China is the second biggest economy in the world by size, but still lacks behind in per capita basis.

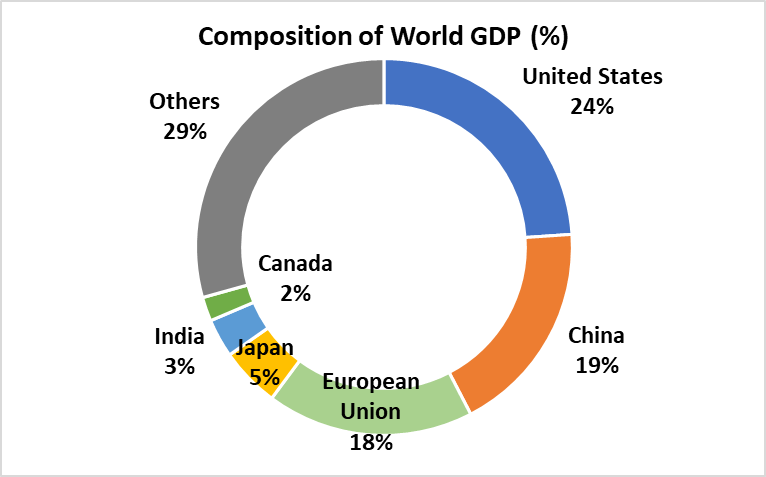

By gross domestic product, China is currently the second largest economy in the world at 19% of the world’s GDP, with United States at first at 24%. This is followed by European Union (18%), Japan (5%), India (3%), Canada (2%) and the rest of the world. Its rapid growth in the last decade has enabled China to climb the ranks to number 2 in recent years. China is expected to surpass U.S. as the biggest economy possibly by 2030.

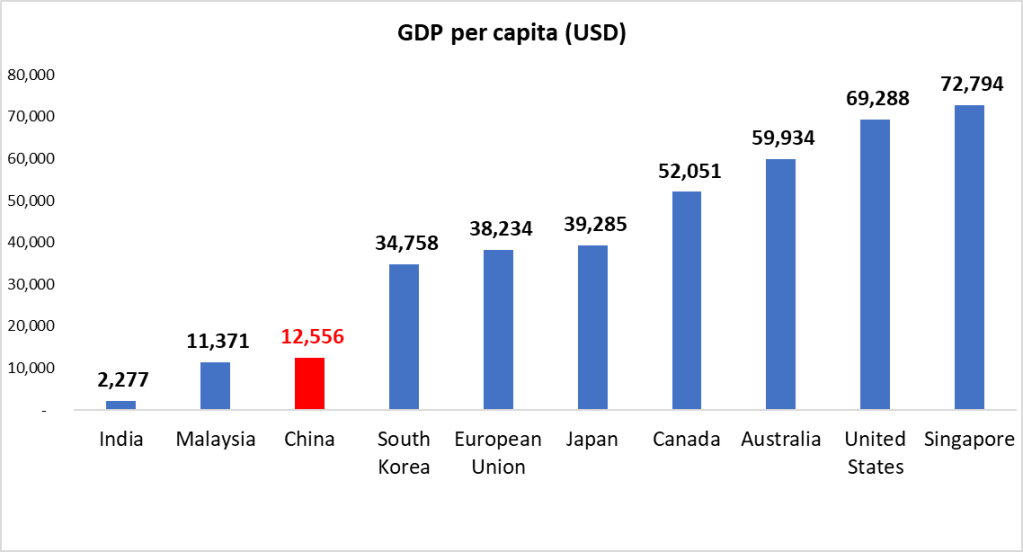

However, on a per capita basis (basically how much GDP per person in the country), China still lacks far behind the other advanced economies. It is currently at the middle of the pack among 190 countries in the database, garnering USD 12,556 per capita. To reach high income status, it needs a bit more to reach the USD 12,690 level. It will probably be until the middle of the century before China can reach the level achieved by other advanced economies.

China has rapidly grown by double digits in the past, but that is not expected to continue.

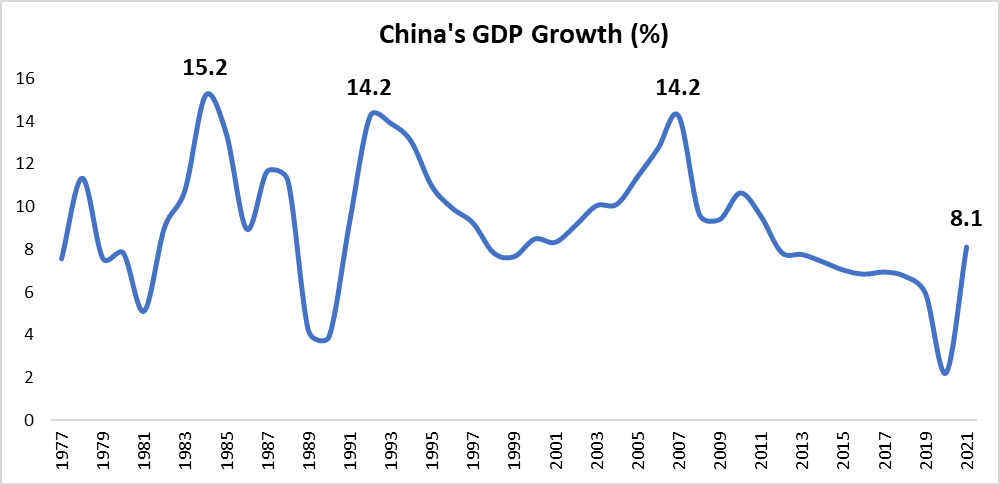

China was one of the fastest growing economies since the beginning of the 1980s, after Deng Xiaoping took over. It grew at an average rate of 9.9% from 1977 to 2010 before slowing gradually to about an average of 7.0% in the recent decade. China’s high growth was driven mainly by its manufacturing and export sectors that lead to it being called the factory of the world. It encouraged high savings by its citizens and channeled them to investments into agriculture and heavy industries, which in turn helped developed both the urban and rural areas.

However, China is not expected to register double digit growths as seen earlier as it enters the later phase of its economic development cycle where growth cannot be driven mainly by exports anymore, but instead consumption from its own citizens. Bloomberg predicts that China will probably grow at a rate of above 5.0% moving forward.

Its export-oriented economic growth model does not work anymore, and China is transitioning to domestic consumption.

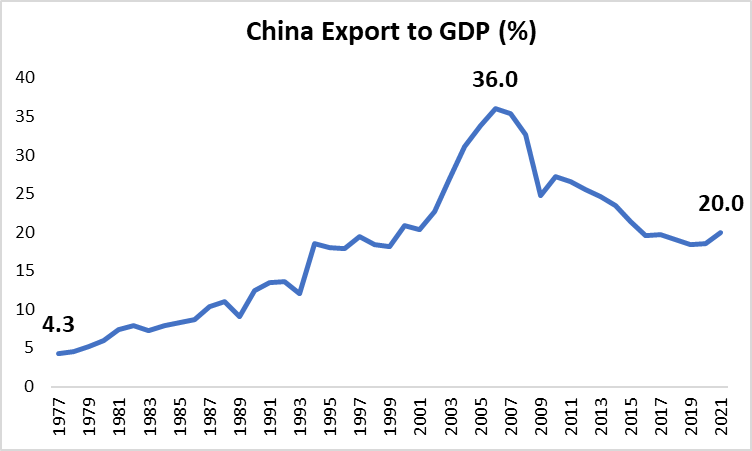

What does this mean actually? China has in the past relied on exports to drive its growth for the economy. It was when Deng Xiaoping opened up its economy for investments into manufacturing activities and spur them into the export market that China was able to achieve high economic growth. After all, most of the Chinese during that time did not have the spending power to consume whatever that was produced from China’s factories. The quickest path to growth was through the export market where both the U.S. and Europe were large consumers. This was the model implemented by most of the Asian economies during this time including Japan, South Korea, Taiwan, and many others. As a result, exports share to GDP in China increased from 4.3% in 1977 to as high as 36% in 2006.

However, that model can no longer be the main driver. For one, China has a huge domestic market. Its population count of 1.41 billion is the largest in the world, with India slightly behind at 1.39 billion. Its traditional export markets of U.S. and Europe are increasingly more hostile to China, as China also has ambitions to be a global superpower. U.S. in this regard, has been in constant tensions with China over the Hong Kong and Taiwan sovereignty, trade tensions, and technology war issues.

Right now, only about 38% of GDP consisting of private consumption. Hence, China needs to increase it to at least 50% to be in line with most of the advanced economies and reduce its reliance on exports. After all, the Chinese has one of the highest savings rate in the world, and if that savings is unleashed into consumption, it will be the other way around – China will be the biggest consumers in the world.

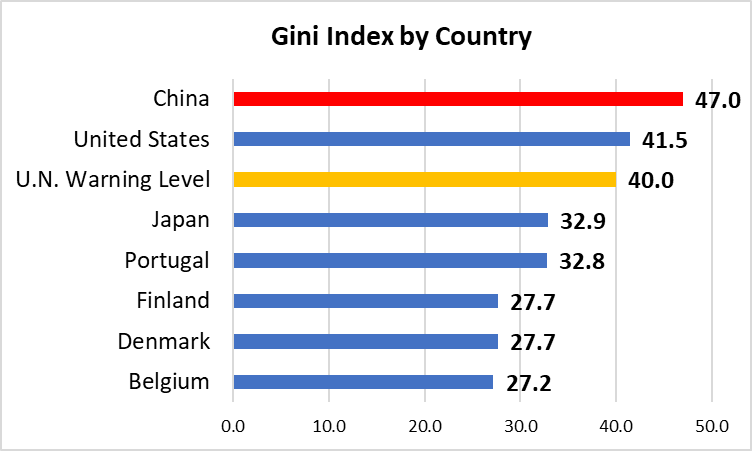

Inequality is a big issue in China, and it needs to address it to ensure that gains from the economy are distributed equally.

China’s Gini coefficient has been stubbornly coming in at 0.47 as of 2020 according to the National Bureau of Statistics China, above the United Nations warning level of 0.40. For some context, Gini coefficient is a measure of inequality in the country – the higher the index, the more unequal the country is and vice versa. Many of the advanced economies did have high inequality while they were growing rapidly previously and addressed them at the later stage of their economic development when higher standards of living became more important.

Part of President Xi’s agenda is also to promote more equitable economic development, as the period of growth at all cost has come to an end for China’s stage of economic development. With the advent of the internet, even the Chinese are more conscious of the state of their country, society and economy, and are demanding more of economic development instead rather than economic growth.

The property sector plays a big role in China, with most of Chinese wealth concentrated in properties that are unaffordable.

You would have surely heard of the recent property market downturn in China. Developers are unable to repay their debt, and hence, are not completing construction. Homebuyers on the other hand, have had enough and refuse to pay their home loan interest and that in turn, affects the financial sector. This cycle is detrimental to Chinese economy and is one of the problems that the current Chinese government is trying to address, but I don’t think they can effectively do so as they are also part of the problem with the control of credit and finances in the market and their slow progress in reforming the hukou system.

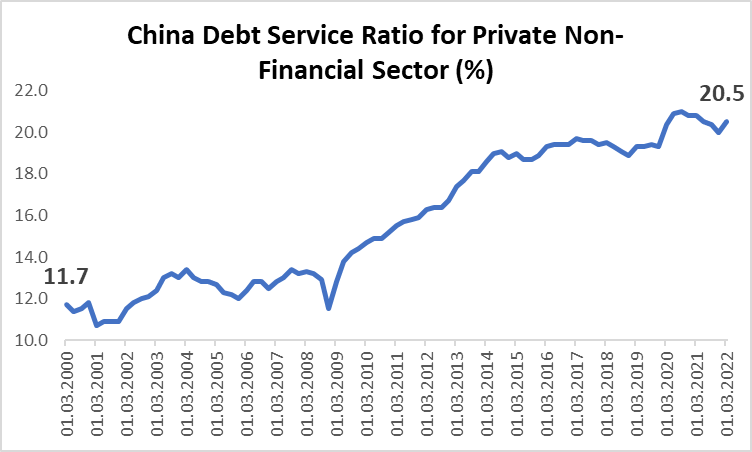

About 71.4% of urban household wealth in China is concentrated in properties according to the China Household Wealth Survey 2019. Couple that with the fact that China’s houses are one of the most unaffordable in the world at a price-to-income ratio of almost 30 times, it is no wonder then that Chinese households are spending more of their money on repaying their debt. Debt service ratio (portion of money spent on repaying debt to income) for private non-financial sector rose by 2 times from The big worry now is that declining house prices in China could drive down consumer spending as Chinese tighten their belts in light of the decreasing value of their homes.

The Chinese economy is still very much reliant on fossil fuel to power its economy, and the move to net zero carbon emission seems very far away.

The biggest energy source for China is coal at 55%, followed by petroleum (19%), and natural gas (9%). All these 3 sources are fossil fuel and encompass 83% of China’s total primary energy consumption. As much as China wants to move to a net zero carbon emission by 2050, this will come at a trade-off of economic growth. Coal shortages in the second half of last year (2H 2021), raised power and energy prices, and disrupted manufacturing activities and overall economic growth.

If anything, China needs even more fossil fuel now to secure its energy needs to power its growth moving forward. While its electric vehicle industry is growing leaps and bounds, renewable energy sources are still not prevalent enough to replace fossil fuel.

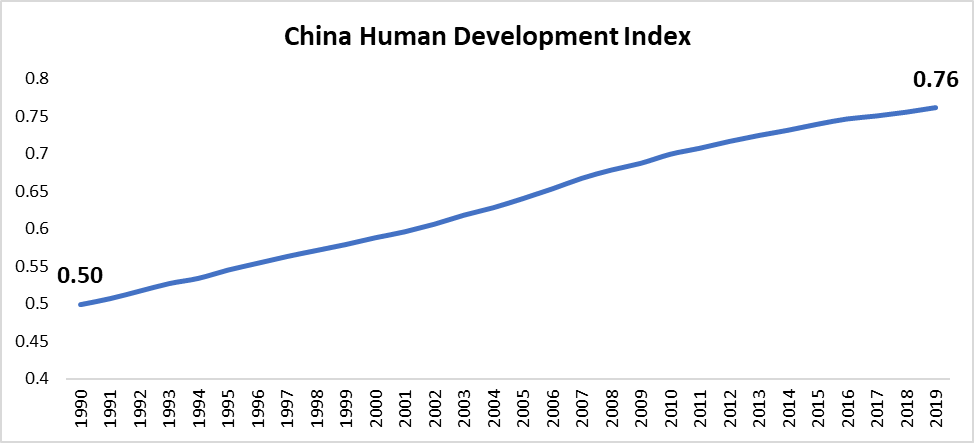

China’s Human Development Index still lacks far behind many countries in the world.

In a nutshell, Human Development Index measures the advancement of life expectancy, education, and income per capita – basically life quality of its citizens. China ranks 85th out of 183 countries in the index at a score of 0.76. While it has improved significantly from 0.50 in 1990 to its current 0.76 level, it still lacks far behind many of the advanced economies and will need to address these problems moving forward and not just focus on economic growth.

Other than that, its economic freedom index (which measures how free is it to do business) has declined significantly from 60.0 in 2020 to 48.0 in 2022 due to the increased regulation in the technology, gaming, education and property sectors. The government’s move to restrict the playing time of children, banning tuition / education services and instituting strict lockdowns and movement restrictions have had a chilling effect on its economic freedoms. China’s position is currently at an abysmal 155th out of 175 countries, bottom of the pack with the likes of Congo, Lebanon, and Zimbabwe.