U.S. Inflation eased at a significant pace finally in October 2022

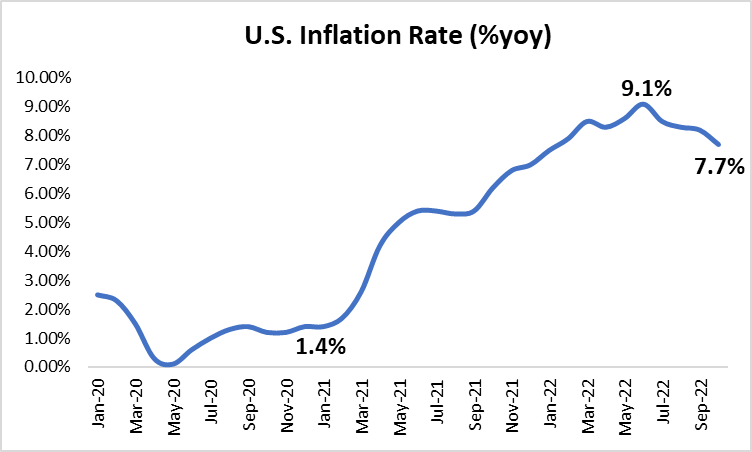

U.S. consumer price growth or inflation finally eased to 7.7% in October 2022 from 8.2% in September 2022. This has come on the back of inflation rising to as high as 9.1% in June 2022 as high crude oil and food prices from the conflict in Russia and Ukraine raised input prices for businesses and they passed on the price increase to consumers.

Since then, the Federal Reserve has raised its interest rates from 0.25% to 4.00% currently to try to curb these inflationary pressures. It does seem like it’s working now.

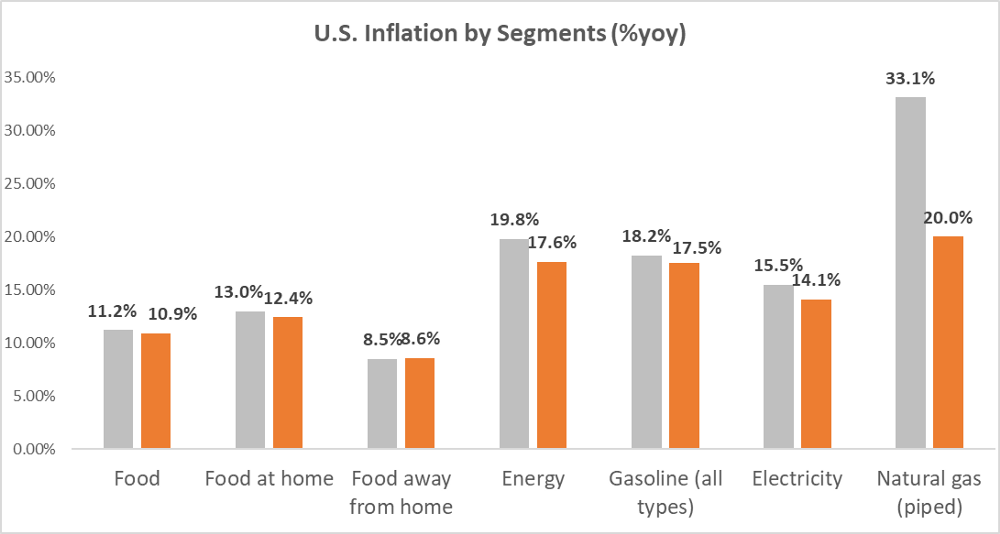

The lower inflation rate was due to slower price increases in the food and energy segments.

The lower inflation rate of 7.7% was driven mainly by the food and energy segments. In the food segment, food prices grew at a slower rate of 10.9% in October 2022 compared to 11.2% in September 2022, mostly driven by the moderation in food-at-home prices. In the energy segment, energy CPI moderated to 17.6% from 19.8% over the same period, due to lower gasoline and natural gas prices increase.

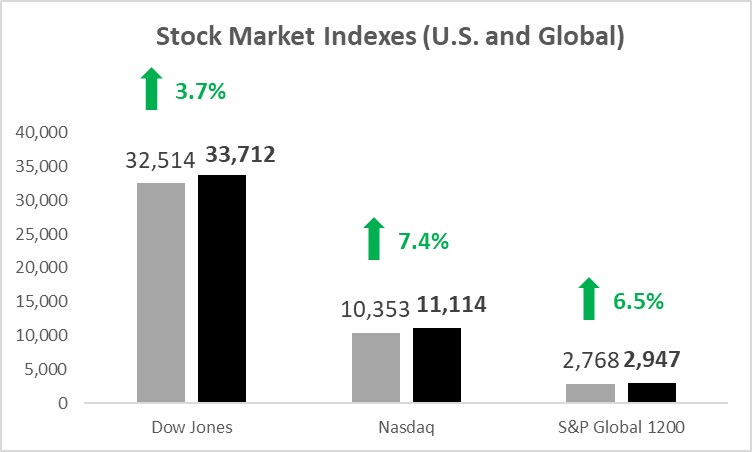

U.S. markets were up due to the news of easing inflation as it signals that rate hikes are working.

When news broke out on November 10, markets rejoiced as it indicates that the Fed’s interest rate hikes are working in taming inflation, albeit at a gradual rate. The Dow Jones rose by 3.7%, while the Nasdaq rose by 7.4%. Meanwhile, the global S&P 1200 (proxy for global markets) rose by 6.5%.

Many market investors are expecting some sort of slowing in the pace of interest rate hikes if inflation continues to ease back to 2.0% (the Fed’s targeted inflation. In December 2022, the Fed will release its latest interest rate and inflation projections for 2023 and 2024, which will give a better view of the Fed’s decisions and views on the inflation situation.

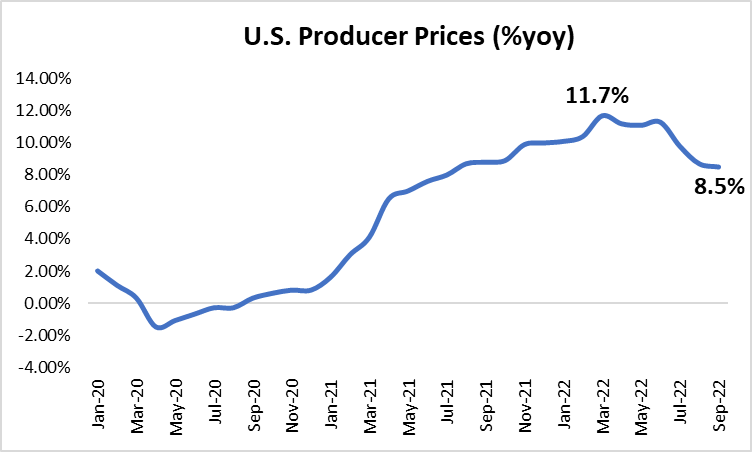

Inflation is expected to continue easing, with producer prices on the way down also.

Inflation is expected to continue easing moving forward, with personal consumption expenditure (PCE) inflation expected to ease from 5.4% in 2022 to 2.8% in 2023. Producer prices have also begun to ease from their peak of 11.7% in March to 8.5% currently in September 2022.

With global crude oil, natural gas, wheat, and soybean prices continuing to moderate due to the resumption in supply, producer prices easing is expected to reduce inflationary pressures for consumers moving forward.