Zoom: Continues its streak of beating expectations

Why this is useful for you: Zoom was a darling among investors during the pandemic as it provided video calling services to companies that needed it dearly. However, going into 2024, there are arguments that Zoom might decline considering the pandemic is over.

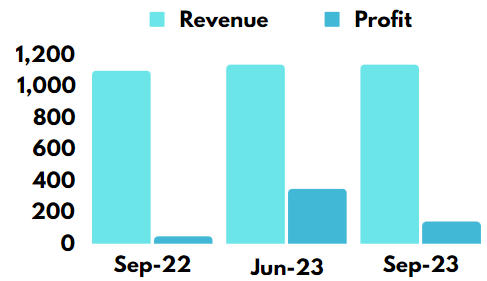

For the 3 quarters this year, Zoom has beaten expectations. Its earnings per share for 3Q 2023 beat expectations by 19.5% which is essentially good news for the company. While revenue was practically flat from last year, profits tripled to US$141 million from US$48 million.

However, it seems like revenue has plateaued, considering that it barely grew from last quarter. Many employers are now asking most employees to return to the office or risk being let go. Hence, that is a big dampening factor. Markets currently have HOLD calls, with an average target price of US$80. This implies an upside of 25.4% from the current share price of US$63.83.

Nvidia: Still a darling $1 trillion stock

Why this is useful for you: Because of the interest in AI stocks, Nvidia became a US$1 trillion stock on par with the likes of Alphabet, Microsoft and Apple. However, can Nvidia continue this trend moving forward? The recent 3Q 2023 results will provide some guidance on this.

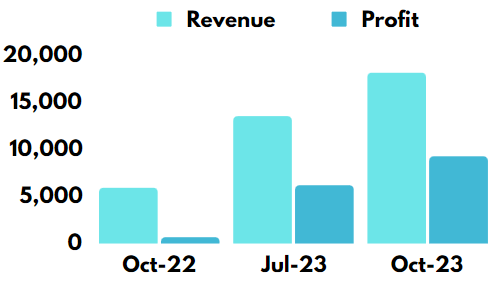

Well, earnings per share beat expectations by 18.7% in 3Q 2023. And Nvidia keeps climbing up from the beginning of the year. Revenue tripled from US$5.9 billion in 3Q 2022 to US$18.1 billion in 3Q 2023 due to a rise in sales of AI-related chips for data centre demand. This segment generated about US$14.5 billion, which is mind-boggling if you think about it. It seems like the AI trend is just starting and Nvidia could be up next.

The market currently has Nvidia at a BUY call with an average target price of US$666. This implies an upside of 36.8% from the current share price of US$487.