Are you struggling to identify good quality long term investments in 2021? Which sectors could stand to gain? Find out more in this article.

Disclaimer: This is purely for information purposes and I take no responsibility for anyone’s investment decisions regarding this.

In the past few weeks, many have asked me the question on which sectors should people invest in now. After all, the vaccine programs have now been rolled out and theoretically the economy should be gradually recovering in 2021. Gloves stocks are increasingly out of favour now, with investors shifting to other more traditional sectors. I am not an expert in investments nor am I qualified to give advice on this but I can talk about which sectors are attractive to me now in Malaysia.

What are the main characteristics that you should look out for then for good investments?

- Sectors that recover in line with the economic recovery

- Undervalued sectors during the pandemic and now

- High potential for upward movement in price

I will be using the 13 sectors classification from Bursa Malaysia to identify 3 sectors that I am looking at right now. They include

- Construction

- Consumer Products & Services

- Energy

- Finance Services

- Health Care

- Industrial Products &Services

- Plantation

- Property

- REIT

- Technology

- Telecommunications & Media

- Transportation & Logistics

- Utilities

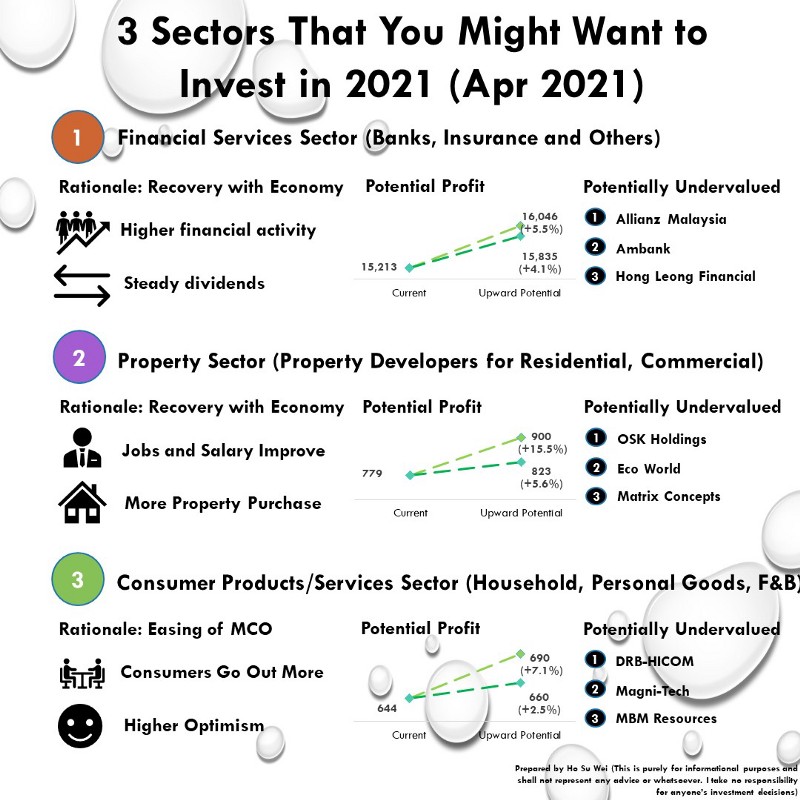

The 3 sectors I am looking into are financial services, property and consumer products and services. They are considered pretty boring sectors to invest in but are normally highly related to how the overall economy is doing. If you are looking for “exciting” sectors to invest in, well, I am afraid this is not the right article to find out about them.

Financial Services Sector

The financials services sector consists of banks, insurance companies, and other financial services companies, and fulfills the 3 conditions quite nicely.

Economic recovery: Financial services companies normally are closely correlated to the performance of the economy. The higher the economic activity, the higher the rate of financial services activities such as borrowing, lending, transactions, and etc. Financial services are companies that have steady dividend yields hence it is perfect for long term investments right now.

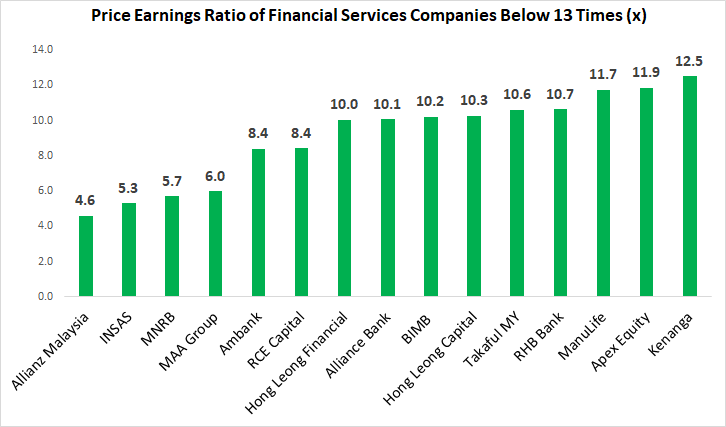

Undervalued: Banking and financial stocks were heavily hit during the pandemic, and while they have recovered, they still remain undervalued, trading below 13 times price earnings ratio. Below are the companies that are currently trading below 13 times currently.

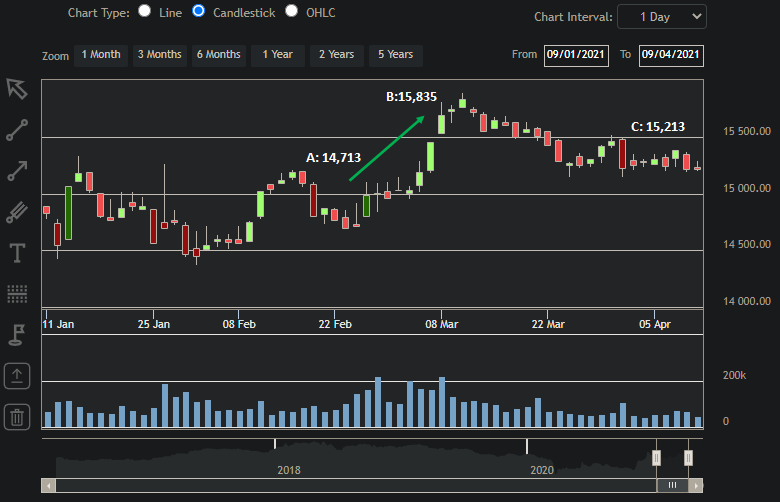

Potential for Gains: The sector is currently trading at 15,213, with the lowest price during the pandemic being 10,885 in Mar 2020, and the highest of 16,046 in Dec 2020. It stands to gain about 4.1% in the short term and 5.5% in the long term in price. With a short term technical analysis of 3 months, there is an ABCD pattern that is forming that you could take advantage of. It is now currently at the point C where there is a potential upward movement to 15,835 in the next breakout trend for point D.

Property Sector

The property sector was heavily hit during the pandemic and even until today, it hasn’t recovered to its pre-pandemic levels. As most developers during 2020 did not actually make much profits or worse losses, relying on price earnings ratio to find undervalued property companies might be hard.

Economic recovery: Property companies performance are inevitably tied to whether people have jobs and high income. Only then can they afford to buy houses and revenue will increase. With the recovery now, jobs will come back and salaries might be going up so property companies performance are expected to go up also.

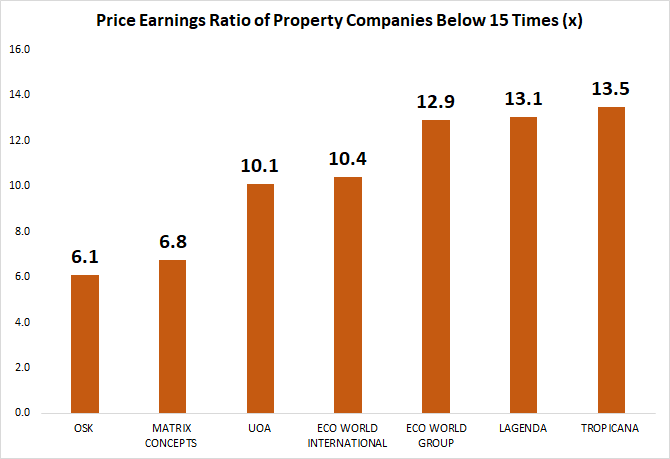

Undervalued: This is hard to do as quite a number of property companies are making losses rendering the analysis of price earnings hard. Hence, I am only picking property developers that made money in 2020 with price earnings ratio lower than 15 times and are also big. Big here means their market capitalization is more than RM750m.

Potential for Gains: The property sector is currently trading around 779, still below its pre-pandemic levels of 823. It stands to gain about 5.6% to 15.5% depending how long term you are viewing the property sector can recover to.

5.6% is obtainable if the market recovers to pre-pandemic levels of 823 (first resistance level). 15.5% is more long term as it needs to trade upwards to the second resistance level of 900. However, 5.6% might be more realistic as the home ownership campaign might be ending soon in June 2021, providing less support for the market.

Consumer Products and Services

Consumer products and services companies are basically retail companies that sells all types of products and services such as agricultural, automotive, consumer services, food and beverages, household goods, personal goods, and tourism. During the pandemic, they suffered tremendously due to the movement control restrictions as they are still very much brick-and-mortar businesses.

Economic recovery: With the rollout of the vaccine and the easing of movement control restrictions, consumer products and services stand to gain from the increased traffic and optimism from consumers.

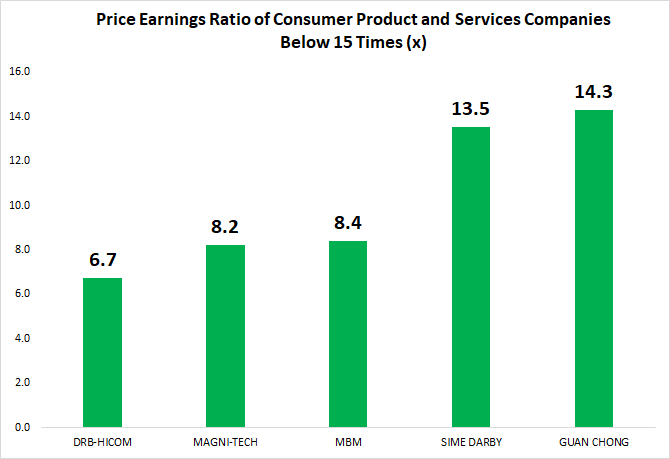

Undervalued: Similar to property companies, many consumer products and services companies made losses in 2020. Consistent with property companies, I only looked at companies that made a profit in 2020 with market capitalization exceeding RM1bn and price earnings ratio below 15 times.

Potential for Gains: The consumer products and services sector is currently trading around 644, where its lowest was 484 in Mar 2020. The sector stands to gain about 2.5% to 7.1%. You can obtain 2.5% returns from it trading back to pre-pandemic levels of 660, while 7.1% can be obtained from it trading to the second resistance level of 690.