Disclaimer: This is purely for informational purposes and shall not represent any advice or whatsoever. I take no responsibility for whatever investment decisions being taken by whomever.

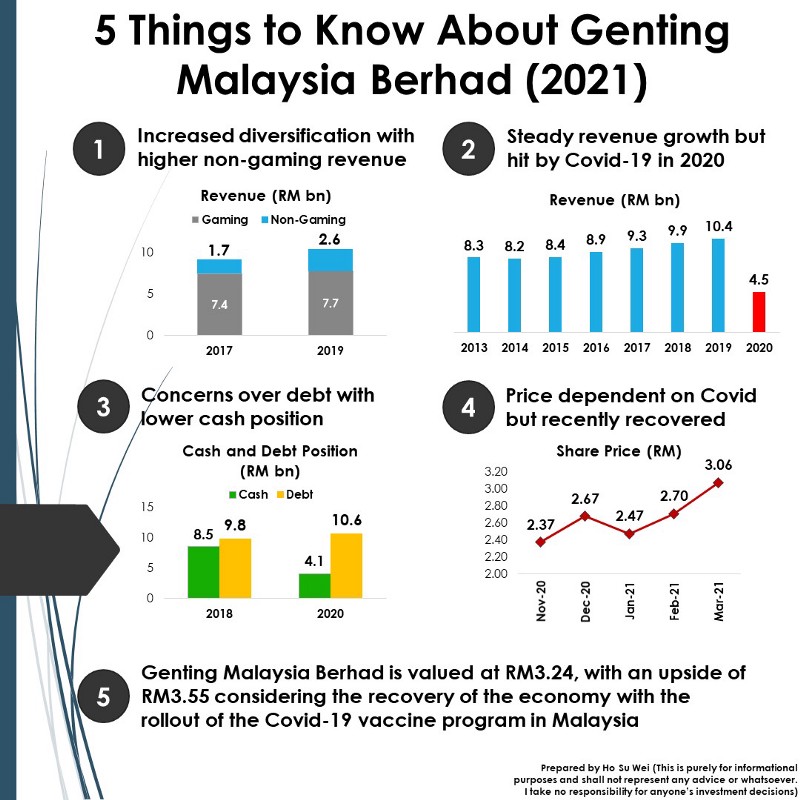

You can find my full analysis on the 5 important things on Genting Malaysia Berhad for the year 2021 here , and the past analysis for 2019. This piece here is just to update on the recent release of the full year 2020 result for Genting Malaysia Berhad and the recent trend of share price. I am also taking this opportunity to release the infographic for Genting Malaysia Berhad so that it’s easier for you to read.

Financials for 2020 are in line with forecast, with not much surprise. Genting suffered its heaviest loss in recent memory

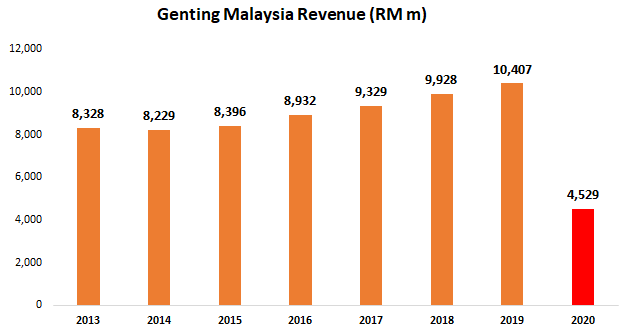

Full year 2020 results are out, and the revenue is in line with the forecast that I had for 2020. 2020 revenue came in at RM4.5bn, while Genting Malaysia suffered a loss of RM2.2bn for the year, making it the biggest loss in the past 7 years. This should really come as no surprise as Covid-19 has adversely impacted the activities of tourism and gaming.

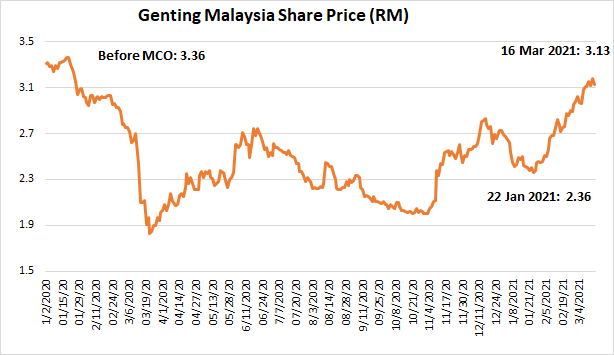

Share price has been on an uptrend since February, with the rollout of vaccine and positive news on recovery

Share price since February has been on an increase, from RM2.36 in end January 2020 to RM3.13 currently. This was mainly due to news on the rollout of the Covid-19 vaccine and economic recovery phase that comes with it. Genting Malaysia’s business should gradually recover in 2021 now, and it is showing signs that it is reverting back to its pre-MCO price of RM3.30.

Genting Malaysia Berhad valuation is upgraded to RM3.24 (previous: RM3.01) to take into account the economic recovery narrative

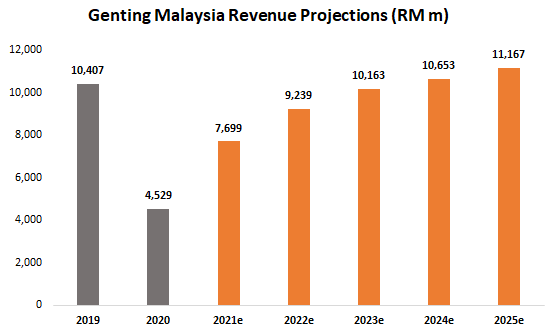

Genting Malaysia has been upgraded to RM3.24 now from its previous valuation of RM3.01. This takes into account the recovery story in 2021, which should lead to a higher 2021 and 2022 revenue. However, there are significant upsides to Genting Malaysia as I have previously in 2019 forecasted that Genting Malaysia Berhad is valued at RM3.55. The upside I am forecasting would be RM3.55 in this case, retaining my previous analysis in 2019.