If you like this content, consider subscribing to the website, or follow my LinkedIn and Medium.

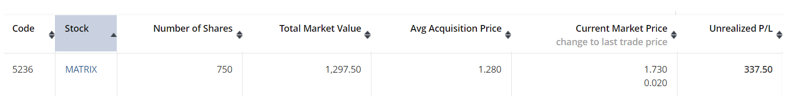

Here’s the proof from Rakuten.

This is the 3rd series (Dayang and Ambank) which I have written about my investments that have been fruitful over the years. I am a firm believer in enabling people to Go Research and Invest, but never in stock-picking for others.

That is why I am only writing this article after I exited the investment recently, and detailing the research process that I took. By doing this, you can use these techniques to get started on yours, and invest for your long-term future.

Here’s the research that I did back in May 2021 for Matrix Concept.

Screen and Find Cheap Stocks

If you have been reading my content, you know I am big on finding stocks that are cheap and undervalued. And I do this by using a stock screener. It doesn’t matter which ones you use as long as you can filter for the following metrics.

- Price-to-earnings (PER) ratio: I have written about this before 3 years ago. I find companies that trade at PER below 10 times or 15 times depending on the sector.

- Price-to-book (PB) ratio: I screen for companies that trade below 1.0 times for PB ratio.

In May 2021, I found Matrix Concept. It was trading at a PE ratio of 6.1 times and a PB ratio of 0.9 times. For historical context, the PE ratio traded at around 7.3 times from 2018 to 2020 (before the pandemic).

Hence, I reasoned that the pandemic was causing Matrix Concept to trade below its historical valuations. The initial potential profit I forecasted was based on the PE ratio trading back up to 7.3 times. This implies a 20% gain in share price.

But of course, this was just preliminary. This did not immediately equate to a decision to invest. I needed to also look at the financials and the prospects of Matrix to determine whether it’s a worthy company to invest in.

Examine Revenue and Profit

Before I get started, Matrix Concept is a property development company. It constructs houses, offices, shops, and other properties. That’s what they do, and the property sector suffered during the pandemic as almost all construction activities were halted.

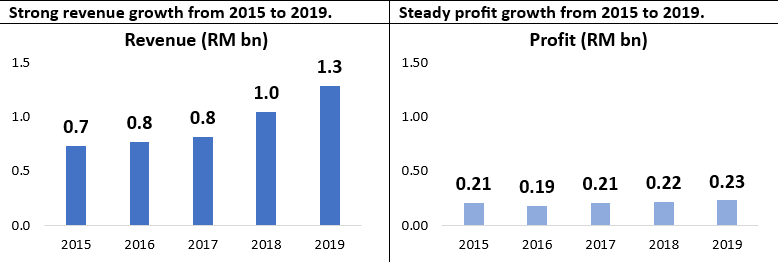

From 2015 to 2019, revenue increased from RM730 million to RM1.3 billion. This translated to an average growth rate of 19.5%. Meanwhile, over the same period, profits increased from RM209 million to RM234 million, averaging 3.0% growth every year. Revenue growth was strong, and profit growth was steady was my takeaway from its financial performances.

Back in May 2021, Matrix released its 2020 annual result and I saw a decrease in revenue to RM1.1 billion, but interestingly, profits rose to RM253 million. That was the first sign that showed some resilience to Matrix’s financials moving forward.

Hence, at this stage, I was positive on Matrix but I needed to check one last thing – the outlook for the company and industry.

Understanding the Outlook

Matrix Concept is in the property sector. And it was not doing well in 2021. The outlook was also hazy considering that there were a lot of uncertainties about the lockdown restrictions by the Malaysian government.

I looked further beyond 2022 and decided that Matrix would probably need at least 2 years to recover fully. By the beginning of 2023, I projected that most of the Malaysian population will have at least 3 doses of the Covid-19 vaccine.

Construction activities will probably be in full swing in 2023 also but will need some time to show in the financial performance.

In hindsight, revenue did decline further to RM892 million in 2021 and recovered back to RM1.1 billion in 2022. Its trailing revenue from September 2022 to September 2023 showed that revenue did indeed recover back to RM1.4 billion which was about the same as the 2019 level of RM1.3 billion.

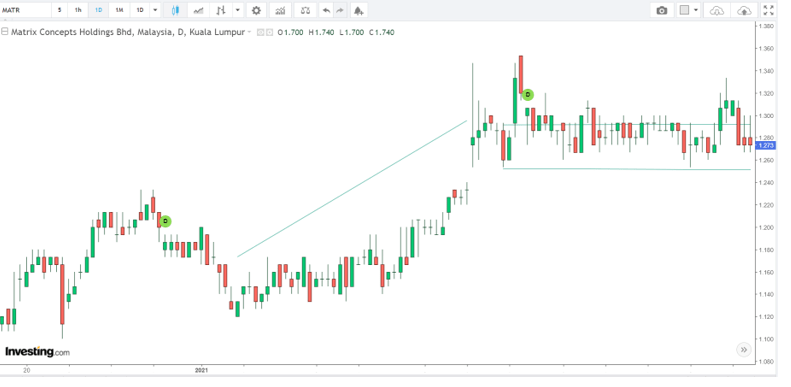

Technical Analysis for Entry Point

There wasn’t anything complicated here. I just saw that the share price stabilized around RM1.25 to RM1.30 from March 2021 to May 2021. Before that, there was already an upward trend from RM1.12 to the current range. Hence, I locked in at the price around this range and acquired Matrix at an average price of RM1.28.

I Made 35% Profit in about 2.5 years

That was the timeline of my investment in Matrix Concept. I invested at RM1.28 in May 2021 and exited at RM1.73 in January 2024 for a 35% gain.

And I have outlined the process here in this article, which you can use for any stocks in the market.

Go Research and Invest!