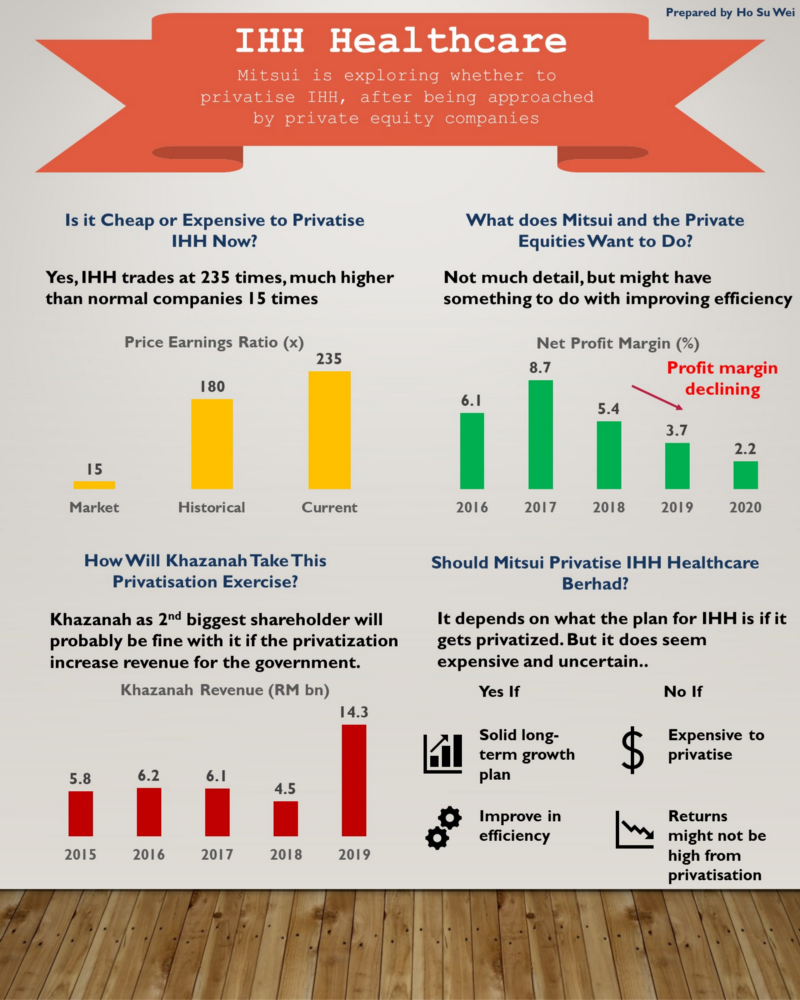

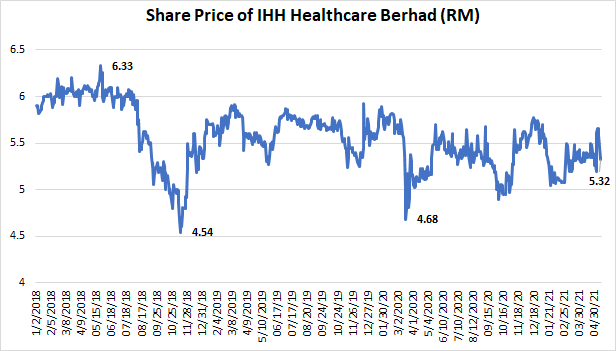

Mitsui has reportedly stated its intention to privatise IHH Healthcare Berhad, with some private equity investors stating their interest to do so with Mitsui. I have previously covered the company in part 1 and part 2, and forecasted that IHH will trade around RM5.30 where it is currently trading at RM5.28 now. Trading at a price earnings ratio of 225 times now, IHH is the darling of the healthcare industry in Malaysia with significant exposure in overseas healthcare industries especially in Singapore, Europe, India and most recently China. Mitsui’s intention to explore the privatisation of IHH does present an interesting proposition for its current investors. This article here will explore what possibly are the considerations that Mitsui is having in regards to this exercise and whether they actually make sense.

Is it cheap or expensive to privatise IHH now?

Whenever it comes to privatisation, majority shareholders inevitably have to consider whether it is cheap or expensive to purchase all the shares out in the market. After all, you will need a substantial amount of cash and funding in the first place to purchase all of them. Judging based on the price earnings ratio currently, it is plain to see that it is considered expensive to undertake a privatisation exercise. IHH trades at 235 price earning ratio now, where normal price earnings ratio in the Malaysian market is only about 13 to 15 times. Historically, IHH has always traded at a very high valuation of 180 times and was generally considered expensive.

However, this needs to be taken into context, 2020 actually was a down year for IHH, registering its lowest profit of RM289m. Earnings per share is the lowest RM0.02 per share in 2020, compared to an average of RM0.08 per share from 2016 to 2019. Hence, if you expect that IHH recovers this year to about RM0.08 or RM0.12 (highest in 2017), you would be seeing about 44 to 66 times price earnings ratio which is cheaper but still considered relatively expensive. In this context, I would say privatising IHH now would be an expensive undertaking considering share price doesn’t seem to be declining anytime soon.

What does Mitsui and the private equities want to do?

Normally, when a company wants to privatise, it wants to undertake some long term investments or implement fundamental changes to the business. Considering that some private equities have approached Mitsui on the privatisation deal means that Mitsui thinks there is some value to these private equities plans and ideas. Private equities are investment companies that specialise in buying companies that are undervalued or having troubles, turning them around and selling them at a higher price in the future.

It all boils down to what Mitsui’s vision is for the future. IHH’s future strategy and vision essentially boils down to three main ones:

- Achieve greater economies of scale and brand recognition.

- Prioritise investments to be more efficient.

- Leverage international synergies to achieve greater cost savings.

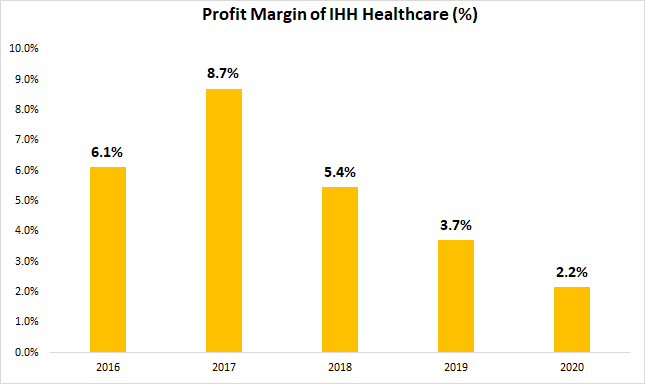

Have they been successful? Not really. I say this because while revenue has consistently increase before the pandemic, its operational efficiencies have actually been declining. This means that its cost structure is growing quicker than revenue growth, reducing IHH’s profitability. Profit margins have been consistently declining from 8.7% in 2017 to 2.2% in 2020.

From here, I can see the logic of privatising IHH to implement some long-term reforms and changes that could potentially disrupt its businesses in the short-term. What about the revenue side? I do know that IHH has recently entered the Chinese market by establishing the Gleneagles brand in Hong Kong. But what about the huge market in mainland China? If the private equities companies have a solid plan in getting into the Chinese market, it might be worth it to privatise IHH as that will involve a comprehensive long term planning. Privatising here will reduce the pressure to generate short term quarterly profits that could jeopardise the long term big investments into the Chinese market.

The main point here is that there needs to be a big enough plan to add more value-added to the company in the long term that justifies the privatisation.

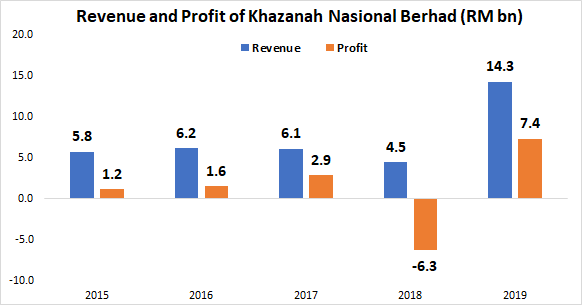

How will Khazanah Nasional Berhad take this privatisation exercise?

IHH’s second biggest shareholder is Khazanah Nasional Berhad, holding 26% of IHH while Mitsui holds about 33%. Khazanah used to be the biggest shareholder in IHH before divesting 16% of IHH to Mitsui in 2019. Judging by this, it does seem like Khazanah is fine with Mitsui being the largest stakeholder in IHH as they will then collaborate with each other to add more value to the company. It doesn’t mind giving up majority control of IHH as it thinks that Mitsui will make better business decisions.

However, I don’t think Khazanah will give up more control of IHH to other stakeholders as healthcare is deemed as a key sector in Malaysia, and it does have a mandate to remain invested and involved in critical sectors. It really depends on who these private equity companies are and what kind of plans they have. If the plan after privatisation doesn’t involve divesting Malaysia’s key healthcare operations, Khazanah might be fine with the privatisation exercise. If the privatisation exercise improves the long term performance of IHH, Khazanah has every interest to participate in it also as it shifts its focus in generating higher dividend revenues by focusing on assets that generate higher returns. In 2019, its divestment of IHH generated RM8bn that helped pushed profits to record high.

Should Mitsui privatise?

It really depends on what is the plan for the privatisation. After all, valuations are quite expensive now to warrant a full privatisation which could affect the returns of the privatisation exercise and the long term plans that come after that. Who are these private equity companies? What kind of expansion plans they have and what value add will they introduce? Much of it is still up in the air. However, there are some justifications from a business point of view to privatise which includes improving the operational efficiencies of IHH (where profit margins have declined throughout the years) and to explore additional revenue sources in a big market like China.