Are you excited about the electric vehicle (EV) industry? Looking to own a Tesla when it comes out? What If I told you there is a company in Malaysia that can make EVs?

That’s right. EP Manufacturing (EP) just got conditional approval from the Ministry of Investment, Trade, and Industry (MITI) to manufacture and assemble energy-efficient vehicles (EEV) and EVs on 11 July 2023.

You might be asking yourself why do I need to know this. Here’s why it matters to you:

- As an investor: Malaysia has few electric vehicle manufacturers. Investors that do not want to invest overseas (for fear of exchange rate risk) can do so with the emergence of new EV players in Malaysia.

- As a consumer: There are no details yet on whether EP Manufacturing will make EVs mainly for the local market (since they are doing so for overseas clients). If they do, consumers could potentially be looking at cheaper EVs in Malaysia.

Without further ado then, let’s look at the 7 key things that you need to know about EP Manufacturing!

#1: EP Manufacturing Makes Vehicle Parts

Before we get into its electric vehicle segment, EP primarily makes vehicle parts for clients such as Honda, Toyota, Perodua, Mazda, and Proton.

This includes products such as suspension, chassis, body parts, cross member, engine parts, plastic components, rear spoilers, air ducts, air-fuel module engines, and other parts.

Furthermore, EP also help assembles cars and fuel rail. In recent years, EP is aiming to diversify its business into new areas, namely EV. On that front, it has the right to supply electric bikes in Indonesia and Vietnam and has the exclusive right to distribute LINGBOX EVs in Malaysia.

At the end of 2022, EP launched the Blueshark R1 electric bike and sold about 150 units worth RM2.3 million. This translates to a selling price of RM15,333 per unit.

#2: Revenue Recovered in 2022 After Declining During the Pandemic

EP’s revenue grew by 50% to RM516 million in 2022 from RM345 million in 2021, marking a sharp recovery in its revenue.

Before this, revenue declined by 29% from 2019 to 2021 during the pandemic as EP ran into production issues (due to a shortage of staff and parts) and weak demand (no one drove).

The recovery in EP’s revenue in 2022 was boosted by higher sales from its automotive components, electric vehicles, and tooling segments.

Automotive components still make up the majority of EP’s business, contributing 89% of revenue in 2022, followed by tooling (10%) and EV (0.4%).

#3: Made 6 Consecutive Years of Loss, But Managed to Turn it Around Recently

You heard that right! EP made losses from 2016 to 2021, totaling RM98 million. In 2022, it did manage to make a small profit of RM400k after losing RM8 million in 2021.

It seems like the fortunes of EP are tied closely to Proton, with its years of losses from 2016 to 2021 coinciding with Proton’s sub-par financial performance also.

Furthermore, this period was also marked by high debt levels which amounted to RM86 million in 2017. Its interest coverage ratio (Profit Before Interest and Tax / Interest Expense) was consistently below 1 from 2016 to 2021 (this means that it doesn’t have enough profits to cover interest on debt).

However, in the last two quarters of 4Q 2022 and 1Q 2023, EP made a total profit of RM2.3 million and RM3.5 million respectively – its most in recent years.

#4: Shareholder’s Reserves Declined Sharply but Still Positive

Why is this important to talk about? For a company that has been making so many losses, there is a worry that it could go bust in the long term.

Shareholder reserve is an indicator to determine how likely this will be so. It is the culmination of how much profits have been made by the company since it was established.

For example, if the company was established in 2021 and made RM2 million in profits and RM 4 million in 2022, the total shareholder reserve will be RM6 million.

Shareholder reserve for EP declined by 62% to RM65 million in 2022 from RM172 million in 2015 but remains positive. In the recent quarter of 1Q 2023, the reserve increased to RM68 million.

However, this just means that EP has an uphill battle to restore its profits to its previous level to justify investors’ investments in it.

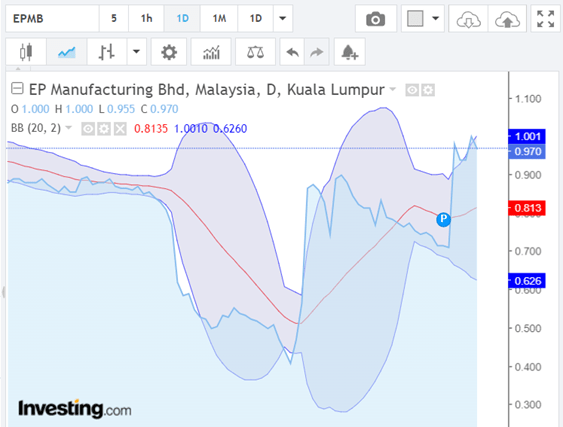

#5: EP’s Share Price has Recovered to RM1.00

In light of its losses since 2016 and the pandemic, the share price has declined to as low as RM0.23 in March 2020 from around RM0.80 in 2015.

Since then, with losses narrowing and EP finally turning a profit, share prices have rebounded to RM1.00 in 2022, reaching as high as RM1.28. Since the beginning of the year, EP’s share price declined by around 3.0% to RM0.97 but remain at the RM1.00 range.

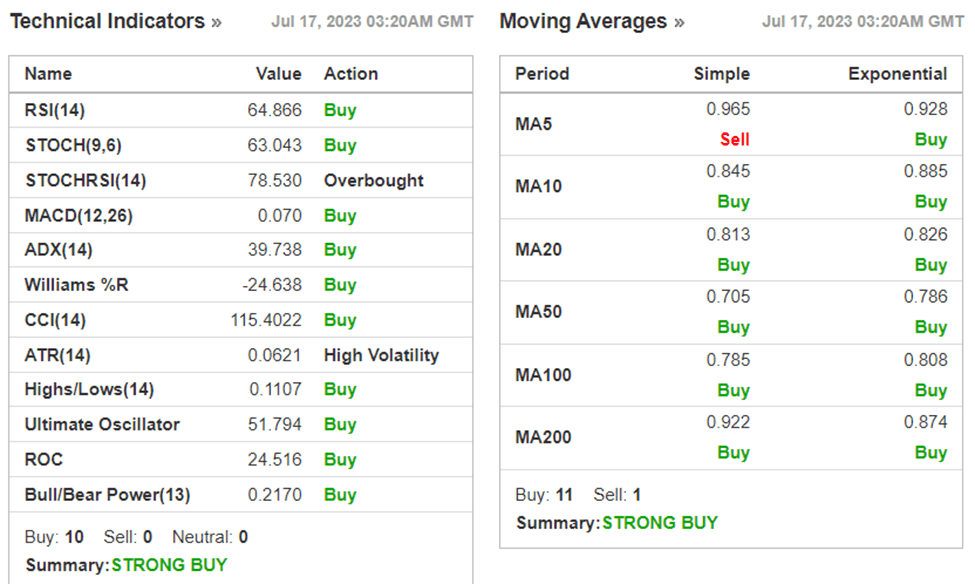

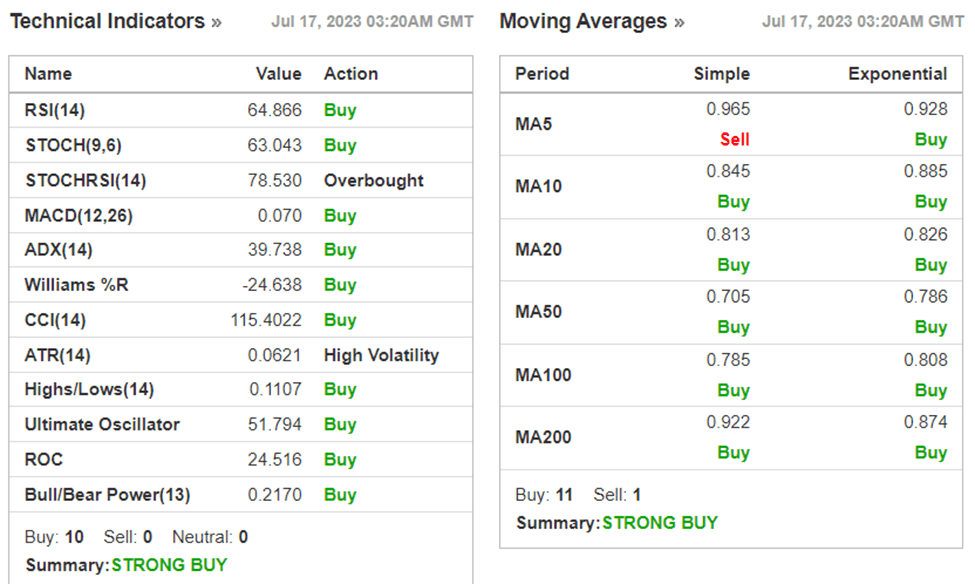

For those who are interested in technical indicators, there are three that are noteworthy from Investing.com

- Relative Strength Index

RSI is at 55.9 which indicates a BUY. RSI measures how overbought or oversold a position is.

- Moving Average Convergence/Divergence

The MACD is also indicating a BUY. MACD examines whether the signal line crosses the MACD line. When it does, it normally means that it has a strong buying or selling momentum.

- Bollinger Band

The Bollinger band is widening again after 7 July 2023, indicating another potential widening of the trading prices for EP.

#6: However, EP Still Lags Behind the Industry

EP’s return on assets and common equity is still below the industry’s average. Return on asset (ROA) is how efficiently the company uses its assets to generate profits, while return on common equity (ROE) means the same thing, just with utilizing the company’s investments.

EP registered a ROA of 0.6% and ROE of 1.3% compared to the industry’s average equivalent of 2.8% and 6.1%. What is more, it has not distributed any dividends to its shareholders in a long-time.

Why should you know this? You need to examine what is the position of EP in the industry. If it’s lacking behind its peers, that means it does not have many competitive advantages.

In the long-term, companies with strong competitive edge and position in the market are the ones who will survive and garner higher market share.

#7: EP is Expensive Currently or Investors Could be Bullish

EP is trading at a price-to-earnings ratio of 61.9 times (as of 17 July 2023), which is high when compared to the industry average of 6.9 times. There are two interpretations here.

One, it is very expensive to buy as its price is trading too high beyond its fundamental earnings. Two, investors are positive on EP so they are willing to buy EP in exchange for higher earnings in the future.

Since EP is not covered by analysts, it is hard to tell what is the correct interpretation. However, there are several questions that you can ask yourself to help you:

- With a PE of 61.9 times, what does that imply about investors’ expectations? 61.9 times is 10 times higher than 6.9 times. This means investors are expecting EP’s earnings to grow at least 10 times the amount for it to go back to 6.9 times.

- Is this possible? The facts are these. In the last 10 years, EP made its most profit of RM18.7 million in 2014. Its current latest annual profit is RM3.6 million (March 2022 to March 2023). EP would have to grow 5.2 times to reach 2014’s level and grow twice that to RM36 million to reach investors’ expectations. Based on the current profit margin of 2.3%, EP’s revenue would have to grow to RM1.6 billion to reach that profit. You would have to ask yourself whether EP can generate that revenue in the future from RM570 million currently.

Conclusion

EP Manufacturing obtaining conditional approval to make EVs should be analyzed from a factual basis to determine whether it’s a worthy investment to undertake.

This research piece helps you to lay down all the facts about the company but ultimately you would have to decide whether this is good for your portfolio.