Disclaimer: This is purely for informational purposes and shall not represent any advice or whatsoever. I take no responsibility for whatever investment decisions being taken by whomever. This has no connection to the company that I work for and represents my own personal view.

This is a bit late considering that Genting Malaysia Berhad (GMB)released its annual report back in April 2022. A lot of things have changed since last year, and GMB’s operating environment in Malaysia, U.S. and Europe remains as challenging as before. For the past analysis on GMB, please refer to the update in 2021. Here are 5 important things to know about GMB in 2022.

Genting Skyworld Theme Park Has Finally Opened in 2022, and is Expected to Contribute Significantly to GMB’s Revenue Stream.

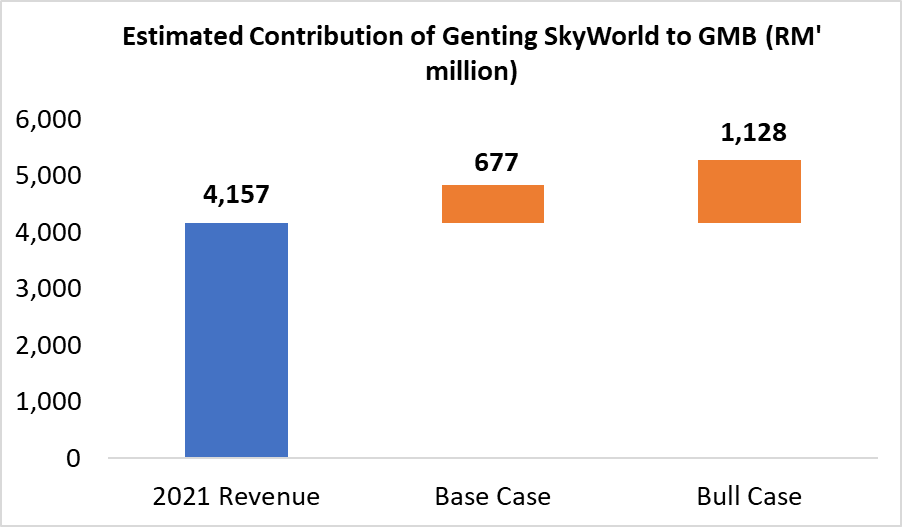

The much-anticipated Genting SkyWorld Theme Park finally opened its doors to the public in February 2022, after the dispute between Disney (who bought 20th Century Fox) and GMB, only allowed GMB to use certain 20th Century Fox intellectual properties. The project was estimated to have cost GMB a whopping RM3.3 billion to build, and is the center-piece of the RM10.4 billion Genting Integrated Tourism Plan.

I estimate that the opening of the park is expected to generate about RM677 million to RM1.1 billion in revenue for GMB, with the assumption of a ticket price per person of RM139.5, and visitor numbers of 4.9 million to 8.1 million. For context, this represents about 16% to 27% of GMB’s revenue in 2021.

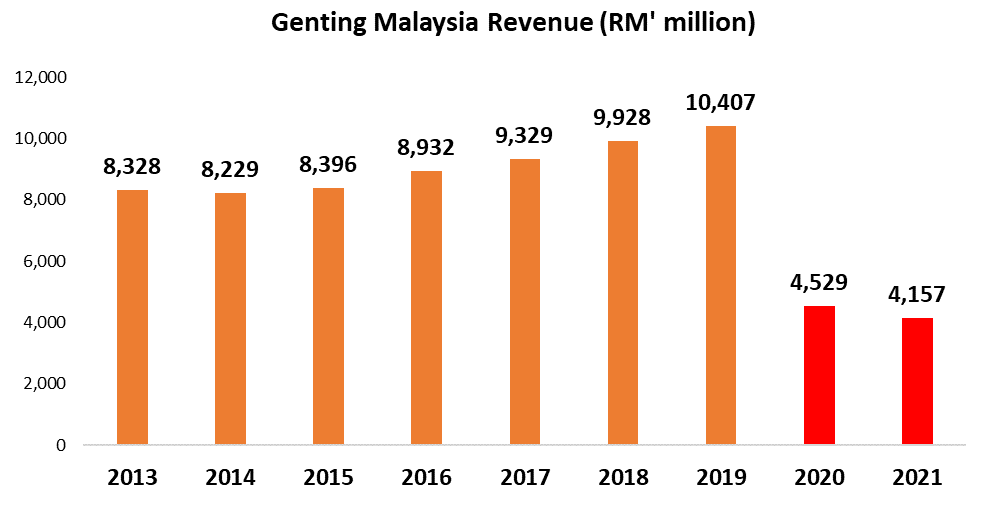

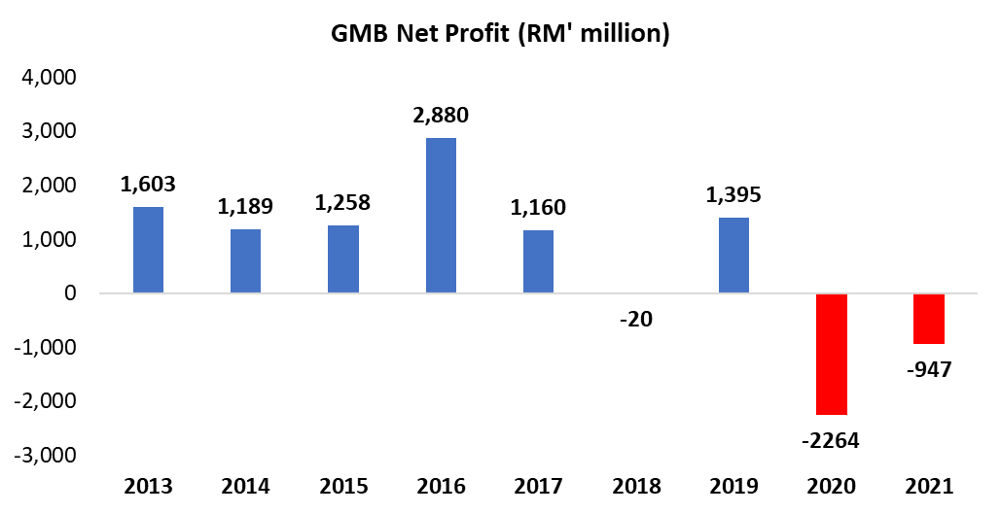

Revenue Declined in 2021 due to the Covid-19 Restrictions in Malaysia, but Losses did Become Smaller

GMB’s revenue continued to decline from RM4.5 billion in 2020 to RM4.2 billion in 2021, as Covid-19 restrictions were placed in Malaysia which reduced the number of domestic and international visitors. However, its efforts in optimising its cost and reducing its workforce, has yielded a lower loss of RM947 million in 2021, compared to a loss ofRM2.3 billion in 2020.

Analysts in the start of 2021, actually expected GMB to recover, with many expecting it to generate about RM8billion to RM9billion, close to the 2019 revenue of RM10.4 billion. However, flare up in Covid-19 cases and the increase in number of variants, prompted the authorities to re-impose multiple lockdown restrictions which meant that Genting Malaysia Berhad had to close its Malaysian operations for about 5 months in 2021, compared to 3 months in 2020.

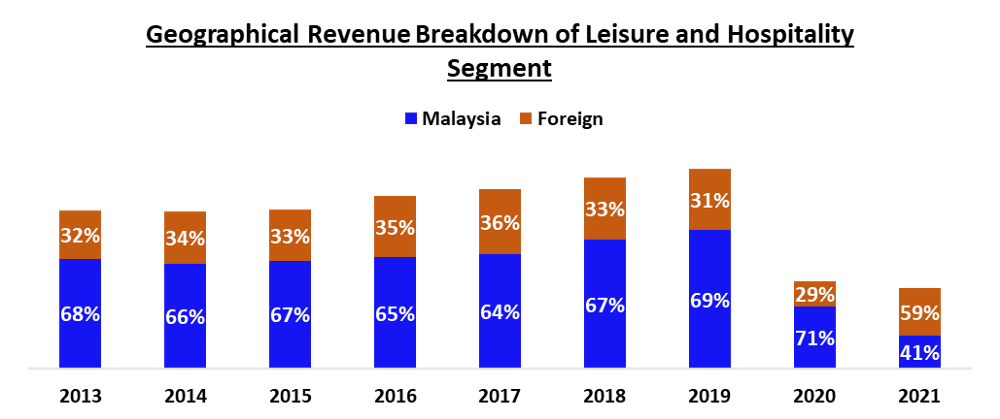

GMB is Still Continuing its Diversification Away from Gaming Operations, But Is Now Less Reliant on Malaysia.

Part of the main thrust for GMB in the Genting Integrated Tourism Plan was to reduce its reliance on gaming to generate its revenue. Traditionally, about 80% of its revenue came from gaming, making it reliant on it. With the establishment of the Genting SkyWorld and Premium Outlet, GMB hopes to diversify away from gaming and into other forms of entertainment and the retail segment. While the percentage of gaming revenue has decreased from 80% in 2017 to 74% in 2019, that percentage has since increased back up to 78% in 2021, making it still reliant on gaming operations.

However, from a country point of view, Malaysia’s dominance as the main source of revenue is becoming less significant, with both the US and Bahamas now encompassing a larger percentage of GMB’s revenue. In that terms, GMB’s country exposure is now more diversified with protection against a Malaysian slowdown in demand.

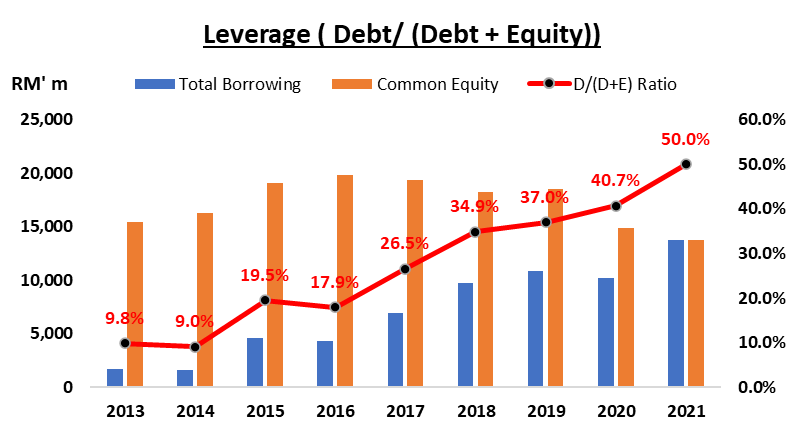

Risks of Having Too Much Debt Has Increased for GMB, Potentially Reducing the Profitability of GMB.

The gearing ratio (Debt / (Debt + Equity), increased sharply to 50% in 2021 from 41% in 2022. Before that, it was as low as 9% in 2014 before GMB borrowed money to fund the Genting Integrated Tourism Plan. While 50% is still considered manageable, the risk of GMB having too much debt to repay has increased significantly.

It has increasingly borrowed more money especially during the pandemic, with its cash position consistently declining to as low as RM2.8 billion in 2020. The cash position has since increased to RM4.6 billion in 2021, as GMB borrowed more money. This is definitely one risk that needs to be monitored closely.

GMB is valued at around RM3.32, which represents about 15% worth of share price appreciation from the current price of RM2.89.

I estimate that GMB is valued at around RM3.32, which is 15% above the current share price of RM2.89. There is no indicated price earnings yield at this moment considering that GMB is making losses at this point in time. This is a revision upwards from RM3.24 previously as I view the opening of SkyWorld and the increased contribution of foreign operations (U.S. and Bahamas) as positive to GMB’s revenue.

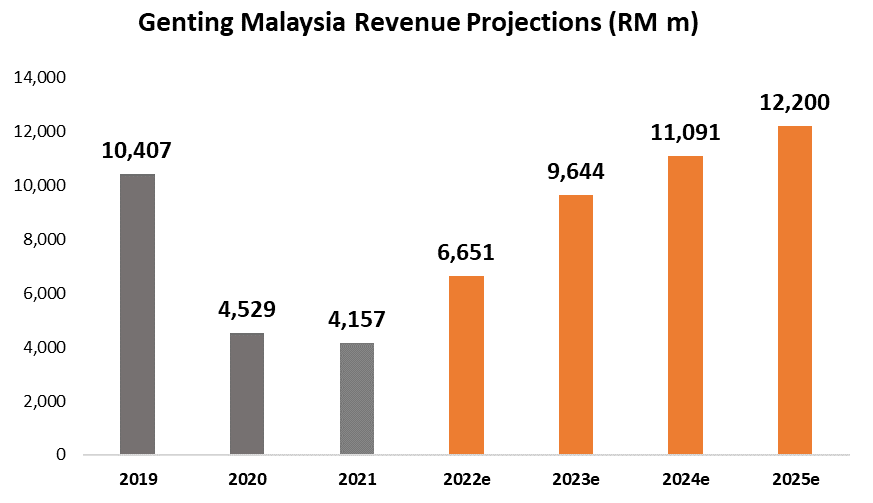

This valuation was done on an assumption of revenue growing to RM9.6 billion in 2023, which is near 2019 level of RM10.4 billion. Weighted Average Cost of Capital is assumed at 7.5%, with terminal growth rate at 2.0%. EBIT margin is assumed at 13% for 2022 and 2023, and 15% for 2024 and 2025 (2025 is the end year of the valuation).