Tenaga Nasional: Decent results with a BUY call from the market

Why this is useful for you: Tenaga Nasional (TNB) is a proxy for the power generation sector in West Malaysia and it is essentially a monopoly. Its 3Q results will let you know whether TNB is still a good investment to hold and how its outlook will pan out in the next few years.

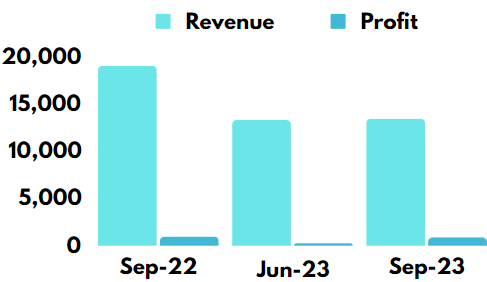

Revenue grew by 1.1% to RM13.5 billion in 3Q 2023 from RM13.3 billion in 2Q 2023 but declined by almost 30% from a year ago. Net profit meanwhile has tripled to RM877 million from RM271 million over the same period. The good thing about TNB is that its profit margin is significantly higher at 6.5% in 3Q 2023 compared to 5.1% in 3Q 2022 when revenue was at one of its highest.

Market analysts are giving TNB a BUY call with an average target price of RM11.46. This is an implied upside of 14.6% from the current share price of RM10.

Sime Darby Plantation: Profits tripled but …

Why this is useful for you: The palm oil sector in Malaysia has been subjected to numerous bans by the EU and now Indonesia is banning some exports of palm oil products. The market is expecting palm oil prices to improve next year but that is still up in the air. The fortunes of Sime Darby will grant you some insights.

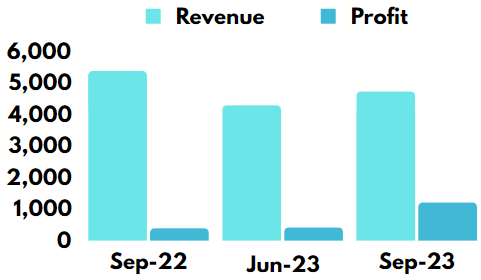

Sime Darby Plantation’s (SDP) profits essentially tripled to RM1.2 billion in 3Q 2023 from a year ago but there’s a catch to this. It profited from the gain in the disposal of lands in Malaysia (+RM607 million) and the divestment of two subsidiaries in Indonesia (+RM278 million). Its operating cash flow declined to RM1.6 billion in 3Q 2023 from RM2.3 billion in 3Q 2022. Hence, I won’t particularly say that SDP improved. Revenue seems to show this also, declining by 11%.

Markets have SDP at an OVERWEIGHT position with an average target price of RM2.60. This gives the company an implied upside of 9.7% currently.