Bit Origin is a great case study to learn more about biases and what NOT to do!

Why should you care: Bit Origin’s tripling share price is a good case study to examine the impact of rampant speculation on crypto-related stocks that have plagued them since the pandemic. While it is astonishing to see a stock triple in share price in just a week, Bit Origin needs to be examined closely to watch out for potential pitfalls, and you can learn a thing or two in fundamental research.

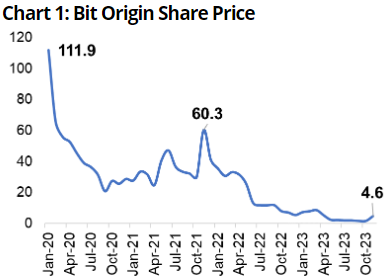

Bit Origin’s (BO) share price rose from just US$1.46 in October 2023 to US$4.60 in November 2023. And most of that increase came from the last week of November 2023. Now, if you are an investor looking at this, you might be tempted to say “Wow, that is such a massive increase, maybe I should get into it”. My advice is to hold your horses first. Most of the time, there is something very speculative that has happened that drove the share price up. And you have to determine whether this is a short- or long-term factor. BO’s case study is a great one in determining our

The first thing that we can look at is its historical share price performance. It’s basic and simple, and it gets the job done. BO’s performance has been abysmal since 2021 when it reached its peak of US$60 in November 2021. And to make things worse, it even traded much higher at US$111 at the start of 2020 during the pandemic. When you look at the overall historical performance of a company such as this, red alarm signals should light up in your head. “Hey, this company is volatile. This increase in share price might be temporary”.

Bit Origin is a great case study to learn more about biases and what NOT to do!

Why should you care: Bit Origin’s tripling share price is a good case study to examine the impact of rampant speculation on crypto-related stocks that have plagued them since the pandemic. While it is astonishing to see a stock triple in share price in just a week, Bit Origin needs to be examined closely to watch out for potential pitfalls, and you can learn a thing or two in fundamental research.

Bit Origin’s (BO) share price rose from just US$1.46 in October 2023 to US$4.60 in November 2023. And most of that increase came from the last week of November 2023. Now, if you are an investor looking at this, you might be tempted to say “Wow, that is such a massive increase, maybe I should get into it”. My advice is to hold your horses first. Most of the time, there is something very speculative that has happened that drove the share price up. And you have to determine whether this is a short- or long-term factor. BO’s case study is a great one in determining our

The first thing that we can look at is its historical share price performance. It’s basic and simple, and it gets the job done. BO’s performance has been abysmal since 2021 when it reached its peak of US$60 in November 2021. And to make things worse, it even traded much higher at US$111 at the start of 2020 during the pandemic. When you look at the overall historical performance of a company such as this, red alarm signals should light up in your head. “Hey, this company is volatile. This increase in share price might be temporary”.

At this juncture, this is looking like a stock that crashes and burns constantly. If you held BO at US$30 in 2022, you will find yourself deep in the hole. If you invested in it at US$1.46 last month, you will find yourself 3 times richer. This is that kind of stock. I call this kind of stock going to the casino and coming out with just your pants or a pack of cold hard cash. Avoid them, avoid them like the plague!

If however, you still want to go ahead and see what the company is all about. Here is the fundamental research that you need to do. Find out what factor drove it so down in the past first. For BO, it is essentially a crypto-mining company and its fortunes are dependent on the price of Bitcoin and other cryptocurrencies. But its share price only showed a resurgence lately when it unveiled a new business plan and financing. It will seek out additional equity funding of US$4 million and invest in a new crypto mine in Wyoming. Construction is slated to start in mid-December 2023 and complete by 2Q 2024. This will host about 4,480 and 8,400 bitcoin miners. It’s really up to you whether you think this project will be successful but I have skepticism.

At this juncture, this is looking like a stock that crashes and burns constantly. If you held BO at US$30 in 2022, you will find yourself deep in the hole. If you invested in it at US$1.46 last month, you will find yourself 3 times richer. This is that kind of stock. I call this kind of stock going to the casino and coming out with just your pants or a pack of cold hard cash. Avoid them, avoid them like the plague!

If however, you still want to go ahead and see what the company is all about. Here is the fundamental research that you need to do. Find out what factor drove it so down in the past first. For BO, it is essentially a crypto-mining company and its fortunes are dependent on the price of Bitcoin and other cryptocurrencies. But its share price only showed a resurgence lately when it unveiled a new business plan and financing. It will seek out additional equity funding of US$4 million and invest in a new crypto mine in Wyoming. Construction is slated to start in mid-December 2023 and complete by 2Q 2024. This will host about 4,480 and 8,400 bitcoin miners. It’s really up to you whether you think this project will be successful but I have skepticism.