Baidu: Big miss in earnings, but revenue is ok

Why this is useful for you: Chinese internet stocks seem to be on everyone’s minds these days. The slowdown is real and it has been wreaking havoc on consumer confidence. Baidu’s status as one of the biggest internet companies tells us about the state of investor confidence.

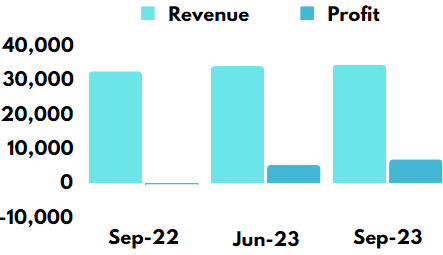

Earnings per share missed the mark by a whopping 85% but revenue was slightly above expectations by only 0.3%. Revenue grew by 6% to RMB34.4 billion from a year ago while Baidu returned to a profit of RMB6.9 billion from a loss of RMB361 million. Despite the miss in profits, its profit margin has significantly improved to 17.1% for the 3 quarters in 2023 from only 5.6% in 2022.

Market analysts are giving Baidu a BUY call with an average target price of RMB1,236. This implies an upside of about 40.2% compared to the current share price of RMB859

Decoding UBS Investment Call on Chinese Internet Stocks

Why this is useful for you: Most often we find that the investment reports by many research firms are too technical. However, they are useful information for ordinary investors in gauging the interest of investors in Internet stocks. I came across this article by UBS and will summarise it for you.

UBS is positive on Chinese internet stocks in 2024 for the following reasons:

- Earnings of these companies will increase in 2024

- Valuations are low

I don’t have a Bloomberg so I don’t know what’s the forecast for Chinese internet companies’ earnings for 2024. However, SimplyWallSt, projects that Chinese tech companies would experience an earnings growth of 40.5%, led by software (47%), IT (42.3%) and semiconductors (43.3%).

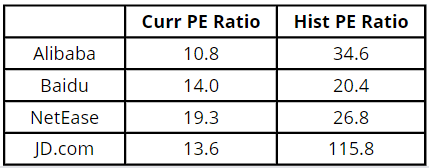

Meanwhile, these are the valuations for the top Chinese internet stocks.