Japan’s Market Has been One of the Highest Performing Market Globally

Since the beginning of the year, the Nikkei 225, Japan’s main stock market, has risen by 19.8%. This makes it one of the best-performing markets in the world after the Nasdaq Composite Index at 20.9%.

Meanwhile, other stock markets such as the KOSPI (South Korea) and DAX (Germany) also recorded impressive performances.

The relative underperformance of China and Hong Kong has been disappointing so far considering that investors were very optimistic about China’s economic re-opening in the first 4 months of the year.

| Market | Country | Year-to-Date |

| NIKKEI 225 | Japan | 19.8% |

| Dow Jones | U.S. | -0.2% |

| NASDAQ Comp. | U.S. | 20.9% |

| DAX | Germany | 14.8% |

| KOSPI | South Korea | 15.4% |

| Hang Seng | Hong Kong | -3.5% |

| Shanghai Composite | China | 4.2% |

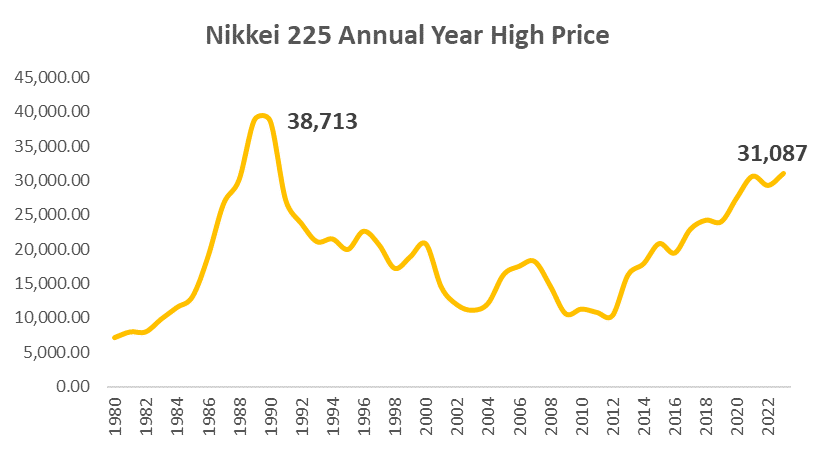

The Nikkei 225 has reached its highest level recently since 1990, when the stock market crashed in 1991, and continued to decline for 14 years to 2004. Since then, the Nikkei 225 has steadily risen back amid the appointment of Shinzo Abe as president in 2012.

He embarked on policies that sought to address the structural economic problems of Japan, and most importantly urged the Japanese central bank to aggressively lower its interest rates to introduce inflation in the economy.

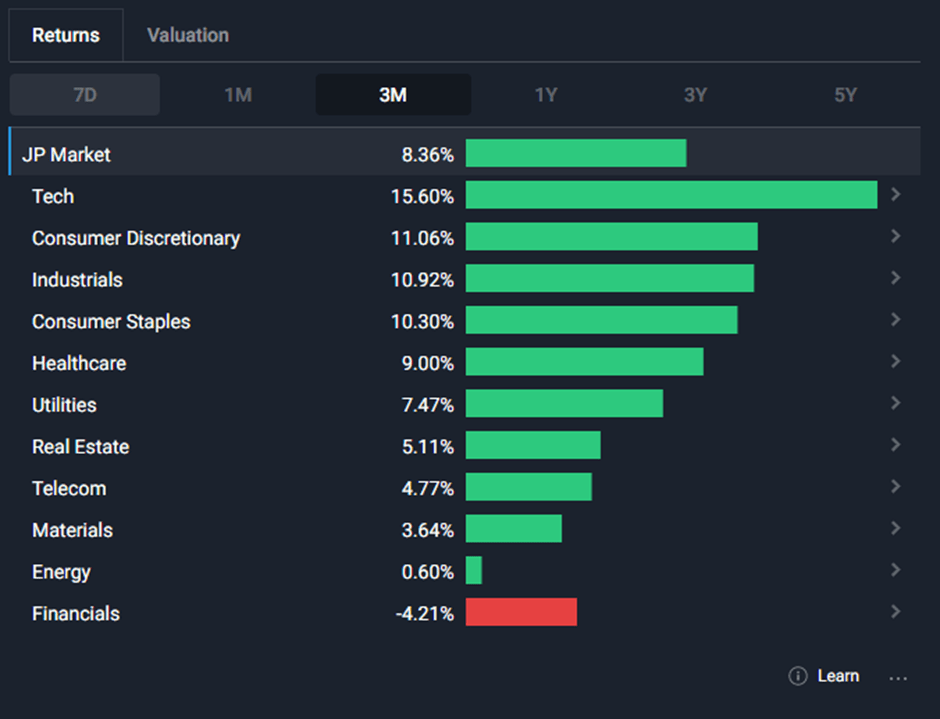

The Technology, Consumer, and Industrial Sectors Led the Gains

So, which are the sectors in Japan that helped it to gain to a 30-year high? In the last 3 months, the technology sector was the highest performing, rising by 15.6%. This was followed by the consumer discretionary (11.1%), industrials (10.9%), and consumer staples (10.3%) sectors.

In the technology sector, it seemed to have risen in tandem with the U.S. Nasdaq Index (which is mostly technology companies) as the Federal Reserve (Fed) has indicated that it might stop raising interest rates in the second half of 2023.

Why is this important? Technology stocks are known to be higher risks compared to other steady sectors (consumer, industrial) so an increase in interest rates affects these higher-risk stocks more.

Meanwhile, in the consumer sector, the higher performance was primarily driven by higher inflation (this might seem counterintuitive but will be explained later on) as consumer confidence also recovered.

Lastly, the industrial sector also rose as the recovery in consumer confidence increased business confidence to produce.

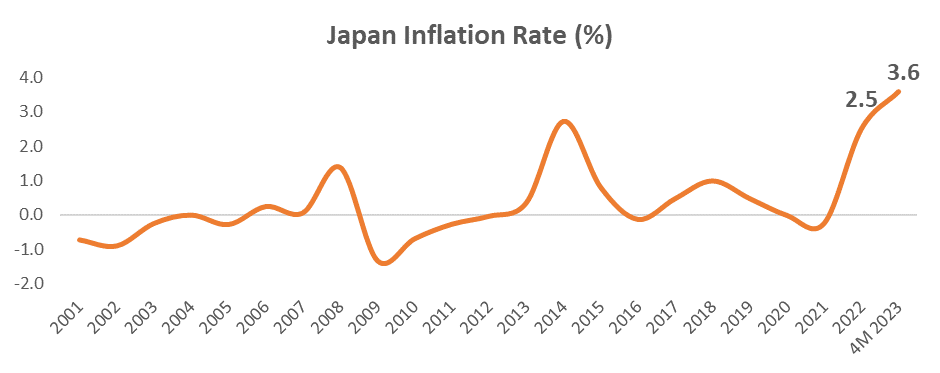

Inflation is Finally Back in Japan after 3 Decades of Deflation

As mentioned previously, the return of higher inflation to Japan is good news. Inflation rose to 2.5% in 2022 from a decline of 0.3% in 2021 and has continued to rise to an average of 3.6% in the first 4 months of 2023.

Back in the 1990s, Japan’s stock and property markets crashed due to the bursting of a very big speculative bubble in both markets.

As a result, economic activities declined so badly for the next decade that prices were declining due to a lack of consumer and business confidence.

When consumers know that prices are declining next year, they will just cut back on spending this year so that they can buy it cheaper next year.

And when that happens, businesses also invest less as consumers don’t spend. This creates a vicious cycle as prices will decline even more as there is no demand.

Subsequent efforts to introduce back inflation after the crash in 1990 fell flat, as inflation only averaged 0.1% growth from 2000 to 2021.

However, 2022 and 2023 were different, it was the first time that Japan saw inflation being persistently above 2.0% that consumers are now spending again.

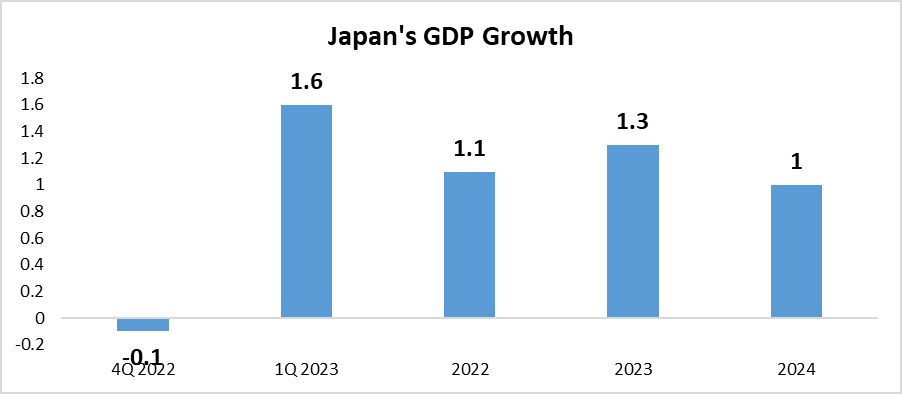

The Economy Grew Stronger-than-Expected in 1Q 2023

And guess what? The gross domestic product (GDP) growth was much stronger-than-expected at 1.6% (Market Expectations: 0.7%) in the first quarter of 2023, and higher compared to a decline of 0.1% in the fourth quarter of 2022.

This was driven by firm growth in private consumption and investments as consumers spend more amid the expectations of higher inflation in the future.

Furthermore, the International Monetary Fund expects Japan’s GDP growth to rise to 1.3% in 2023 from 1.1%, indicating that Japan’s economy remains on a strong footing.

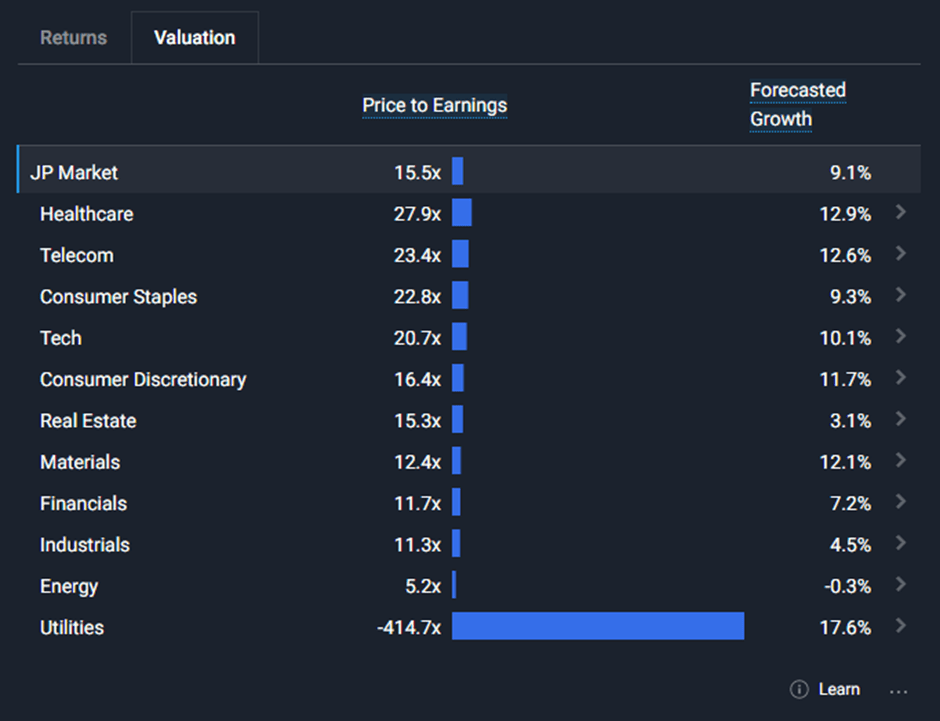

Meanwhile, in the Japanese stock market, based on data from SimplyWallSt, analysts are forecasting for the utilities, healthcare, telecommunications, materials, technology, and consumer discretionary to register double-digit growth in corporate earnings.

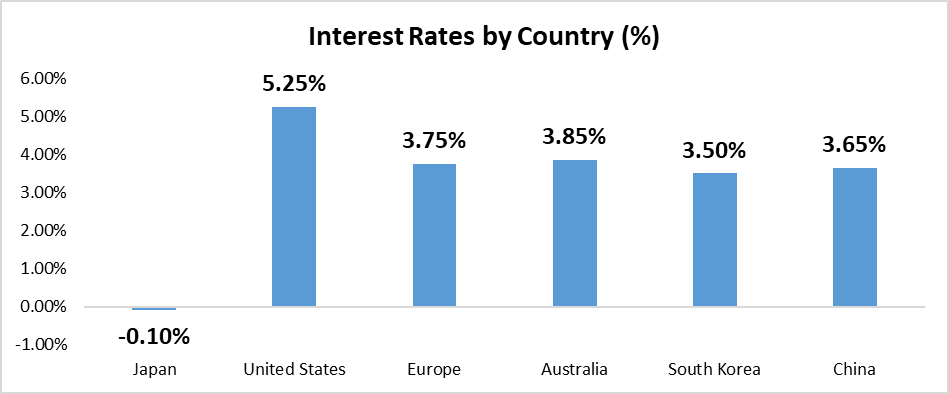

Interest Rates are Still Low In Contrast to Other Countries

Lastly, believe it or not. Japan is one of the few countries in the world that have not aggressively raised interest rates. Countries like the U.S. and Europe have done so as inflation rates were very high in both the years 2022 and 2023.

When interest rates are raised, consumption normally declines as consumers find that it is better to store their money to capture higher fixed deposit rates. Businesses also borrow less to invest as interest rates on loans are higher.

Investors are attracted to Japan as they view the low-interest rates to be still positive for economic growth while inflation has remained relatively low.

If anything, investors love the fact that there is now inflation in Japan after 3 decades.

Conclusion

Japan’s stock market has been on a tear this year and is actually due to stronger long-term fundamentals.

Inflation is finally back in Japan after 3 decades, which is encouraging Japanese consumers to spend. This, in turn, supports business confidence to produce.

Meanwhile, interest rates remain low compared to other countries, which ensures that the economy remains supported by the government’s pro-growth policies.