If you like this content, consider subscribing to the website, or follow my LinkedIn and Medium.

Currency: Continued Weakening of Dollar Should Make You Think About Currency Differences Now

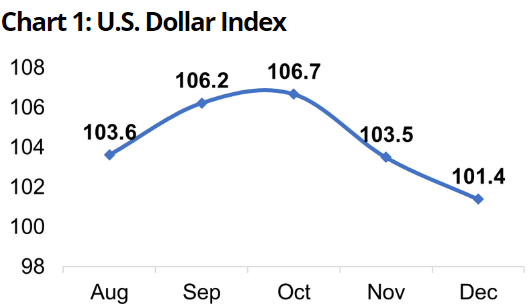

Why it matters to you: A pivotal change has occurred for the US Dollar in December. The sharp weakening of it signifies things to come in 2024. This will have implications for investors invested in US markets in that it could reduce the foreign exchange gains.

What happened

The Fed decided to maintain its interest rates in December 2023. And investors seem to take this as a sign that rate hikes have definitively come to an end. What’s more, some are even talking about a potential reduction in interest rates if a recession were to happen in 2024.

Take note of

Recession probabilities in the U.S. This might be the primary driver of the U.S. Dollar in 2024. Right now, investors are pricing in more than 50% chance of it happening in the first half of 2024. If it does happen, the Fed might reduce interest rates to support the economy.

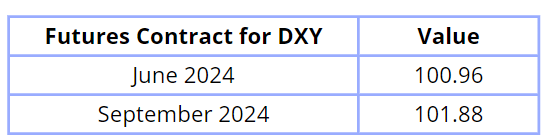

Dollar index futures for June 2024 (100.96) and Sep 2024 (101.88) indicate further weakening in the dollar from the current 102.18.

Commodity: Lower Commodity Prices A Sign of Recession

Why it matters to you: Crude oil prices weakening seems to indicate a possible recession in 2024. While it may not be true entirely, the global economy might not be on a strong footing. Investors should do well in gauging the trend of crude oil and coal prices in the coming months for any such signs.

What happened?

Nothing much in December 2023. There wasn’t any surprise from OPEC in terms of oil production numbers. There was some news of a supply chain bottleneck in the Red Sea but even that did not have much impact on prices.

Take note of

The economic data coming out from the U.S. and China. While the U.S. has shown strong economic growth numbers in the latest quarter (3Q 2023), there are already signs that it is coming down again.

In China, expectations have gone down so much that investors are not expecting spectacular growth from it in 2024. Both of these could bring down commodity prices.