If you like this content, consider subscribing to the website, or follow my LinkedIn and Medium.

There’s just something about blue-chip stocks. Everyone talks about them. Everyone wants to invest. But do we really know how to get started in researching them?

In that matter, when should we invest in them? How long should we hold? Those are the questions that I shall try to answer in this article.

I won’t be giving stock picks, but I will build the framework for you to do it yourself and choose your blue-chip stocks to invest in.

And don’t worry, they will be simple to understand and implement. I will even throw in a model template for you to use!

First, Let’s Get the Objective Here Straight for Blue-Chip Stocks

There’s only one objective why you are investing in blue-chip stocks. You are looking for a stable stock with consistent dividends.

Stable here means that its share price doesn’t move 10% in a single day, but rather is very steady. In a year, you might be only looking at a 3-4% gain.

Consistent dividends mean you will regularly get dividends every year without fail.

You are not looking for high-flying stocks where their share price can gain by 100% in a year. Because that same stock can also decline to nothing the very next day.

Blue-chip stocks are the definition of a company that is ‘boring’ but gives you stable returns year in and year out. And they normally don’t make the headlines in the news.

Blue-Chip Stocks Are Large

The most important aspect of a blue-ship stock is its large size. It has to be big to be steady and stable. And big companies tend to have established markets which will support them in the long term.

How do you find them? There is an indicator called market capitalization. It measures how much the company is valued by investors in the open market.

There is a simple way to find these large companies. Just go over to this website called companiesmarketcap.com and just click on ‘large-cap companies’ for any country. This is an example of the U.S. market.

From here, you can see the companies that have the highest market capitalisation.

You can filter them further by listing what kind of sectors you want to look at.

Certain industries can generally be categorized as stable, namely:

- Energy

- Telecommunications

- Transportation

- Consumer (Necessities)

And They Have an Established Market and Consumer Base

The most straightforward way to think about this – how long have they been in operation? If they have been in their business for more than 10-15 years, they would already have an established market.

This is good. It means that it is easy to research how sustainable they are. And they are probably ‘boring’ too. After all, they would have more than 10 years of annual reports to read.

Speaking of that, how do you research their market or consumer base? There is a quick and thorough way to do this.

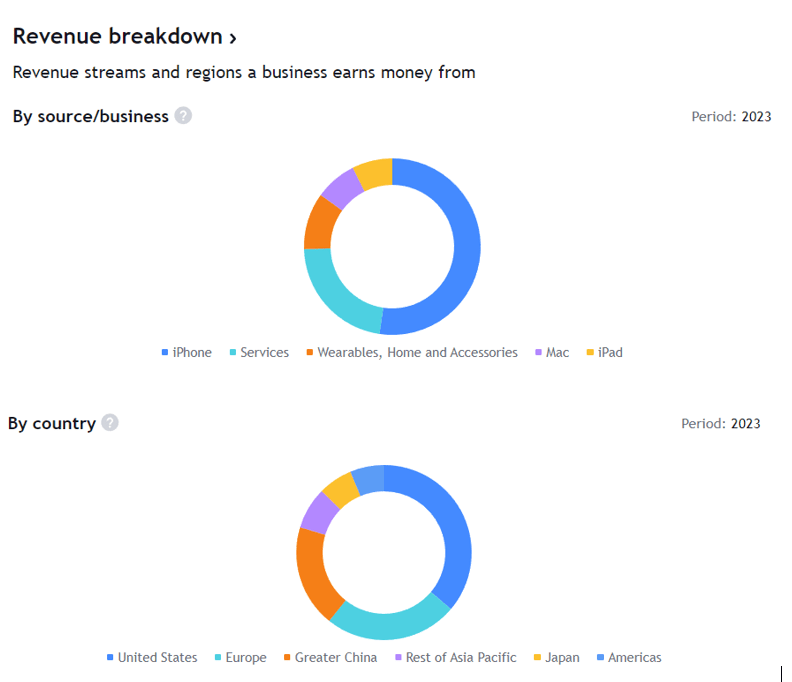

The quick way is to head over to TradingView.com and click on ‘Financials’ and ‘Overview’. From there, go to the section called ‘Revenue breakdown’. You can look at the type of business segments and their country breakdowns.

This is an example of Apple stock.

Just from this, you can conclude several points about its business:

- The iPhone is their biggest and most established market.

- The United States, Europe and China are their main consumers.

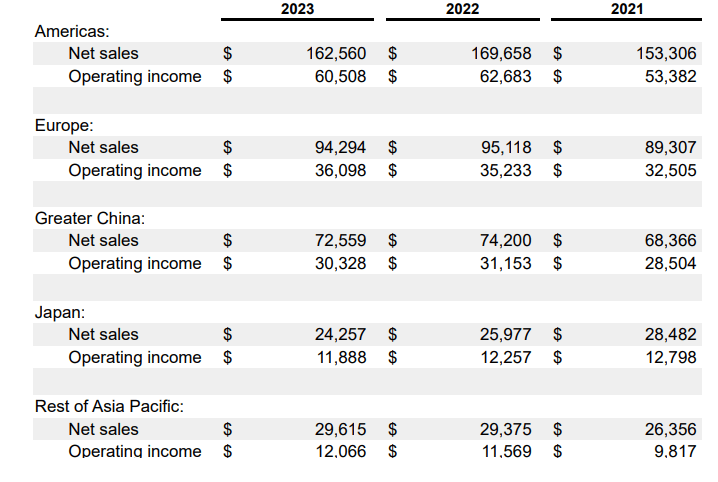

Meanwhile, the thorough way to do this would be to look at their annual reports or investor presentations (not all companies have this).

Make your way to the ‘Segmental breakdown’ and you can find the revenue by business segments and countries same as TradingView.

But you can also get the company’s view and analysis of all the performances of the businesses. What’s more important is to see which segments are the most profitable.

Here’s what it looks like from Apple.

There are some additional analyses you can do from this:

- While China and Japan don’t contribute the most revenue to Apple, they are certainly the most profitable with an operating profit margin (operating income/revenue) at 42% and 49% compared to America (37%) and Europe (38%).

Revenue and Profit Growth Are Steady

What defines steady revenue and profit growth? Here’s my opinion on this. Firstly, revenue and profits are always increasing from year to year no matter how small it is.

Even if it only grows by 2% every year, I would consider that to be steady as long as it’s still increasing. That is my most important criterion.

Secondly, it needs to be resistant to recessions. What does this mean? This means when there is a recession, its revenue doesn’t decline by much or still grows. And it’s still making profits.

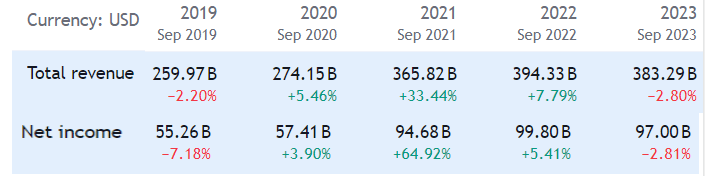

Let’s again look at Apple in regards to this. I extracted this information from TradingView.

The recession happened in 2020, and Apple still managed to grow its revenue by 5.5% and remained profitable with a profit of US$57 bn.

Consistent Dividends

This is the crowning feature of a blue-chip stock. It needs to have a consistent dividend policy and payout to investors.

Like a fixed deposit, it needs to constantly generate money for you. It doesn’t have to be a high one. But it just needs to be higher than fixed deposit rates.

Find dividend yields that are at least above 3% for the last five years.

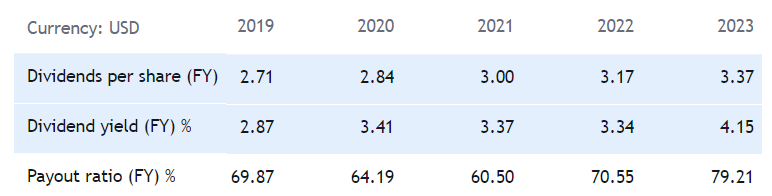

Apple doesn’t have such a high dividend yield (less than 1%). Let’s look at a very stable one – the American Electric Power Corporation (which produces electricity for households and businesses).

This company has the two most important features – dividend yields of more than 3% and a high payout ratio of about 70%.

Now, what does it mean to have a high payout ratio? It means that the company pays out most of its profits as dividends back to shareholders, rather than keeping it for themselves.

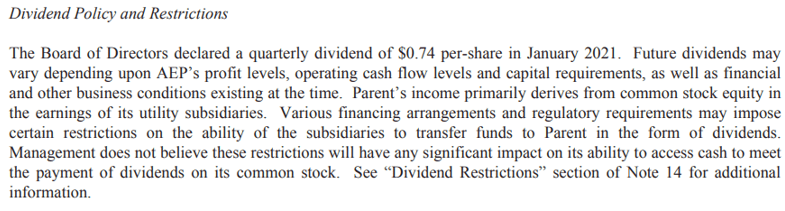

Normally, you can get a feel of what the company will do with their profits from their annual reports in its dividend policy. Open up any annual reports and go to the section called ‘Dividend Policy’.

Here’s American Electric Power Corporation’s one.

Conclusion

If you are having trouble getting started on investing in blue-chip stocks, you can use these steps above to get you going. They are meant to be simple and easy for you to do.

And if you are still confused, drop us an email or comment to ask for more. We will gladly help you out however we can!

Go Research and Invest!