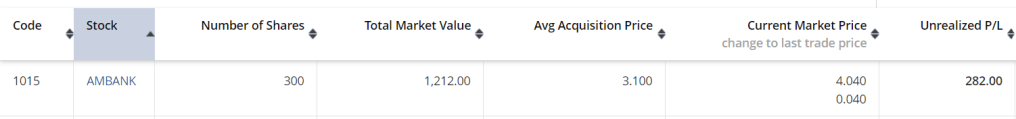

Here’s the proof. I invested in AmBank for RM3.10 in August 2021 and exited at RM4.04 in November 2023.

The bank that was in the middle of the 1MDB crisis in the late 2010s – AmBank. It has since tried to move away from that image after that.

For me, I don’t care about those things. There are only three things that matter to me as a long-term investor. 1) Strong financials, 2) Steady future outlook and consistent dividends, and 3) cheap valuations.

Short-term market events are negligible in my opinion, unless of course, they present a low point to enter. I will salivate at those opportunities.

I am not a financial advisor so none of these are investment advice but I can talk about the research process I went through in investing In AmBank and how I made 30% profits on AmBank in 2 years.

#1: Used a market screener to search for stocks with a price-to-earnings ratio below 10 times.

I love doing this. Taking a market screener whether it’s from Rakuten, Investing.com, or Simply Wall Street and looking for cheap stocks to look at.

I did the screen in August 2021 during the pandemic and found that AmBank was only trading at a price-to-earnings ratio of 8.1 times.

It was still the pandemic and investors were still fearful of the 1MDB case as Najib was still on trial. I looked at this as a rare opportunity considering that many of the bank’s financials were under pressure from the pandemic and recession.

However, that is not enough for me to make an investment decision.

#2: I looked at its 5-year historical financials and examined its 2021 resilience to the pandemic

In terms of revenue, there’s nothing special about AmBank. Revenue declined in the financial year of 2015 and 2016 and grew steadily from then on.

For the years from 2015 to 2019, revenue grew at an annual growth rate of 2.9%, which is normal for a matured bank. From a profit standpoint, nothing spectacular. Net profits grew by an annual growth rate of 0.8% over the same period.

In 2020, AmBank went into a loss of RM3.7 billion due to the pandemic and its revenue declined by 10% to RM7.4 billion. The loss is okay as I also looked at its operating cash flow, where AmBank still managed to register a positive cash flow of RM721 million.

The loss isn’t a big deal, as long as its operations are strong enough to still generate positive cash flows. And the pandemic was just temporary so I had the outlook that it will returned to profitability the next financial year.

#3: Examined the banking sector outlook and AmBank’s strength

Here’s the thing. The outlook of the banking sector is generally tied to the state of the overall economy. Banks lend money to consumers to buy houses and cars, and to businesses to invest in expanding their production.

Hence, I looked at the GDP forecast by IMF for 2021 and 2022 to determine the trend in which the Malaysian economy is going. At that time, Malaysia’s economic growth declined by 5.5% in 2020 and was projected to rebound to 6.5% and 6.0% respectively in 2021 and 2022.

I was reassured that time in August 2021 things will resume to normalcy in 2021 and 2022. However, that took some time as several movement control restrictions still took place in Malaysia.

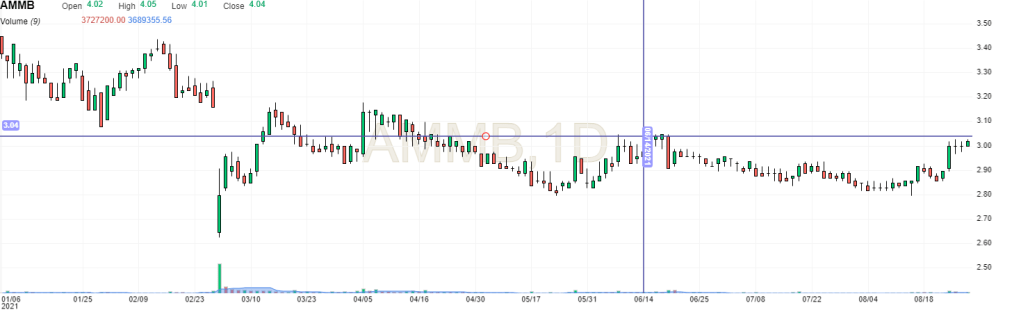

#4: Find an entry point through technical analysis

This is more art than science. Even though I was convinced back then that there was a potential for AmBank to gain, I needed to find a valid entry point into AmBank.

My technical was simple. I just looked at the previous high price which was in the middle of June 2021. It was trading at about RM3.05, and I observed that AmBank’s share price was on the brink of breaching that level in the middle of August 2023.

Hence, I just entered at RM3.10 when it finally breached the previous high.

Conclusion

Investing doesn’t have to be hard. Yes, there are a lot of factors that will influence share price performance but don’t let those factors distract you from the most important ones. Its financial and operational performance, outlook for the future, and whether they are cheap to buy.