If you like this content, consider subscribing to the website, or follow my LinkedIn and Medium.

Reddit, oh Reddit. The place where I go to join Gacha game communities and watch people being salty about their summons and pulls.

I remember my first time there. I was young, and I was looking for information on Final Fantasy Brave Exvius, a Gacha game I have played since 2015 (still playing now).

There were just so many people giving guides, tips and all manners of information. And they were doing it willingly. If I like the comments, I will give it an upvote. And this will give the commentator points or badges. Street cred began to be a thing for them.

Fast forward to 2024, Reddit is doing an initial placement offering (IPO). If you are an avid user of Reddit, I will list down the 7 things that you should know about its IPO. If you are not, you should take a good look at the company also.

#1: Reddit’s Share is Priced at US$31 to US$34

Yeap, about US$31 to USD$34. This gives Reddit a valuation of US$6.4 billion, which is lower than 2 years ago when it was valued at US$10 billion.

Why is this important to know? Firstly, it seems like the market is not that receptive to Reddit in 2024 giving it a lower valuation.

And this is even though AI-related stocks have gained prominence recently. You see, Reddit is planning to incorporate huge elements of AI technology into its company to personalized information for users and advertising for businesses.

So, to me, this tells me something about Reddit. Investors are less optimistic now about it. And I have thoughts on why this is so.

#2: Rapid Growth During the Pandemic

This is one of the main reasons why I think the valuation has decreased. Firstly, Reddit reported this about its user growth during the pandemic.

At the onset of the COVID-19 pandemic, we saw an increase in user growth and engagement on our platform. The post-pandemic period presented challenges such as lower user growth and declining engagement in 2022 and the first half of 2023.

When everyone was locked at home, many went online to Reddit to entertain themselves. And there has also been a strong growing trend of users going to Reddit to research products to buy.

Hence, it makes sense that Reddit obtained a higher valuation back then. Many investors were excited about the break-neck growth of many online companies then.

However, that craze has died down when countries reopened in 2022. As such, Reddit also reported that it experienced lower user growth in 2022 and 2023.

So, many investors came down from their craze, and Reddit valuations fell to earth also. But I feel there’s also another reason why investors are still a bit concerned about this.

#3: It’s Still Loss-Making

Now, Reddit was founded in 2005. It is almost 20 years old now. And it’s still loss-making.

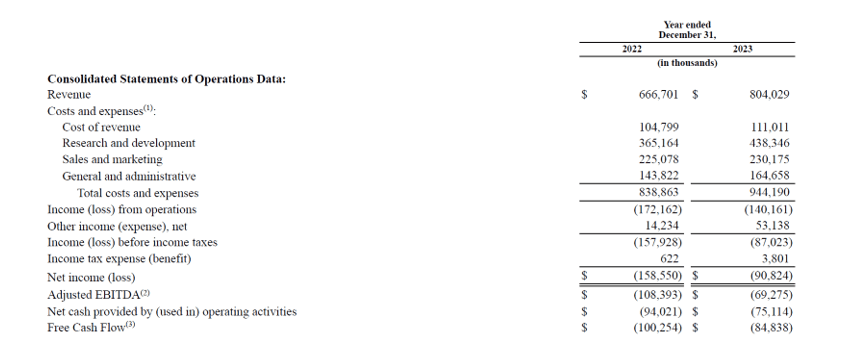

That’s the reality of an internet company. It made a loss of US$90.8 million in 2023. But to give it credit, it did manage to reduce its losses from 2022 (US$158.6 million).

All in all, Reddit has made a combined loss of US$716.6 million over its 20-year tenure. This translates to an average loss of US$36 million every year.

Things might not be getting any better for Reddit. Here’s what it has to say about its projection of profits in the future.

We also expect our operating expenses to increase in future periods … we expect our costs and expenses to increase in future periods as we intend to continue to make significant investments to broaden our user base, develop and implement new products, market new and existing products … we may not be able to achieve or maintain profitability.

I would be worried reading about this. Reddit is probably going to make more losses for the foreseeable future.

But this needs context of course. Reddit’s strategy moving forward actually illuminates why it is aiming to capture market share instead of making profits.

#4: Aims to Expand Market and Product Offerings

Reddit’s main strategy is simple – increase users on its platform, provide more advertising avenues for businesses, and leverage AI to scrape its data to be sold to other businesses.

After all, the market opportunities that they have identified are huge.

- Advertising: Total addressable market of US$1 trillion today and expected to grow to US$1.4 trillion in 2027. Reddit hopes to capture US$750 billion of the market.

- Data Licensing: To grow at 20% every year to US$1 trillion by 2027. Companies would want to mine data on Reddit for their AI models.

- Commerce: The online marketplace on Reddit is expected to grow from US$1.3 trillion today to US$2.1 trillion by 2027.

So far, Reddit is established in the advertising space where almost all of its revenue is derived from advertising.

Data licensing seems to be promising considering the potential it could have for businesses to do their marketing on Reddit and other platforms. However, much of this is still in the infancy stage.

Commerce, on the other hand, seems much more solid. There is already an established market where users on Reddit are going to it to find information on products. All Reddit need to do now is to build the infrastructure and ecosystem for them to also buy and sell on it.

#5: Revenue Growth was Solid and Important to Reddit

Revenue grew by 21% from US$666.7 million in 2022 to US$804 million in 2023. Make no mistake, this is solid growth and is positive for the company.

And this is much more important to Reddit. Now, it has been quoted that it is a scalable business. The reason why they are making losses is because they spend a large portion of their money on research & development and sales & marketing.

No doubt, for a company that has a strategy of aggressively expanding, these are the things that you spend on.

But I worry about this.

How long will this go on? At least, according to what I have read, Reddit’s spending is projected to increase even more in the future. It is trying to come up with new products to market to users and businesses. So, research & development is going to sharply increase.

And to market them, sales and marketing expenses are going to increase too. To be honest, I don’t have a clear view of when these investments will come to fruition. And thus, I am not sure how or when they will contribute to Reddit’s revenue.

For that, I am negative about the company. Unless there is more concrete information on the timelines of these investments, I reserve my judgment on it.

#6: Something is Weird About Reddit’s ‘Other Income’

If you notice in the image above on its financial statement, you would have noticed a line item called ‘Other income (expense) net’.

Now, this is the income Reddit obtained from its investments in marketable securities. It has a ridiculous US$1.2 billion in cash. So, it invests them into fixed deposits, U.S. government securities and other types of investments.

This ‘other income’ increased by five times from US$14.2 million in 2022 to US$53.1 million in 2023. The increase was mainly due to ‘higher interest earned on cash and investments driven by higher interest rates’.

If you are unsure about what this means, it means Reddit invests in U.S. government bonds that have higher interest rates. 10-year U.S. government bond yields have increased from as low as 1.5% in 2021 to as high as 4.9% in October 2023.

Is Reddit an investment company? Certainly not. However, that US$53.1 million in investment income has reduced its loss to US$90.8 million in 2023.

Without that contribution, Reddit would have made a loss of US$143.9 million compared to a loss of US$172.8 million in 2022.

This analysis is very different. I would say Reddit would need to work much harder to increase its revenue and profits in this case. It is not an investment company.

And what is it doing with such a big cash pile? It could put them to better use. The answer could lie in its Restricted Stock Unit (RSU).

#7: Its RSU is … Complicated

It’s quite common these days to pay employees in stocks. In Reddit’s case, it has been paying its employees and management in Restricted Stock Units (RSU). If you are unsure about this, me too. I had to research quite extensively.

RSU is a stock-based compensation or salary paid to employees. It is restricted as employees need to fulfil certain obligations or conditions to be able to ‘claim’ them.

Why am I bringing this up? About US$195 million or close to half of the IPO proceeds of US$450 million will be used for the tax withholding and remittance obligations for the RSU Net Settlement.

After reading up more about it, here’s what I found out.

There are two types of service-based RSUs – service-based and performance-based. Reddit does pay its employees in RSUs, and here are some of the conditions.

- Employees who have worked 3 to 5 years in the company.

- Successful sale of Reddit shares in the public market.

Reddit estimates that there is a total of US$740.3 million of unrecognized stock-based expenses related to the RSUs.

And US$472.3 million in service-based RSUs have been satisfied as of now. So, Reddit would need to expense and pay this out.

So, Reddit plans to do this in March 2024, where it will record a one-time stock-based compensation expense of US$513 million.

What you need to know is this. Reddit needs to pay a shit load of RSUs as an expense for its employees for their long services. And they plan to use some of the IPO proceeds to do it.

While this is good for its employees, I think this is not that great for Reddit as it has only about US$250 million to invest in other projects to expand its business.

Conclusion

Reddit’s IPO presents an interesting opportunity for investors to look at. It has been around for 20 years and offers a unique business model that has a lot of users and engagement. The potential for advertisement and commerce is big.

However, you need to be wary about the fact that it is still loss-making and will continue to be so for the next few years. Furthermore, it has weird quirks regarding its income from investing in U.S. government bonds and its obligations to RCUs.