Disclaimer: I do not take responsibility for anyone’s investment decisions. This article is just for informational and educational purposes and is not meant to be construed as investment advice.

I am sure many of you have heard for the thousandth time that the Chinese economy re-opening will carry the global markets out of their slump. “Chinese tourists will bring about a boom back to tourism worldwide” or “Chinese factories are opening up again, and spending is also picking up are the most common narrative you read and hear in the media now.

However, how valid are these claims? What are the data and historical context backing these? Understand these facts about the Chinese markets, which could help you get a good perspective on them.

Chinese tourism is big for the world, but we probably won’t see an immediate recovery.

Best believe it. US$255 billion or 20% of the world’s tourism spending is from Chinese tourists in 2019. Not only that, they are big spenders on items such as shopping (25% of total spending), accommodation (19%), and dining (16%).

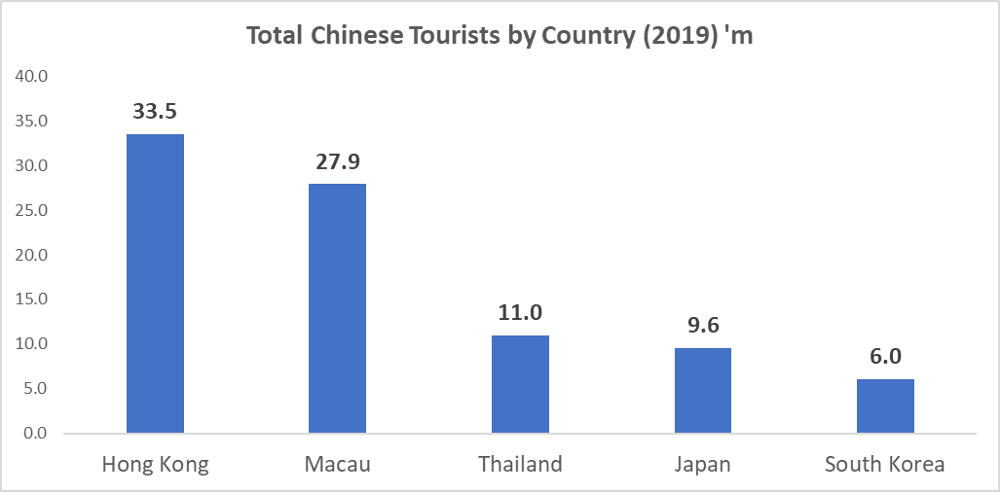

Countries like South Korea, Thailand, Japan, Australia, Macau, and Hong Kong are set to welcome these tourists based on the number of Chinese tourists in 2019.

However, I got to warn you. Chinese tourist numbers won’t immediately recover to 2019’s levels. Some countries like South Korea are imposing some form of restrictions on Chinese travelers. Furthermore, it will take some time for Chinese citizens to renew their passports and hit the road after 3 years of being in the pandemic. Airlines are opening back up flight routes into and out of China, but nearly not enough.

Yes, Chinese tourists are coming back, but slowly.

Exports from China are Expected to Improve But Probably Not By Much also.

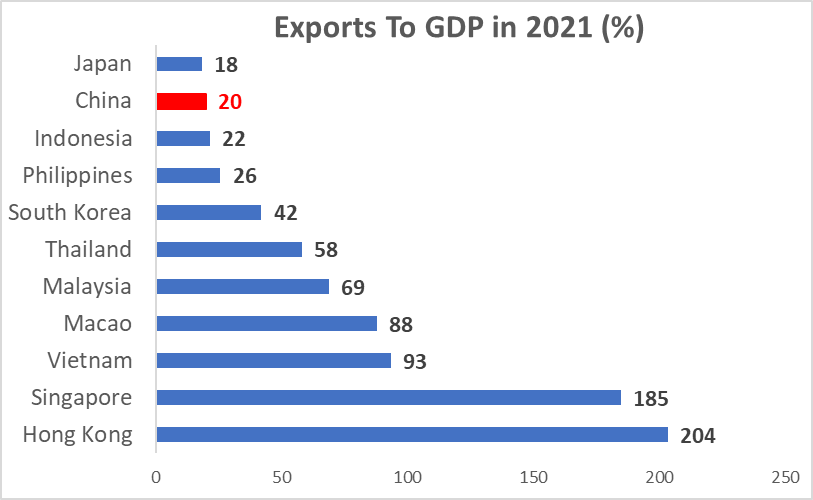

Here is a point that many don’t get it. Exports are important for China, but probably not as much as people thought. Here is a comparison of exports to the GDP of several countries in the Asia region, which measures how important exports are. Yes, China’s exports are one of the biggest in the world but are not a big portion of the Chinese economy if we look from this perspective.

Now that I have established the context for China’s exports, this brings us to the performance recently. Exports grew by 7.0% in 2022 compared to 29.9% in 2021, and this masks what was actually happening towards the tail end of 2022. Exports declined by 3 consecutive months from October to December 2022, and quite steep too.

So, what is going to drive export growth for China in 2023? Good question. I don’t know to be honest. We have global growth expected to moderate to 2.9% in 2023 from 3.4% in 2022 according to the IMF. Not only that, one-third of the world could be undergoing recessions this year — certainly not helpful to China. The reopening does help though right?

GDP Growth Expected to Rise to 5.2% in 2023, but Is that Even High?

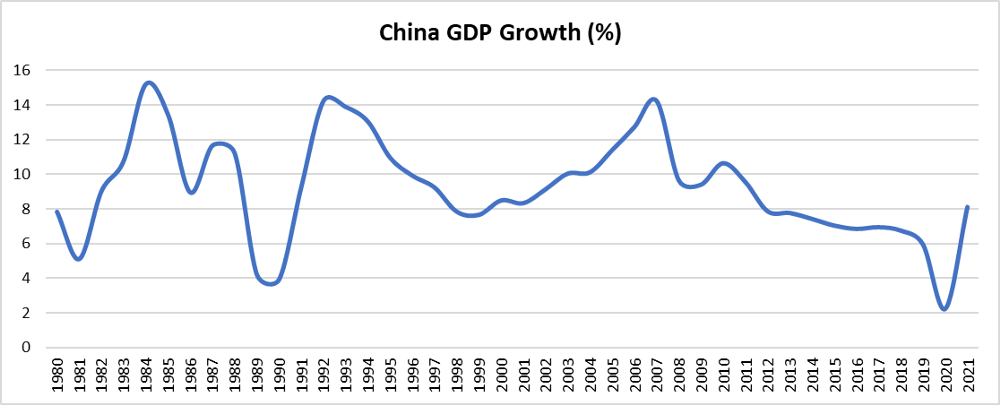

5.2% in 2023 is definitely better than 3.0% in 2022. That’s the main bottom line of many of the analysts in the market right now for China. This will be driven mainly by what is happening in China aka domestic demand rather than banking on exports to drive growth. If you have been reading until now, you would realise exports are really not the main driver of the Chinese economy — domestic demand is.

But if we go back in time, 5.2% is really not that high for China. The historical average from 1980 to 2021 is about 9.2%. To be fair, growth has been slowing down since the 2010s, when it averaged about 7.3%. So, things are definitely improving for China in 2023 but will that be enough to bring the global economy out of this slump? Probably not.

China’s Markets Underwent a Deep Downturn in 2022, so 2023 is the Year for Recovery… or is it?

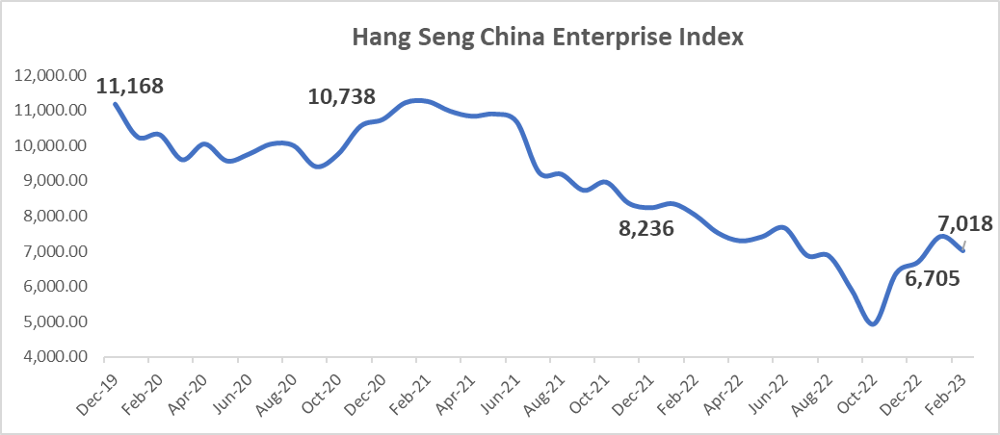

Here’s how the Hang Seng China Enterprise Index has been since December 2019.

The worse seems to be over for China, as it reached its bottom in October 2022 when lockdown restrictions were at their peak. However, did it actually recover to the levels in 2019 or 2020 for that matter? Nope. Its current level is just about 62.8% of its 2019 level. I leave it up to you to consider whether it can grow by a whopping 59.1% from its current level.