Ah, Grab. How I remember the times when it was just MyTeksi in 2012. I was just an intern back then, fresh off the boat, not knowing how the world works. Then, in 2014 and 2015, they rebranded to Grab, and the war between Uber and Grab started. We all know how this story played out. Grab won, and they merged.

Fast forward to 2023, Grab is still the dominant player in Malaysia and Singapore. But something peculiar is still happening. Grab is still making losses. How can that be? What happened to the chosen one?

Grab is Still Making Losses in 2022, After 10 Years of Being in the Market

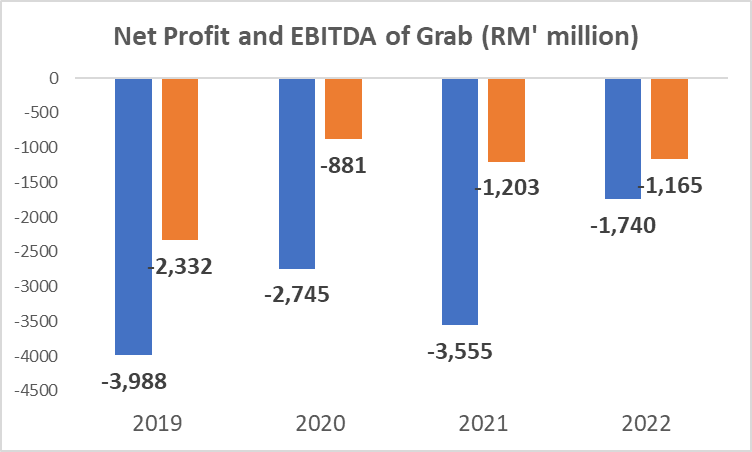

Yes, you heard that right. Grab is still making losses in its 10th year. In 2022, it made a loss of about US$1.7 billion, and surprisingly this was the smallest loss in 4 years. Oh, Grab, oh Grab. When will you ever be profitable? You made a loss of US$3.7 billion in 2019 and continued to do so in 2020 (-US$2.7 billion) and 2021 (-US$3.6 billion). Even from an EBITDA standpoint, you are still making losses.

Grab only Made a Smaller Loss as It Didn’t Pay as Much Interest on its Loans

In 2021, something happened. Grab had US$10.9 billion of debt in 2020. Then, in 2021, that debt declined to US$2.0 billion. What happened? Turns out Grab raised about US$6.9 billion in funds from the issuance of convertible redeemable preference shares. That’s a mouthful. This just means that it is technically a loan or bond, but the investor can change it to shares of the company. This was actually converted to shares for the company, and that means Grab didn’t have to pay the interest on the debt in 2022. Grab’s common equity (where the debt has now been converted to shares) increased from -US6.4 billion in 2020 to US$7.7 billion in 2021.

Grab paid US$1.7 billion in interest in 2021. Guess how much it paid in 2022? US$353 million. If Grab was still paying that US$1.7 billion, it would have made a loss of US$3.1 billion.

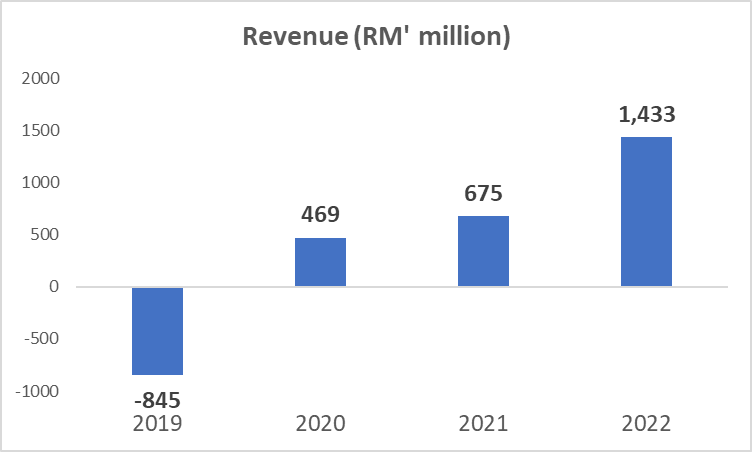

At Least Grab Doubled its Revenue in 2022, Which is Good News for Such a Big Monopoly.

Yes, I said it. Grab is a monopoly — at least in Malaysia and Singapore. Its revenue doubled from US$675 million in 2021 to US$1.4 billion in 2022, making 2022 the best year in the record it has. It managed to register a positive gross income of US$77 million in 2022, compared to dismal performances in the past 3 years.

Investors have been waiting a while now for Grab to capitalise on its position to capture more revenue from its clients. Better sooner than later.

Grab Lost Almost Two-Thirds of its Market Capitalisation Since 2021.

US$26.7 billion. That’s the market capitilisation of Grab at the end of 2021. That’s even higher than Maybank’s market cap (Malaysia’s biggest listed company) of US$22.2 billion currently. Two things happened that had investors running from Grab until it is now trading at a market cap of US$10.8 billion, a two-thirds decline.

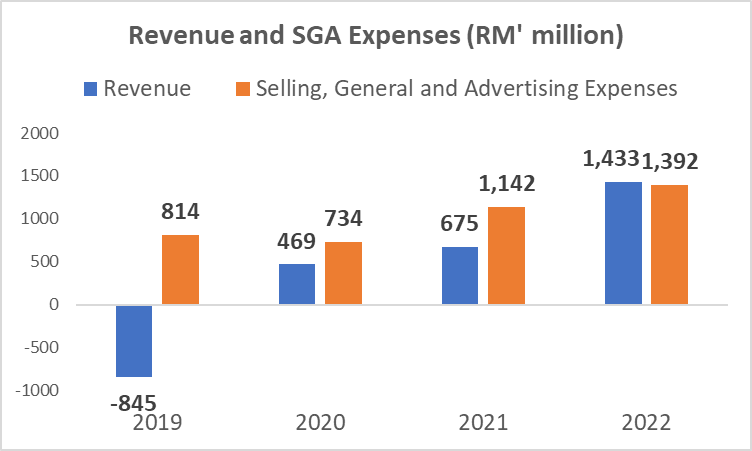

First, investors realised that Grab still had to burn a lot of cash to gain market shares. Its rewards program was proving to be unsustainable. For example, its selling, general, and advertising expenses (for its reward programs and advertising) always exceeded its revenue from 2019 to 2021. Secondly, the interest rate hikes by the Federal Reserve in 2022 (from 0.25% to 4.75%) crippled most of the technology companies in the world, adding to Grab’s misery.

Grab Still Has A Long Way to Go to Live Up to Investors’ Expectations.

Here’s an example. Grab’s market cap of US$10.8 billion makes it comparable to companies such as CIMB Group (US$10.4 billion) and IHH Healthcare (US$11.5 billion). But CIMB and IHH Healthcare Group make about US$4.4 billion and US$4.1 billion respectively in 2022. Grab makes only 25% of these companies’ revenue and is not even profitable.

Grab would have to at least triple its revenue in the next 3 to 5 years to even live up to investors’ expectations.

However, most of the ride-sharing companies in the world are also not profitable. Uber is still making a loss of USD9.1 billion, similar to Gojek (-USD1.5 billion) and Lyft (-USD1.6 billion). Maybe Grab still making losses after all these years isn’t such a surprising thing after all.