Is there a viable investment/trading strategy for U.S. companies during Black Friday?

Why this is useful for you: Sales for big U.S. retailers typically gain during the Black Friday quarters. This research will examine whether there are opportunities for investors to capitalize on during the Black Friday sales period.

Black Friday. The one holiday season during Thanksgiving sends hordes of U.S. consumers into all retailers to take advantage of the spicy deals and promotions. Typically, during this period, retailers’ revenue and profits will rise exponentially and there might be some movements in share price that could benefit investors.

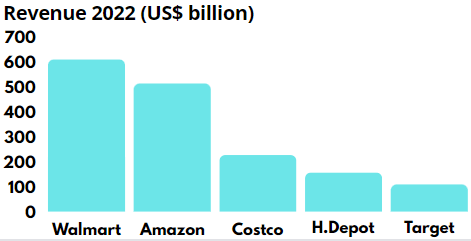

Let’s look at this systematically. What are the biggest retailers in the U.S.? The top 5s are Walmart, Amazon, Costco, Target, and Home Depot. For Walmart, Costco, Target and Home Depot, you might have imagined the pictures of a big crowd of people rushing into their stalls. For Amazon, it’s also the same thing when too many people are checking out it slows the website down to a halt. Here’s how much these companies made in revenue in 2022.

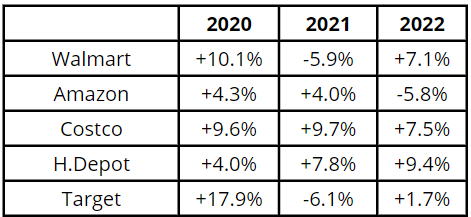

Next, let’s look at the share price performances of these companies for the past 3 years during the Black Friday month.

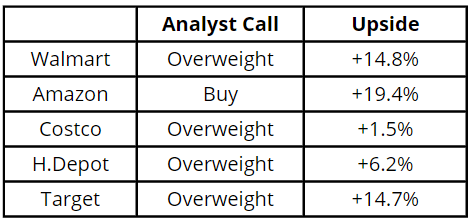

I know. This is not a complete analysis of cause and effect. Just because the company gained in the month of November, it does not mean that it was due to Black Friday. However, the sentiments surrounding Black Friday sales for these companies are crucial determinants of their share price performance during the month. Only Home Depot and Costco showed a consistent rise in share prices during the month. Walmart, Target and Amazon were mixed in this regard, with one year of declines. At least from this limited data set, there is a case to make for a short-term investment/trading strategy of investing at the beginning of the November month and divesting by the end of it. However, it will also be wise to look at the WSJ analyst forecast to gauge the upside.