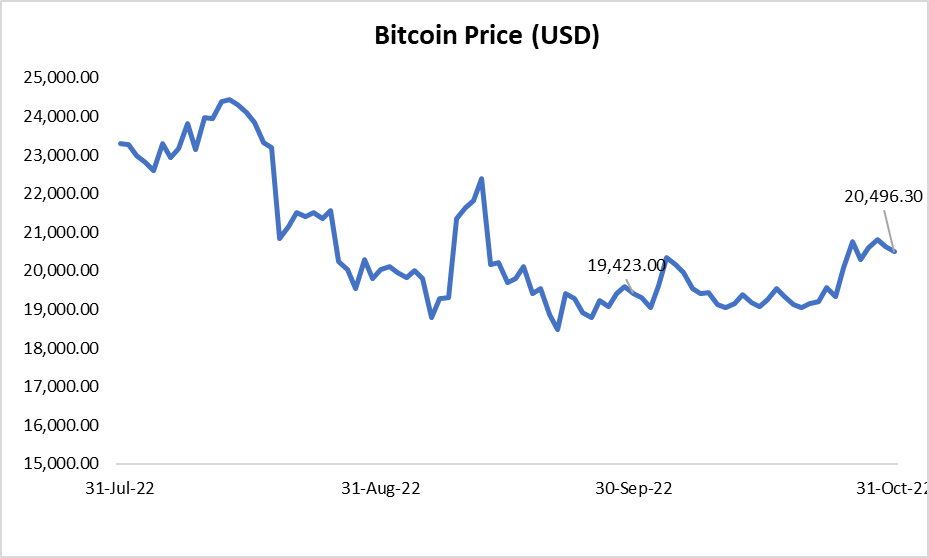

Bitcoin prices rose in October 2022, buoyed by increased buying interest as the market rose in line with the U.S. equity markets.

Bitcoin prices rose by 5.5% in October to $20,496 from $19,423 in September 2022, in line with the U.S. equity markets. The Dow Jones Index increased by a whopping 13.9%, while the Nasdaq Index rose by 3.9%. Both U.S. markets rose on the back of stronger-than-expected GDP growth of 1.8% in 3Q 2022 compared to the consensus of 1.6%. Meanwhile, for the Bitcoin market, it registered its best returns in the last week of October as a series of upbeat quarterly earnings in the banking and consumer sectors, and easing inflation boosted buying interest among investors for riskier assets.

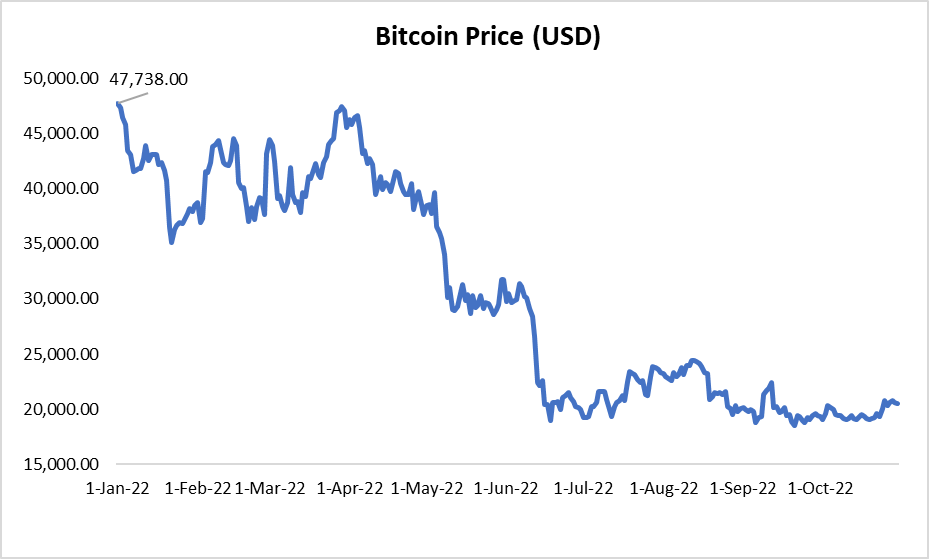

However, Bitcoin prices remain far below the peak price of 2022 as a struggling global economy especially in the U.S. and Europe, dampened investor sentiments.

Bitcoin traded at a price of $47,738 at the beginning of the year, and has since more than halved to its current levels. Two significant evens had happened since the beginning of the year. One, the Russia-Ukraine conflict caused a supply disruption in crude oil, natural gas, and food commodity prices, and raised inflation for many of the economies in the world which depend on them. Two, the Fed started its interest rate hikes and wind down its quantitative easing program amid high inflation (mainly caused by high commodity prices and the tight labour market) and the strong recovery of the U.S. economy. Demand for Bitcoin started to decrease as the crypto market performances started to go hand-in-hand with the equity markets performances, as investors fled to safe-haven assets.

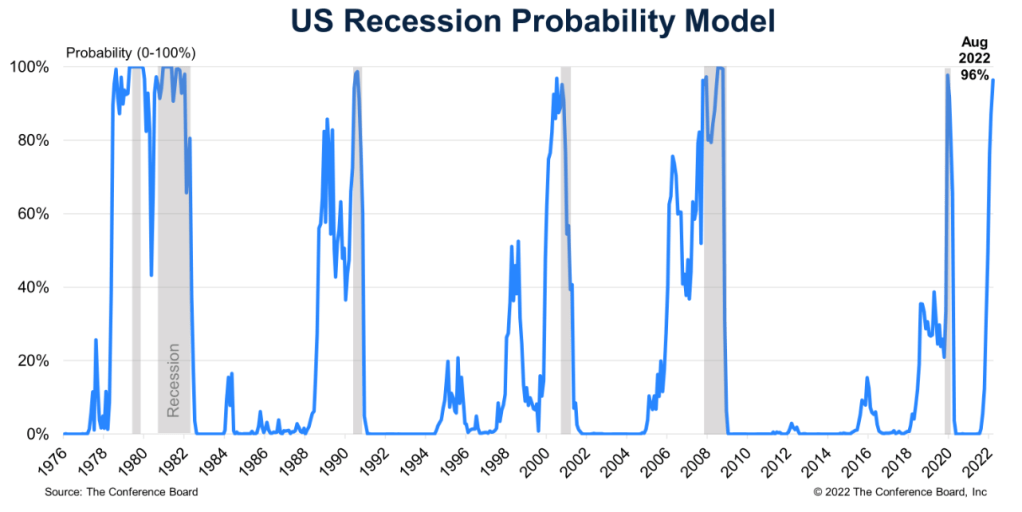

The Bitcoin market is expected to remain slightly flat for the time being, considering the potential risks of recessions in the U.S. and Europe.

Bitcoin prices have been relatively flat since June 2022, as its prospects remain clouded by the potential recessions in the U.S. and Europe as inflation remains elevated and interest rates are increasing. The Fed is projecting for interest rates to hit 4.50% by the end of 2022 and 4.75% by the end of 2023, while the European Central Bank has subsequently also raised interest rates to 2.00% and expects to raise it further in light of very high inflation. Producer price index growth in Europe rose to a peak of 43.3% in September 2022 before easing slightly back to 41.9% in October 2022. This had a pass-on effect to consumers, with consumer price index growth rising to 10.7% in October 2022 from 9.9% in September 2022. Markets are now expecting a recession for both the U.S. and Europe in possibly 4Q 2022 or 1H 2023.

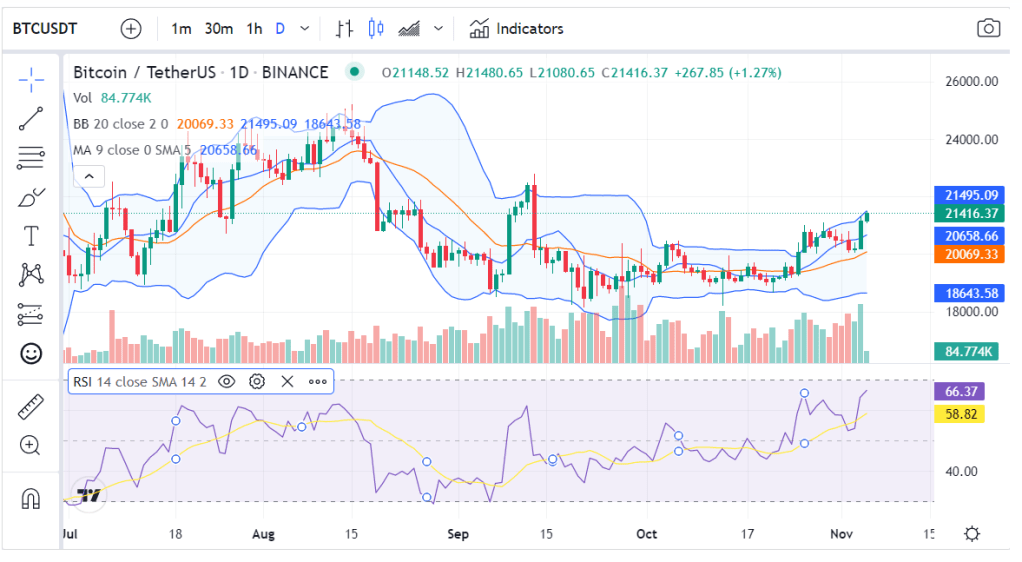

Technical trading indicators seem to indicate a potential upward trend moving forward currently.

So far, the bollinger band seems to be starting to widen, indicating a potential breaking increase in the trading range of Bitcoin. Judging based on the moving average line (blue line), it is indicating an upward trend, as moving average has started to trend upwards since the last week of October 2022. The relative strength index has also showed a similar trend, increasing upwards since the last week of October 2022 at a current level of 66.37. The previous widening trend at the end of August and early September 2022, led to a decline in Bitcoin prices as the candle sticks and price movement were already indicating a downward trend. This time around, the price movements seem to be in favour for an upward trend.