Disclaimer: This is not investment or financial advice. I take no responsibility for anyone’s decision.

I built a model back in February to try to predict the S&P 500. And no, I didn’t build it just to ‘syok sendiri’. I intend to take responsibility for it as I think it is useful for many of us who can’t compete with the big boys of finance and investments.

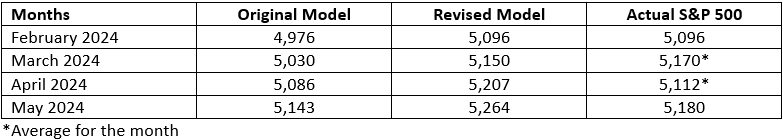

Here are the model projections and the revised one according to the latest data in February in comparison with the actual data.

The Model Predicted the Trend Correctly in March and May

Let’s get to the trend first.

My original model predicted that the S&P 500 would rise in March, April and May 2024. It was 2 out of 3 as both March and May showed increasing trends.

The month of April declined as U.S. inflation came in stronger-than-expected and investors feared that interest rates will remain higher for longer.

For me, the trend is more important than the accuracy of the S&P 500 level.

The Model is Accurate for March

What about accuracy?

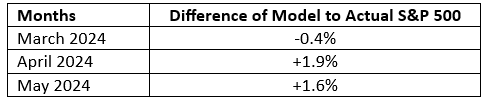

Only March showed a level that is close to the average level of the S&P 500. April is off of course as the trend is also wrong. As it is still early in May, it is hard to tell whether the model is accurate yet.

Here’s the difference in percentage from the real data of the model.

New Projections for May, June and July 2024

Things have changed in the past 3 months. In particular, these are the 3 main things

- Manufacturing activities in the U.S. have weakened. The Purchasing Manager’s Index for Manufacturing declined to 50.0 in April 2024 from 50.3 in January 2024.

- Volatility in the global markets has increased. CBOE Volatility Index (VIX) has risen to 15.65 in April 2024 from 14.35 in January 2024.

- 3-month treasury bills have risen slightly to 5.40% in April 2024 from 5.37% in January 2024 and indicates the increase in global risks.

Hence, here are the projections for May, June and July 2024, which shows that the S&P 500 is actually projected to rise in the coming months. It seems like investors in the U.S. like risk.

And that is expected to boost the S&P 500 moving forward.

What Can You Do with This?

As I said previously, this is just a model. It has a lot of flaws as I didn’t test for stationarity or heteroskedasticity to make things simple for everyone.

It is just a tool to enable regular investors like us to reliably project forward. I have attached it in the Google link here for you to use.

Like I said previously, I don’t take any responsibility for any of your investment decisions. I believe in providing you with the tools to do it.