Hi all, I have been missing for 2 weeks. But for a good reason!

How I intend to entertain my daughter at night “I AM BATMAN, NANANAANNAANA”

I just welcomed my first child – a beloved daughter. And who cares about the markets and economies when you have that little bundle of joy?

I am pretty sure she’s not a daddy’s girl … but my wife disagrees. Like they said, the wife is always right.

However, this week, there is some great news coming out of the US. Someone said something, and the whole market ran with it. Power of words!

Meanwhile, Malaysia and China are flat like my chest. Though I feel like I have used that joke before.

We have decided to provide this newsletter for free to you. If you want more in-depth content, we do run our paid Substack Newsletter. If you are looking to solve your problems of understanding what the market and economic news mean to you and how they affect your investments, our content will help you on your journey to becoming an informed investor.

Disclaimer: This is not financial or investment advice. I will not take responsibility for any decision made by anyone in regards to this.

Markets Fresh from the Oven

Malaysia (FBMKLCI): Whew, flat again huh? It looks like 1,700 is still a way off for the Malaysian market. The FBMKLCI is at 1,652, virtually unchanged from 1,653.

Despite two positive economic data (retail sales and industrial production), investors didn’t digest them positively and left the market neutral (more on this later).

United States (S&P500): 4%. Man, if my investments return 4% a week, I will be riach, biatch.

The S&P 500 is at a record level of 5,633 this week. When the Federal Reserve (Fed) said “It’s time to pivot”, the markets took it and flew.

August inflation also came close to the 2% level set by the Fed. So, the Fed’s job to control inflation might be done.

China (HSCEI): Flat performance infected China too. The Hang Seng China Enterprise Index (HSCEI) is unchanged at 6,072 as investors still think China is in a rut

They are worried that China might be like Japan – going into a lost decade. Slow economic growth coupled with slow inflation.

While I don’t think it will go that way, it certainly isn’t going well.

Slicing the Economic Pie

This week, we focus on economic news coming in from Malaysia, China and the US

Malaysia: On the up and up

Retail sales: Wholesale & retail trade (WRT) grew by 6.7% in July 2024, up from 5.4% in June 2024. I usually look at the breakdown individually in the table below

Source: DOSM

Two things to note here.

Most of this growth is driven by wholesale trade and motor vehicles. It tells us that it might be the right time to look at large hypermarkets, logistics companies, and automobile companies for wholesale trade.

Two, retail trade seems to be slowing down but it remains strong. So, this indicates that retail companies are still growing well.

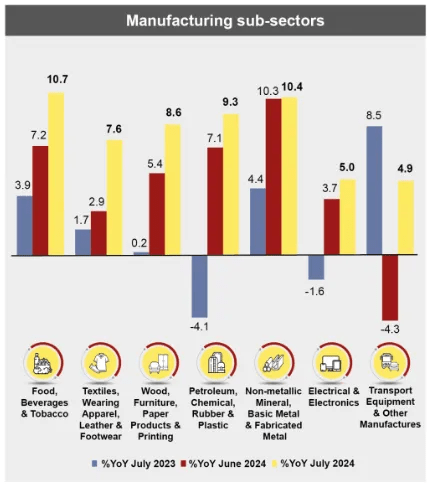

Industrial Production: Malaysia’s industrial production growth rose to 5.3% in July 2024 from 5.0% in June 2024. I normally look at the manufacturing sub-sectors to see which drove the growth.

It seems like this round, most of them are up.

What I want to look at are the sub-sectors of food & beverage (F&B), petroleum, and electrical & electronics (E&E).

F&B and petroleum seemed to have performed mightily well, while E&E is growing at a steady rate. It might be worth taking a look at companies in these sectors for any investment opportunities.

Takeaways: For me, here are the things that I will be looking at.

I will look at several companies in the logistics, supermarkets, retail, automobile, food & beverage, petroleum and electrical and electronics industries.

I am looking for companies that have either

1) Performed well for the last 3 months ( > 5% increase in share price) or

2) Trading at cheap valuations (price-to-earnings ratio below 10 times)

China: Japan’s Lost Decade?

Inflation: 0.6%. That’s how much China could muster in terms of inflation in July 2024.

But isn’t this better than the 0.5% in June 2024? And isn’t low inflation good?

It depends. Of course, consumers prefer when inflation is low but it means something more disastrous for the Chinese economy.

A low inflation means that the economy isn’t generating enough demand.

And low demand equals low business revenue and profits.

I am concerned that inflation is so low in China now. Historically, inflation averages around 2.0%. But since February 2023, inflation only averaged around 0.1%.

Holy shit.

This is not good for the company’s share prices in China if this continues.

Takeaway: I am not too sure about China’s economic and market strength right now.

It seems like it will be weak at least for the next 3 to 6 months. But things could change if economic data such as gross domestic product, retail sales or industrial production show significant improvement.

But all bets are now on its high youth unemployment rate and property market collapse. If these things don’t improve, China will be like Sisyphus eternally pushing the rock up.

Of course, there are opportunities to get some cheap bargains. But I will only reserve that for the strongest of companies with a long dividend track record.

United States: Money on Rate Cuts

Inflation: Good news. Inflation came in at 2.5% in August 2024, down from the 2.9% in July 2024.

This means that the Fed’s job might be done soon, and it might cut rates in the next meeting.

I can already feel investors salivating at the idea of a rate cut in September’s meeting. Investors are pricing in a 100% chance of a rate cut. How big the cuts are is the big question. According to CME Fedwatch, these are the odds

1) 58% chance for 25 bps cut

2) 42% chance for 50 bps cut

All eyes will be on 18 September 2024 when the Fed convenes to decide on this. Let’s hope they play ball and cut.

Takeaway: I will be keeping a close eye on the cuts next week by the Fed. Historically, when the Fed decides to cut rates, stock markets in the US have gone considerably up.

But I am holding my reservations first.

After all, a recession might be coming. The odds are still more than 50% for the next couple of months, peaking at 63% in December 2024.

Either way, it will be a good opportunity for me to pick up some US blue-chip stocks with a fantastic dividend track record.

Disclaimer: I take no responsibility for anyone’s investment and financial decisions. The information here is all meant for providing information only, and shall not be interpreted as financial advice or recommendations.