If you like this content, consider subscribing to the website, or follow my LinkedIn and Medium.

This is the 5th investment piece that I am writing. I wrote similar investment pieces for MBM Resources, Dayang, Ambank, and Matrix Concept.

In 5 months, I have made about 28% (including dividends) on Hong Leong Industries and I am going to share with you the research process that I used.

I believe in providing you with the tools to research stocks, and not picking them. Picking stocks is more detrimental as it makes us complacent in investing.

This article will detail 4 parts in general. Firstly, I list down the valuation I found Hong Leong Industries (HLI) was trading at. Secondly, I investigate the financials of HLI. Thirdly, I examine its future outlook and lastly, I find an entry point using a simple technical analysis.

HLI Was Trading at A Cheap Valuation

Like many of my investments in the market, I always find one that is cheap to buy. Just like I am attracted to things selling at a discount or promotion at a supermarket, I do the same for investments too.

I screened through a stock screener on Rakuten to find companies with price-to-earnings ratio below 10 times (share price divided by earnings per share. If you are interested in this, you can have a look at this piece I wrote about the PE ratio).

And HLI appeared on the screener. It was trading at a PE ratio of 9.6 times in September 2023. I looked at two things mainly.

- It was trading above the industry’s average of 8.6 times.

- Its historical average was at 11.4 times.

Two conflicting analyses here. On one hand, it might converge to the industry’s average. On the other, it might rise to its historical one.

Every time, in this case, I fall back to the historical average. The industry average is useful to determine whether the company is favoured or not favoured by investors. A higher-than-average means investors think it outperforms the industry and vice versa.

Hence, I look at the historical average more as valuations will always trade at around it. From it, I predict the potential upside to be 19% (11.4 / 9.6 – 1).

But this is not enough for me to make a decision. I needed to look at its financials and outlook also.

Solid Revenue and Profit Growth in 2023

There were a couple of things I took a look at. Firstly, its 2023 full-year results were out when I was looking at HLI in September 2023.

Its revenue and profit growth were very solid at 39% and 38% respectively. Even though its revenue declined by 6% in 2022, the solid recovery in 2023 signified that HLI was on its way up.

Furthermore, it had a ridiculously good cash position with a current ratio (current assets divided by current liabilities) of 4.4 times.

With so much cash, it can always give out dividends to its shareholders. It traded at an average of 5.5% yield from 2019 to 2023.

Lastly, it had no problems paying off its debts. Its interest coverage ratio was 233 times.

All that is left now is to look at the supporting factor for HLI that will drive its share prices up.

New Product Offerings for 2024

There were two main reasons why I thought HLI prospects will be solid for 2024.

Firstly, it was bringing to market a new generation motorbike model of Y15ZR, XMax 250, and Ego Gear. It is under the Yamaha brand and is meant for the middle- and lower-income classes in Malaysia.

Secondly, Yamaha is the market leader in Malaysia, followed by Honda and Modenas. This gave me confidence that HLI could successfully market and sell any of the newer products.

Analysts were also positive on these developments, giving HLI a target price of RM11.40 (+27% upside from the current share price then of RM8.96).

I was sold then so I looked for an opportunity to enter.

Simple Technical Analysis to Enter at RM8.96

I didn’t do any sophisticated technical analysis. I looked at the share price chart and determined that it was stable at around RM9.00.

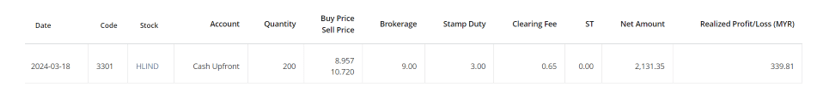

I then keyed in a position at RM8.96 at the third week of September 2023.

From there, I waited for 5 months to exit the position at a price of RM10.72 for a 20% profit. This was actually quite in line with the upside I estimated from the historical average method.

And because I also received dividends of RM0.70 per share. This came up to about 7.8% in dividend yields.

In the end, I made about 28% in profits from HLI in 5 months.

Conclusion

If I can do it, you can also.

I have been very consistent in how I invest in the market so far. I find investments that trade at below historical valuations, examine whether its financials is strong, and project whether its outlook will be positive for the company.

If you want to learn more, consider subscribing to my LinkedIn, website, and Medium. I post on them regularly, and you can definitely benefit from my content for your investment journey.

Go Research and Invest!