If you like this content, consider subscribing to the website, or follow my LinkedIn and Medium.

I have to admit.

When I went on holiday to New Zealand last year, I was looking at my bank account and sobbing. RM3.00 for NZD$1.00. The trip was great, but I was scraping the bottom of my wallet for any change after that.

If only I had a crystal ball and could predict the ringgit in the future … And that’s exactly what I did. I built a simple model to try to project the ringgit in 2024. Cause … I want to plan for the holidays without burning down my wallet again.

If you are in the same boat as me, maybe this will help you out in planning for your holidays also. In the meantime, let’s get right to the forecast of the ringgit against the U.S. dollar for the year!

The Intuition and Common Sense

It is hard to predict how currencies will perform. Many people have done it. The ones who are successful are laughing themselves to the bank but they are probably the 1%. The other 99% like me and you, can just cry into our pile of tissues while paying for the next RM1,000 for our next accommodation in a foreign country.

But it doesn’t have to be that way. Today, we rise up and try to build a model. A model simple enough to understand and do. From my ahem extensive economics and finance background ( I say that but I am still a peasant ), the performance of the ringgit is dependent on the demand and supply of the currency.

If you demand more of the ringgit, the ringgit will get stronger and vice versa. If Bank Negara Malaysia decides to increase interest rates (reduce money supply), the ringgit will get stronger and vice versa.

So, good sentiment (or vibes in Gen-Z language) for Malaysia equals more demand for the ringgit and that equals stronger ringgit. The other way around is true also.

We can see investors’ vibes about Malaysia from its government bond yield. The stronger the vibe, the lower the government bond yield because investors buy more Malaysian bonds (there is a long explanation for this but basically, the price of the bond increases which reduces the bond yield).

But that’s not it. It also depends on the U.S. government bond yield. If U.S. government bond yield is higher than Malaysia’s, you would see ‘Oh, hey, more returns from U.S. bonds’ and buy U.S. dollars. That actually drives the ringgit weaker.

The intuition here is that the performance of the ringgit will be heavily influenced by the difference between Malaysian bond yield and U.S. bond yield.

So, if the Malaysian bond yield is 5.5% and the U.S. bond yield is 1.0%, people will be more inclined to buy Malaysian ringgit to buy bonds. But if the gap of 4.0% (5.5% Minus 1.0% = 4.0%) is reduced to 3.0%, it seems like there is more interest in buying the U.S. dollar then which weakens the ringgit.

Model

The model is simple. I just took the data of both Malaysian and U.S. government bond yields from investing.com, ranging from 3 months, 1 year, 3 years, 5 years, and 10 years.

Then I take the difference between each period (MY 3M – U.S. 3M, MY 1Y – U.S. 1Y, etc) and regress it on the exchange rate of ringgit against the U.S. dollar (RM4.58 / US$1). In statistical terms, it’s called an ordinary least squares regression. But it’s the simplest of models.

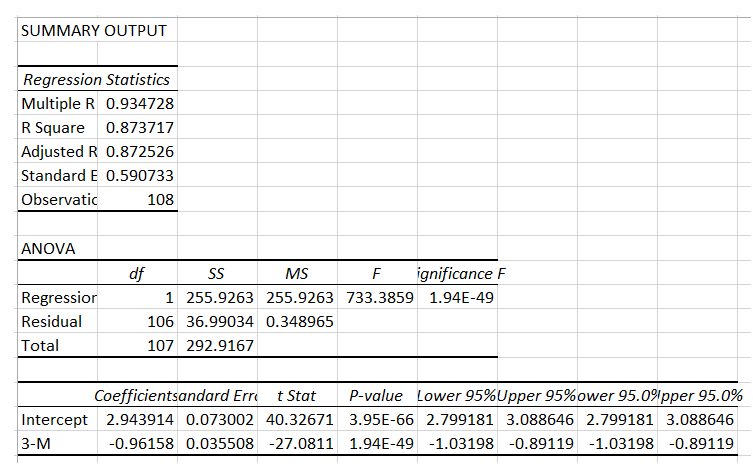

I did some tests and found that 3 3-month gap is the best variable since it gave an R-squared of … 87%. I mean, that’s pretty good. Here’s the summary which I did in Excel.

The only thing you need to pay attention to here is the coefficient, which is -0.96. This means that if the yield gap increases by 1.0%, the ringgit will get stronger by 0.96. The RM4.58 per USD could go to RM3.62 per USD if the gap increases by 1.0%.

Forecast

So, exactly how do I make forecasts then? The thing is I don’t know what Malaysian and U.S. government bond yields going to be for the year. But World Government Bonds do.

So, I will be using the forecasts from there. But I won’t use them exactly. Some of the projections are just wild. I will need to use some discretion in determining whether they ‘make sense’.

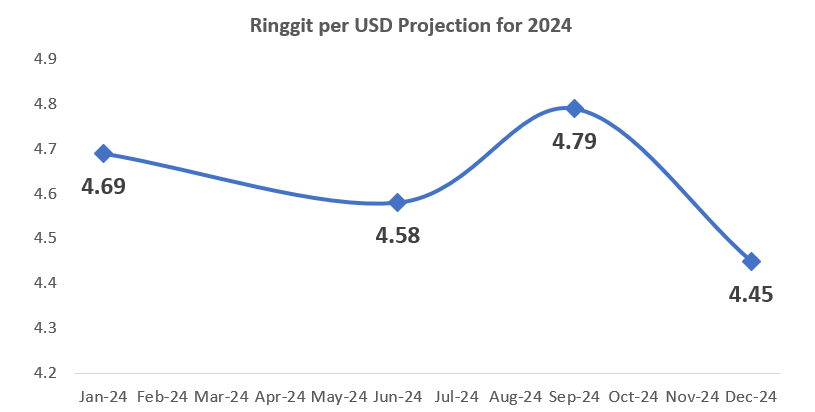

So, here they are. Based on the forecast from World Government Bonds (which I also tinker with), the model projects that the ringgit will get stronger from RM4.69 per USD in January 2024 to RM4.58 per USD by June 2024. Then, it will weaken to RM4.76 per USD in September 2024, and then finally strengthen back to RM4.45 per USD in December 2024.

What does this mean? By the end of the year, you could potentially be looking at spending 5.4% less ringgit to exchange for one U.S. dollar.

So, how does this compare to what the market is expecting? It’s actually not that different. The market expects the ringgit to trade around RM4.40 to RM4.60 by the end of 2024. The projection from the model is RM4.45 so it’s within range.

Conclusion

Pack your bags! We could be looking at a stronger ringgit (RM4.45 per USD) by the end of the year 2024. That will certainly help with that big hole in my bank account (Send help! Writers are very broke ( ఠ్ఠᗣఠ్ఠ ))