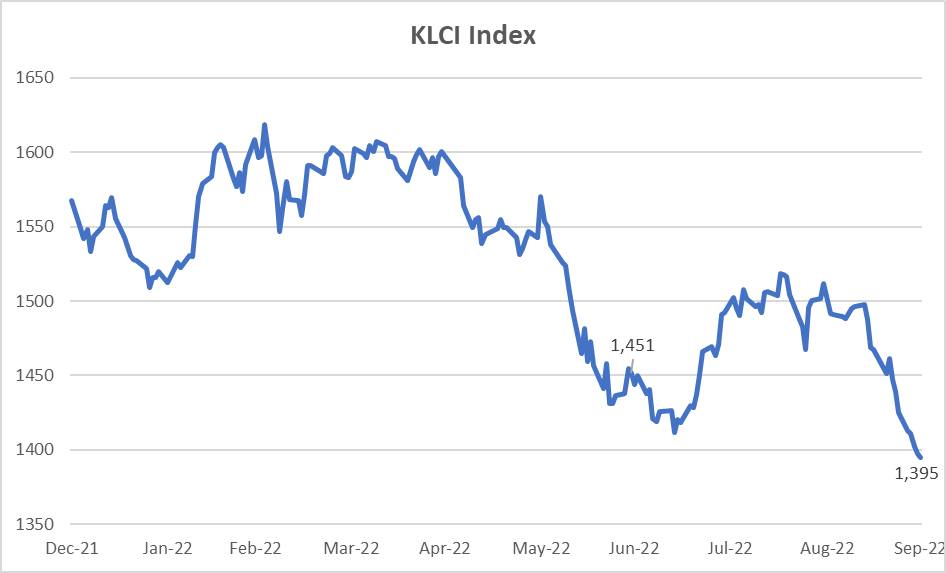

The Malaysian Stock Market (KLCI) Declined in the 3Q 2022, as Global and Local Interest Rates Rise and Inflationary Risks Increase.

The KLCI Index declined by 3.9% in the 3Q 2022 (from 29 June 2022 to 30 September 2022), as global and local interest rates rise in line with higher inflation risks. In the U.S., the Federal Reserve has continued to raise interest rates by 150 bps during the period to about 3.25% currently. Meanwhile, in Europe, the European Central Bank (ECB) also raised its interest rate by 125 bps to 1.25% currently.

In Malaysia, Bank Negara Malaysia has increased its interest rates by 50 bps to 2.50% as inflation continue to record relatively high growth rates of 4.7% in August 2022 and 4.4% in July 2022. Higher interest rates are generally negative for the economy and stock markets, as borrowing cost increases for companies and consumers. Companies and consumers tend to invest and consume less, and that reduces the revenue and earnings of companies in the stock market.

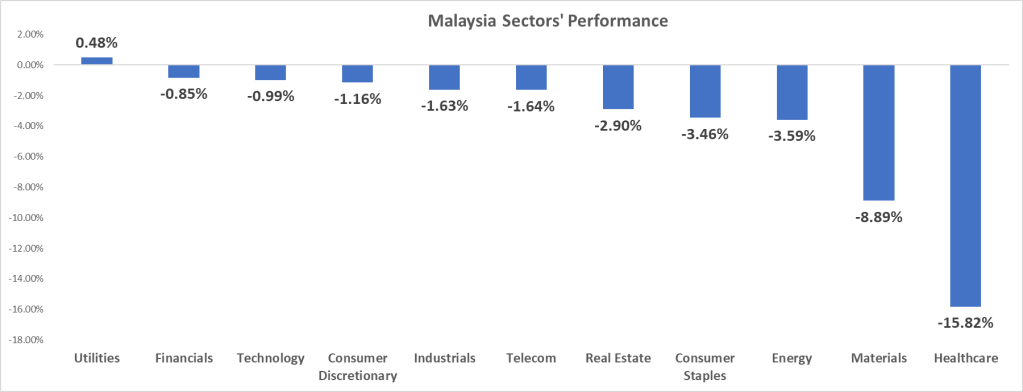

The Utilities, Financial, Technology, and Consumer Sectors Were the Best-Performing Sectors

In the 3Q 2022, only the utilities sector gained while the rest of the sectors all declined. As commodity prices such as crude oil, natural gas and coal were still high during the quarter, this meant that utilities companies benefited from a higher selling price of electricity. The sector also benefited from investor’s shifting to defensive stocks where utilities companies are regarded as recession-proof stocks.

Financial sector’s decline is the least among everyone else as higher local interest rates mean that banks can charge a higher interest rate and generate more profits. The technology sector only declined by 1.0% in the 3Q 2022, as it has already declined by a lot in the first half of the year, rendering the sector potentially oversold at this point.

The Healthcare Sector Continued to Decline Sharply, as Investors Shift Away from Gloves Stocks.

The healthcare sector declined the most as investors continue to sell gloves stocks in light of the reopening of the economy from the Covid-19 pandemic. Malaysians do not really need gloves now as things are returning to normal. The four main gloves companies of Top Glove, Hartalega, Supermax, and Kossan, have all experienced sharp declines in share prices.

Previously, glove companies were the subject of much speculation and investor frenzy in 2020, as many investors rush to buy these stocks in light of the pandemic. Valuations rose to crazy levels of above 150 times price earnings ratio for some companies. Since then, the frenzy has died down with the roll-out of the vaccine and glove companies have continued to be sold down.

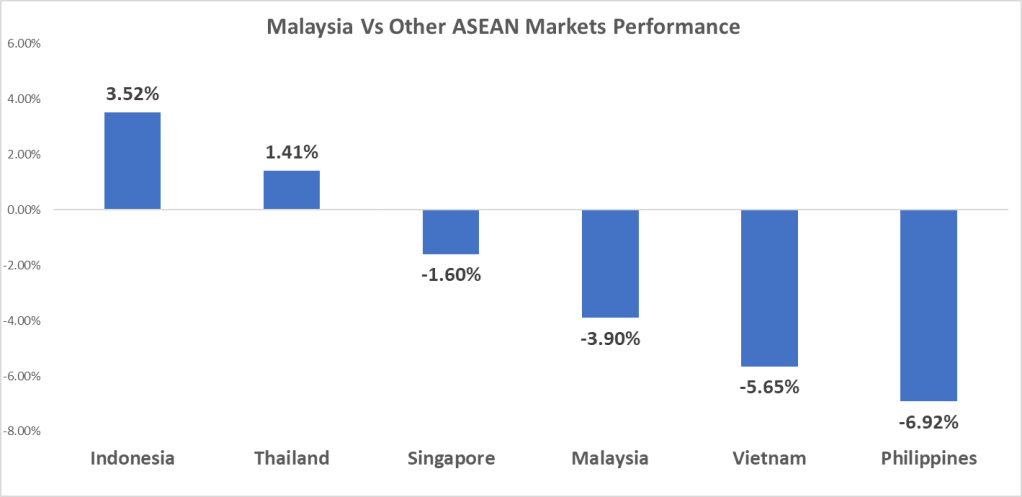

Malaysia’s stock market performance is right in the middle, when compared to other ASEAN markets.

When compared against other countries in the ASEAN region, Malaysia’s stock market performance in 3Q 2022 is right in the middle – neither high nor low. The stock markets of Indonesia and Thailand benefited from high commodity prices and the reopening of borders for tourist respectively.

Meanwhile, Singapore who is highly dependent on exports (about 150% of GDP are exports) declined as the global economic outlook especially in the U.S., Europe and China softens in light of high inflationary pressures. Vietnam on the other hand, also faces pressures from a slowing down of China’s economy as it exports most of its products to the country. Philippines registered one of the highest inflation rate of 6.3% in August 2022 among the ASEAN countries.

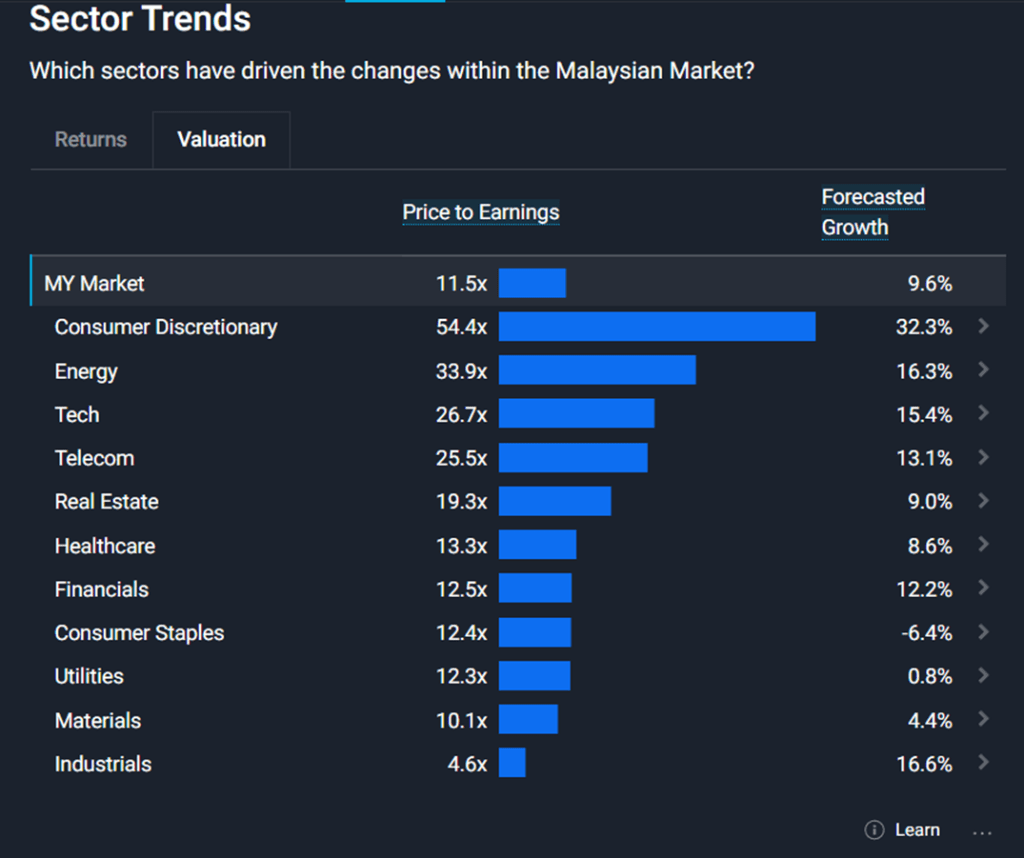

Malaysia’s stock market valuation is currently below its 3-year average, with investors bullish on consumer, energy, technology and telecommunication sectors.

Malaysia’s stock market currently has a price earnings ratio of 11.5 times, which is much lower than the 3-year average of 22.2 times. This represents a potential upside of almost 100% if KLCI trades back up to its historical average. By sectors, consumer, energy, technology, and telecommunication sectors registered price earnings ratio that are higher than the overall market, indicating that investors are bullish on their prospects.

For details on the excel file I used and the source, please click here.