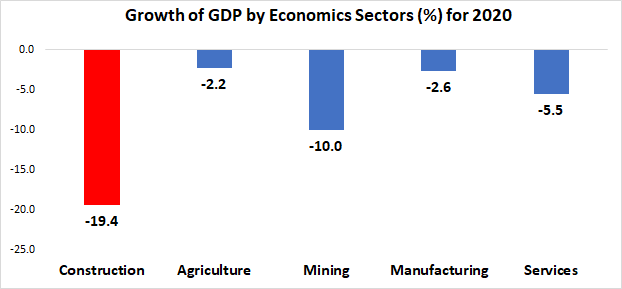

From the general economic point of view, the construction sector underwent the deepest contraction in Gross Domestic Product growth at -19.4%, compared to every other economic sectors. This marks the biggest contraction in recent memory. This made sense as almost all construction activities were halted during the MCO period which resulted in a whopping 44.5% in contraction in 2Q 2020.

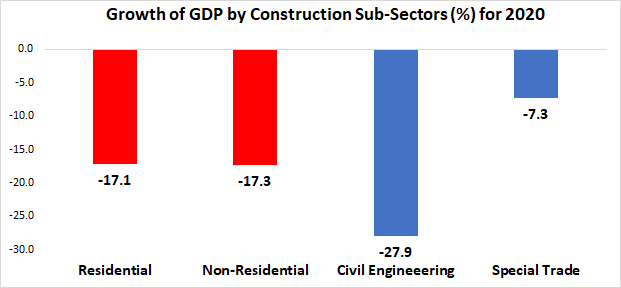

During 2020, both the residential and non-residential sub-sectors experienced steep contractions of 17.1% and 17.3% respectively, making it the biggest contraction in the past decade. For your information, the construction sector consists of the sub-sectors of residential, non-residential, civil engineering and special trade.

As a result, house prices and commercial rents have been declining, indicating the lack of demand in the overall markets

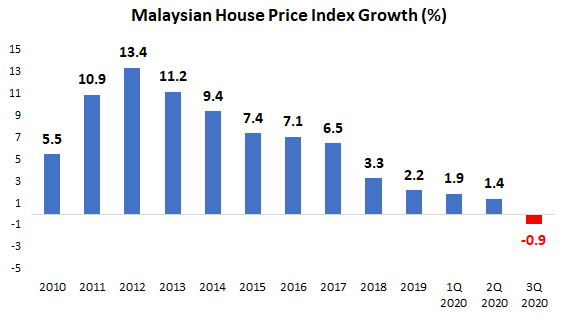

Firstly, the decline in economic activity has resulted in falling house price growth in Malaysia, contracting for the first time by 0.9% in 3Q 2020. Before that, house prices growth have already started its downward trend since 2012, with a sharp drop in 2018 when oversupply conditions worsened in the market (too many houses being built).

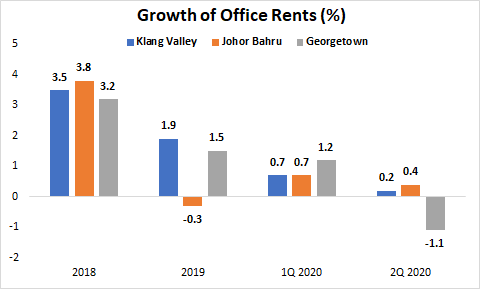

In the commercial market, office rents have also been going down in the 3 key areas of Klang Valley, Johor Bahru and Georgetown, Penang. Georgetown experienced the the lowest growth rate in rents among every cities.

The housing and commercial markets remain oversupplied, but at least houses are more affordable now.

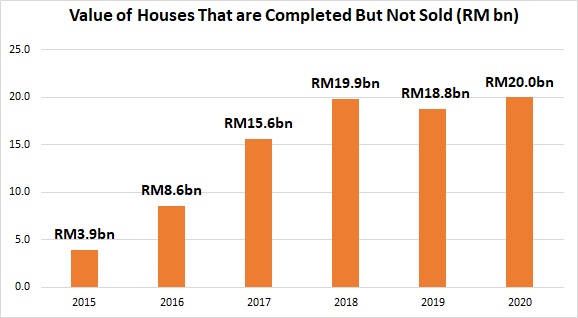

Overhang of properties means that the property is completed but not sold yet. This is a recurring problem in Malaysia’s housing market with the number of overhang increasing sharply since 2015. More and more houses are being built with no buyers. Back in 2015, only about RM3.9bn worth of houses were unsold. This number has since ballooned by almost 5 times to RM20.0bn in 2020. Considering the economic conditions now, it will take a long time for these unsold properties to actually be sold.

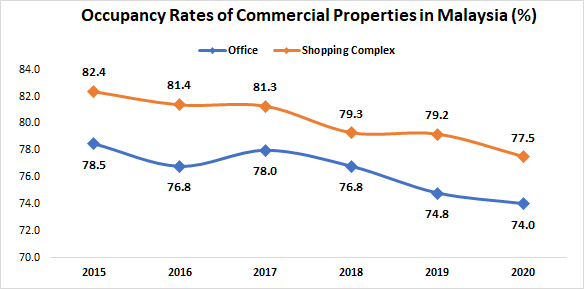

In the commercial markets, occupancy rates declined slightly in the office market while shopping complexes declined even more in 2020. Occupancy rates is defined as how much space is occupied by tenants divided by total space. The higher the occupancy rate, the better, as more space is utilised to generate revenue. Office occupancy rates declined slightly from 74.8% in 2019 to 74.0% in 2020, but is generally much lower compared to its historical records. Shopping complexes occupancy rates declined from 79.2% in 2019 to 77.5% in 2020.

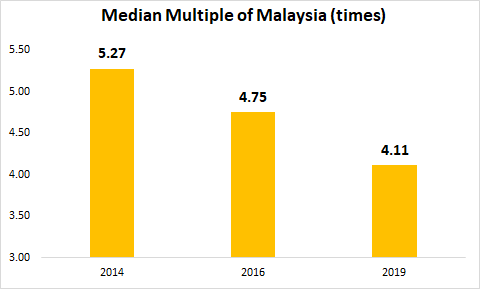

However, there is some goods news for the housing market, as housing is getting more affordable for the masses with house prices declining and workers income still growing. Median Multiple which is used to measure how affordable houses are, consist of dividing median annual household income over median house price. A ratio of below 3 times indicate that houses are affordable while ratio of above 3 times indicate that houses are unaffordable. Median multiple of houses in Malaysia have actually declined from 5.3 times in 2014 to 4.1 times in 2019, indicating houses are getting more affordable.

Even with property incentives in place, most of the problem in the property market is structural and is only expected to recover slowly

The oversupply problem in both housing and commercial markets are man-made in that there was a lack of planning by the respective city councils to manage the kind of property development that was happening. Property developers kept building properties that are unaffordable and not suited to market demand, and thus are left now with a big overhang of properties in their inventory. Offices and shopping complexes were often built together with residential developments to increase the value of the development but fail to take into account whether are there any market demand for commercial activities in the area they are building in.

Thus, the outlook for property moving forward is expected to recover but in a slow pace that are in line with how the overall economy is doing. There is still a big oversupply problem that both the government and private market would need to clear first before embarking in new projects. The recession in 2020, showed how vulnerable the property market was in terms of its fundamentals.