Canaan Inc is a hardware provider for supercomputing solutions, mainly for the Bitcoin industry.

Canaan Inc (CI)is a Chinese-based IC designer company mainly involved in the production of ASIC chips that are mainly used in the Bitcoin industry. CI has a reputation for providing the Avalon brand to Bitcoin consumers in 2013 and has since been mainly involved in the Bitcoin and AI chips industries.

It is involved in both the front- and back-end development of the IC design and has the capability to assemble Bitcoin mining machines and AI chips. Its highest capability now is the 7nm first-generation chips in Bitcoin mining machines.

CI is increasingly shifting its sales to overseas customers, with sales outside of China encompassing 64.4% of total revenue in 2021 compared to 26.2% in 2019. As China is now clamping down on Bitcoin operations, it makes sense for CI to shift its sales overseas. CI is wholly reliant on Bitcoin machine sales, which encompass 99.1% of revenue in 2021.

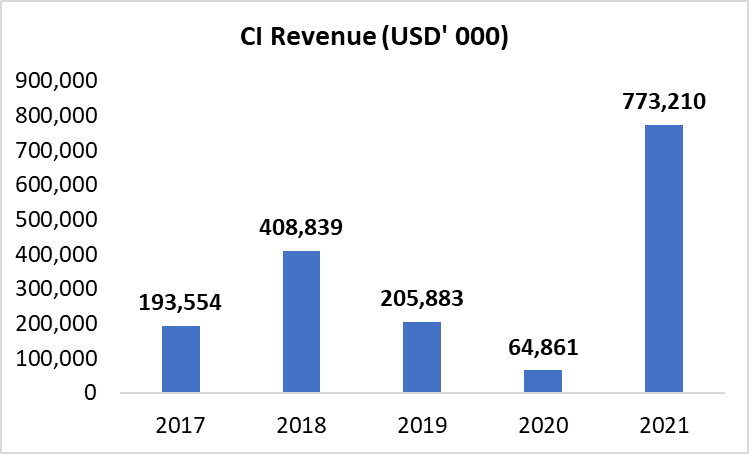

Canaan Inc grew a whopping 10 times in 2021, due to high demand for Bitcoin machines amid the boom in crypto markets.

Canaan’s revenue increased by tenfold to USD773.2 million in 2021 from USD64.9 million in 2020, due to sharp increases in sales of bitcoin mining machines and the recovery of China from lockdown restrictions in 2020. This was 4 times higher than pre-pandemic level of USD205.9 million in 2019 and the peak of USD408.8 million in 2018.

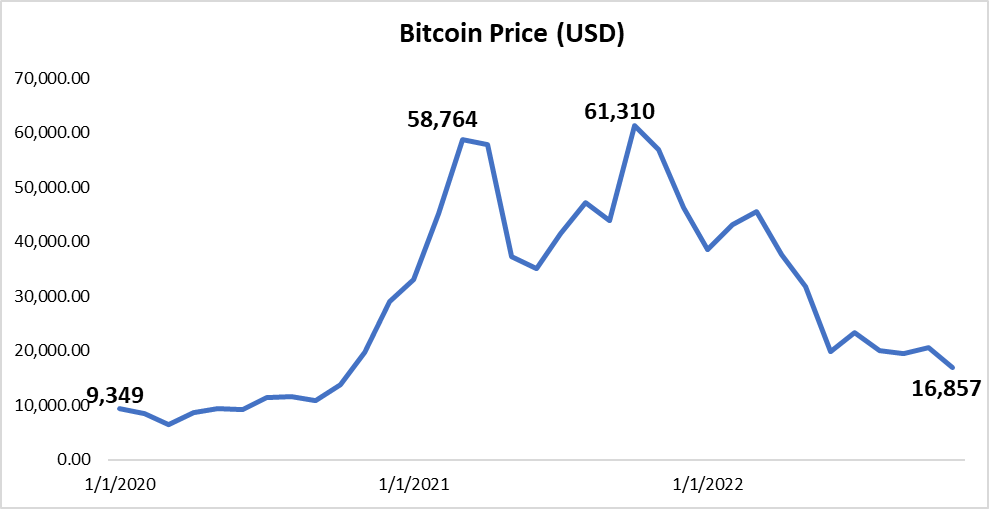

Bitcoin mining machine sales rose from USD201.1 million to USD 766.3 million over the same period. For some context, bitcoin prices to as high as USD61.3 in October 2021, a six-fold increase from January 2020.

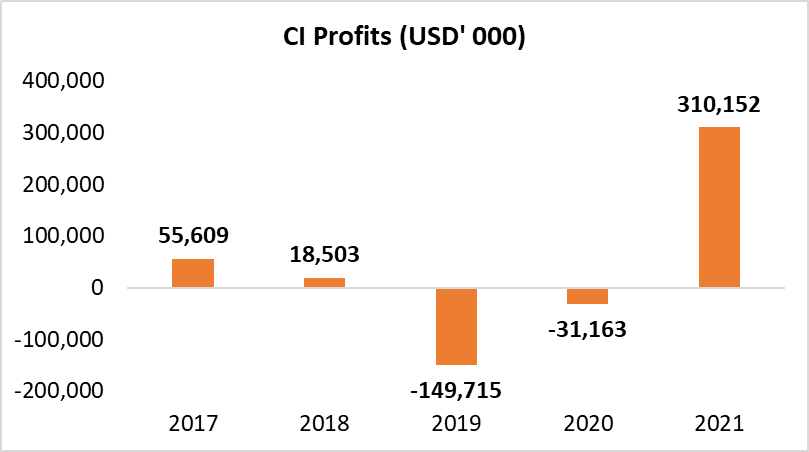

However, it seems that CI is very reliant on generating high sales to generate more profits and needs significant scaling up to achieve so. Even in 2019, when revenue was decent at USD205.5 million, it incurred losses of USD149.7 million. This was due to primarily a write-down of inventories in 2019, due to declining bitcoin prices that prevented CI from selling their bitcoin mining machines at above cost. This amounted to USD104.7 million. In 2021 with favourable Bitcoin prices, CI has been able to generate its highest profits in 5 years at US310.2 million.

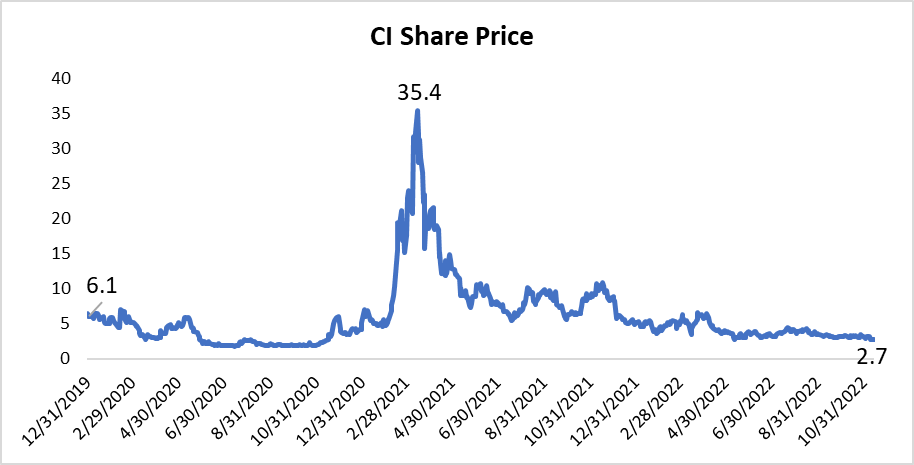

Canaan’s share price has declined in line with the crash in crypto markets and is trading at very low valuations.

Canaan’s share price rose to as high as US35.4 in line with the rise in crypto markets in 2021 as more miners entered the Bitcoin market in need of Bitcoin mining equipment. However, as CI also lives and die by the crypto market, its share price declined subsequently to as low as US2.7 currently as Bitcoin prices crashed.

CI is currently trading at a price-to-earnings ratio of 1.3 times, where it traded at 8.7 times as of 31 December 2021. In comparison, the Information Technology sector is currently trading at a price-to-earnings ratio of 36.6 times.

CI is valued at US5.15 according to DCF, with an implied upside of 90.8% and an implied price earnings ratio of 2.5 times.

According to DCF valuation, CI is valued at US5.15 with the following assumptions:

- Revenue growth: -20% in 2022, -5% in 2023, and 10% for 2024 to 2026. 20% decline in revenue might seem drastic, but it is in line with the decline in crypto prices and the ban by the US on semiconductor chips related to AI.

- EBITDA margin: 9.5% in line with the historical average.

- Weighted Average Cost of Capital: 6.1% based on U.S. 10-year yield of 3.9%, equity risk premium of 4.2%, and cost of debt of 8.0%.

- Terminal Growth Rate: 1.0%.

Median target price by analysts is about $7.31, more bullish than my DCF valuation here.

Technical indicators indicate flat performance and a possible slight downward trend.

The bollinger band currently is still narrowing, with no indication yet that it is widening soon. It did widen in the middle of August 2022 slightly for a downward trend, and a downward trend might be coming in light of the FTX filing for bankruptcy affecting the wider crypto market.

The relative strength index is at 47 points, still low when compared to its peak of 74 previously. It is showing a possible upward trend in RSI but that remains unlikely given the negativity surrounding the overall crypto market.

MACD line is now below the signal line, indicating short positions for CI. However, the MACD and signal line remains relatively flat recently.