A man by the name of John used to live in the center of town. He was brilliant, and every young innovative person in town trusted him with their money as he was known to be great at protecting and growing their money. For a while, John was the talk of the town. Many young entrepreneurs used his company to keep their funds and operate their businesses. The business was booming as John invested all their money into very profitable investments.

However, one day, as its investments were making big losses, John thought that these losses were temporary and he kept holding these investments. Days turned into months, and a 5% loss turned into 15% and eventually into 30%. John who was well-regarded as a brilliant investor was now being visited by many of his clients demanding their money back. His clients were not doing well as a lot of their funding dried up from their investors and they needed to take their savings from John to pay for their businesses.

John, not wanting to anger his clients, sold his investments at a loss, and gave them back the money. The problem was that it was not just one client doing this, but hundreds more. Very soon, most investors realized that John’s investments have gone very bad and he might not even have money to repay them. They keep demanding their money back and John had to keep selling his loss-making investments to have enough cash to repay people back, but one day, he just didn’t have enough money to repay everyone. By then, people were banging on his door, and he was forced to declare that he was broke and proceeded to file for bankruptcy.

John’s story is a cautionary tale similar to Silicon Valley Bank (SVB), which was once regarded as the bank for venture capitals, technology companies and IT workers.

SVB Started Off as a Darling for Venture Capitalists, Big and Up-and-Coming Technology Companies, and their Workers.

Originally founded in 1983 to serve the needs of the start-up community in San Jose, it has gone on to become the United States’ 16th biggest bank by total assets. Its main clienteles were mostly in Silicon Valley, California, where many of the big venture capitalists and technology companies deposited their money with SVB.

SVB’s biggest tech clients include Halozyme Therapeutics, Oncorus, Blizzard, Buzzfeed, Roku, Roblox, Rocket Lab USA, Proterra, Astra Space, and many others more.

The Pandemic Triggered a Sudden Sharp Increase in Deposits in SVB

It’s 2021, the pandemic is in full force all over the world. Tech companies and workers were flushed with cash as they were unable to spend their money indoors and proceeded to deposit large amounts of their money into SVB — because that’s what you do with the money when you can’t spend it.

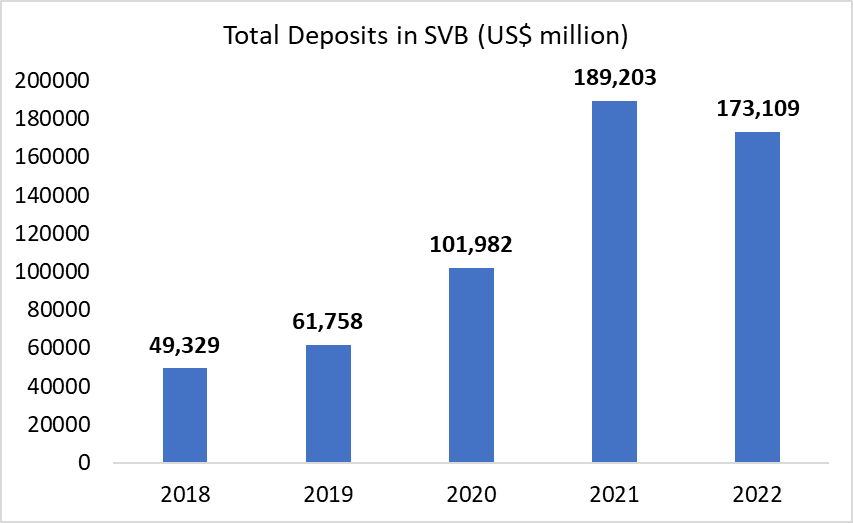

SVB’s total deposits tripled from US$61.8 billion in 2019 to US$189.2 billion in 2021. In just 2 years, SVB found themselves strapped with 3 times the amount of funds available to them.

Of Course, SVB Invested the Deposits to Maximise Their Profits.

Flushed with so much cash, SVB invested the money into long-term government bonds in 2021. At that time, government bonds in the U.S. were considered the safest asset to invest in with interest rates being low. Before I proceed, just a quick explanation of how bonds work. You can actually buy a government bond where the government promises to return you US$100 in let’s say 1 year’s time. You normally buy it at a discount at let’s say US$98 which means that you are able to obtain a “profit” of RM2 which translates to an interest rate of 2% (US$2 divided by US$100). However, if the central bank, the Federal Reserve wants to increase the interest rate of 2%, it would sell government bonds at a lower price of US$95 to set interest rates at 5%. Remember this, as this will be important to SVB’s story.

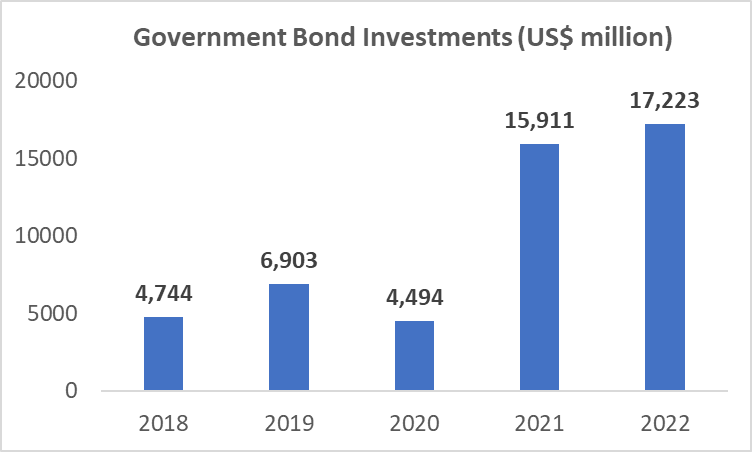

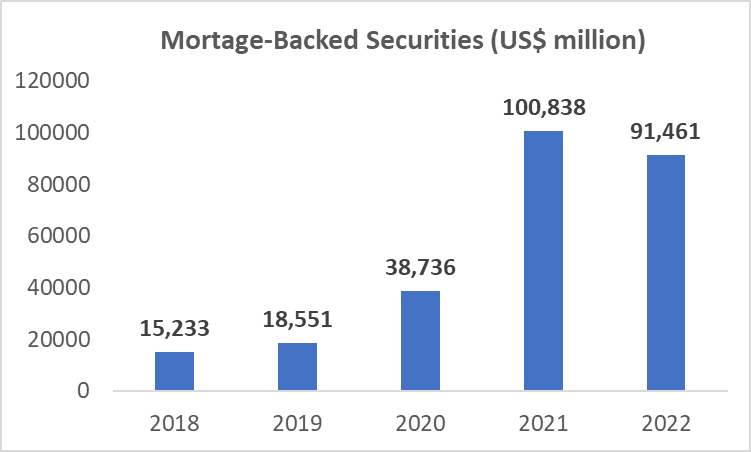

Back to the story, SVB invested most of the deposits into government bonds and surprise, surprise, mortgage-backed securities. Government bond investment increased from US$4.5 billion in 2020 to as high as US$17.2 billion in 2022. Meanwhile, mortgage-backed securities increased from US$18.6 billion in 2019 to US$100.8 billion in 2021.

There was No Problem Until the Federal Reserve Snapped its Fingers like Thanos.

On that day in March 2022, the Federal Reserve finally snapped… well not like Thanos but finally decided to raise interest rates. Inflation was running high at around a range of 5% to 9% in some months of 2022, way higher than the historical average of around 2%. The Fed had to do something about inflation and it did so by increasing interest rates to get people and companies to spend less.

The Fed increased interest rates from near zero in March 2022 to as high as 4.75% currently. Remember when I explained government bonds and interest rates previously? This means that the price of the bond that you bought at US$100 (when the interest rate was zero) has now lost about 4.75% as the price has gone down to US$95.25. Both SVB’s government bond and mortgage-backed investments lost a lot of money from the Fed’s increasing interest rates.

Furthermore, many of SVB’s clients were also tight on cash. The Fed’s high-interest rates lead to funds drying up as loans became more expensive, and companies and workers tightened their belts as higher costs of living ate into their savings. They proceeded to try to withdraw their money from SVB in big batches and SVB suffered such huge losses in their investments that it couldn’t repay its clients.

The Federal Deposit Insurance Corporation had to Step in to Rescue SVB

On 10 March 2023, the axe finally came. SVB clients lost faith in SVB and the FDIC had to step in to guarantee the deposits in SVB. FDIC and the Fed have promised that SVB clients will get all their deposits back, and many actually got their money back.

What the FDIC will do now is actually sell off SVB’s investment assets to get enough cash to repay back its clients. However, if I am being honest, the collapse happened because most of SVB’s clients wanted their cash back when the bank didn’t really have enough cash at the moment. SVB knows it will be selling its investments at a loss, but it has to do so. The problem was confidence. Now that the FDIC is in control, I don’t think there is such a problem anymore. The FDIC can guarantee that the deposits of SVB are secure and clients don’t actually need to withdraw their deposits now.

SVB did make a mistake by not exiting their investments in government bonds and mortgage-backed assets when they were making losses. however, I think since SVB is now guaranteed by FDIC and the Fed, there shouldn’t really be a crisis of confidence in SVB anymore.