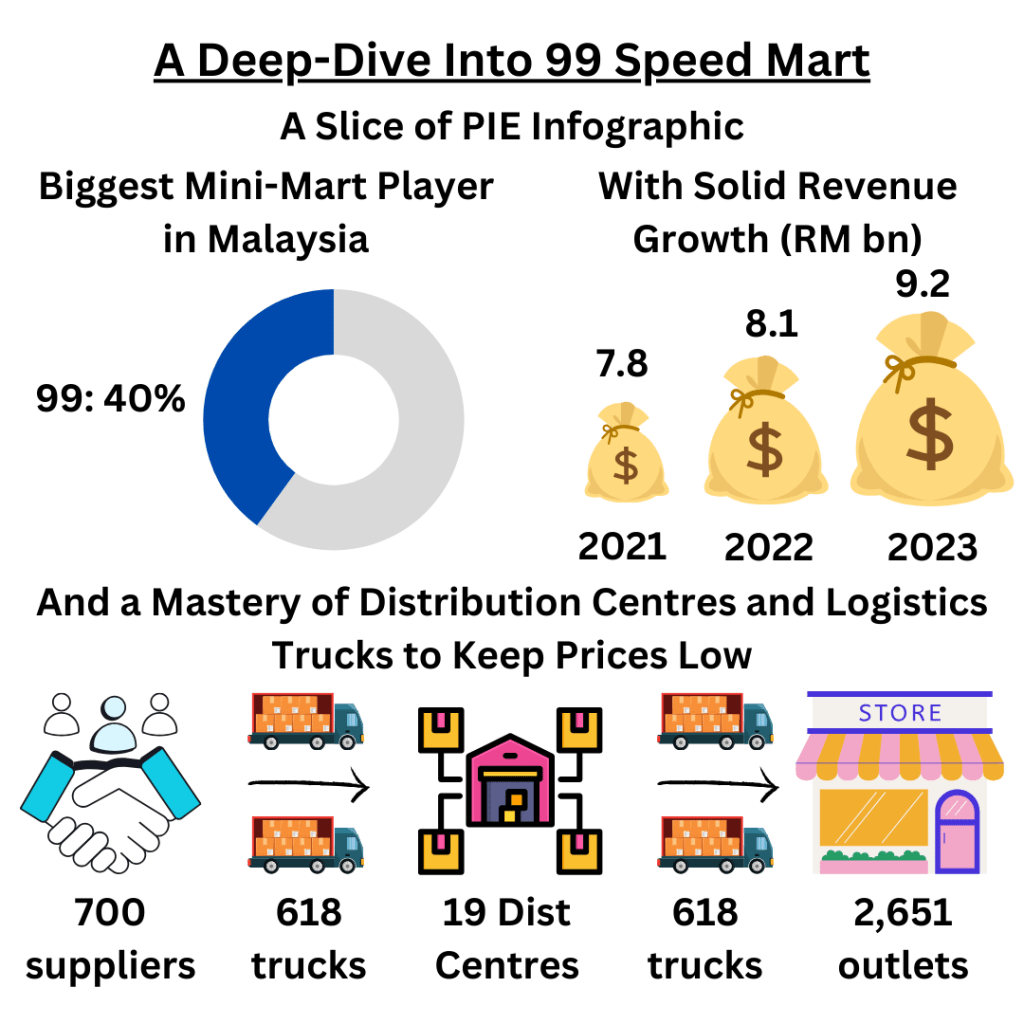

99 Speed Mart was listed on 9 September and the share price soared by 16%. It is Malaysia’s biggest mini-mart player, and investors are excited about investing in it.

It is currently up by 16% from its listing price of RM1.65.

I didn’t want to cover 99 before this as I think it is still in the honeymoon phase. This was undoubtedly one of the most anticipated IPOs in the Malaysian market since Mr. DIY in 2020.

Here is an objective analysis of the company and its pros and cons.

Summary

- Pro 1: 99 Speed Mart is the biggest mini-market player in Malaysia

- Pro 2: It garnered strong financial performance in the past 3 years

- Pro 3: 99 has a high dividend payout and has stated a 50% dividend payout policy

- Con 1: It is a low-margin business with risks threatening their profitability

- Con 2: Inventory risks are high

Disclaimer: This is only meant for educational purposes and should not be construed as financial or investment advice. I take no responsibility for any decisions made.

The Economics of 99 Speed Mart

If you are a Malaysian, you will be familiar with the joke. Wherever a 7-Eleven opens up, a 99 Speed mart will also open up.

Here’s the economics.

Firstly, their target market is shoppers who want to buy daily necessities such as instant food & beverages, personal & baby care products, and household products. Their purchases are small and it is an in-and-out kind of purchase. 99’s average transaction is just about RM22.

99 offers three values – fast, convenient and affordable.

- Shoppers don’t take long in a 99 – maybe up to 10 minutes only

- The nearest 99 is probably only 5 to 10 minutes (whether by driving or walking)

- 99 products are priced lower than other convenience stores

It can offer a quick shopping trip as 99 focuses on fast-moving consumer goods (FMCG) (that you don’t think too much about when buying).

Meanwhile, 99’s strategy is to put its stores as close as possible to where its customers live. They are all one or two-shop lots at the corner where parking is ample.

Lastly, it prices its products affordably. It can do so because it buys things in bulk and distributes them efficiently to all its stores.

How 99 Perfected its Supply Chain

I will give kudos for this.

Not many mini-marts can provide the 3 value-add to customers.

I think its supply chain is worth another long-form article on its own, but here’s a concise version of it.

It relies heavily on its supplier relationships. In economics, when you buy in bulk, a seller would be willing to sell the products cheaper.

And it has big, long-term contracts with the likes of Nestle, DKSH, TTS, Dutch Lady, and Great Plus. These 5 companies make up 27% of 99’s purchases.

Most of its suppliers also provide incentives and fees that represent about 9% of 99’s revenue in 2023. This enabled 99 to reduce prices and gain money from suppliers.

But 99 brought this a step further.

It built 19 central distribution centres (DC) across Malaysia. And it owns and operates 618 delivery trucks to handle the logistics and transportation.

80% of its products are first delivered to DCs, then redistributed to its outlets. The other 20% are delivered directly and include perishable products such as bread, fresh milk, eggs, ice cream, and frozen food.

TLDR: 99 has excellent relationships with its suppliers, buys a shit-ton of products, and controls the whole logistical process.

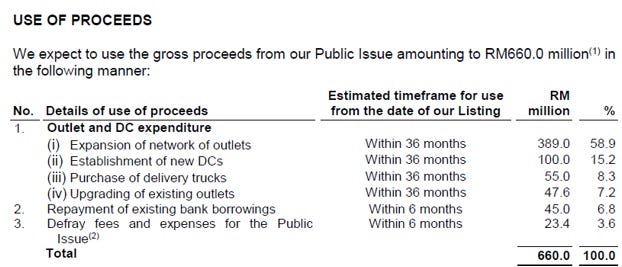

99 Raised RM660 million to Expand to Kelantan, Terengganu, Pahang, Sabah and Sarawak

Well, the number is different. I know.

You would have seen RM2.36 billion floating around in the media.

But that’s a misleading figure. 99 is raising RM660 million to fund the company’s expansion, while Lee Thiam Wah will pocket the rest. He wants a payday basically.

I am not one to comment on someone’s company, but this makes him among the richest person in Malaysia.

I digress. Let’s look at what the RM660 million will be used for. Here’s the table provided

There are two key ones here that I want to talk about – expansion of network outlets and establishment of new DCs.

Both are the right moves.

99 aims to expand its outlets to 3,000 by 2025 from its 2,651 currently. More outlets equal more penetration into markets and more sales.

It will utilise RM220 million to as capital expenditures for the outlets (to buy equipment and renovate) and RM169 million for inventory. The inventory part reminds me of how Farm Price used 43% of its IPO money to buy inventory to stock up. 99 is using about a quarter of them. I don’t like it, but it seems that this is an industry norm.

Secondly, 99 will use RM100 million to build 6 distribution centres by 2027. Right now, it has plans to build 3 in Kedah, Sabah and Pahang.

99’s strategy here is to expand outlets to the northern and eastern regions of Peninsular Malaysia and East Malaysia (Sabah and Sarawak). These states currently only make up about 26% of its revenue in 2023.

Pros and Cons

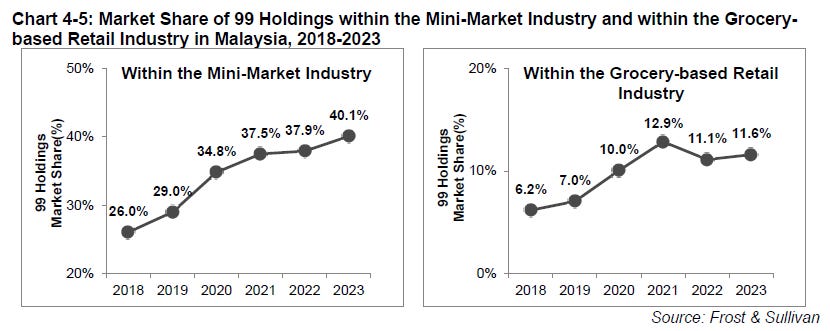

Pro 1: 99 is the Largest Mini-market Player in Malaysia

Everyone loves monopolies.

And 99 is close to one. According to data from Frost and Sullivan, 99 make up about 40% of Malaysia’s mini-market industry and 12% of the grocery-based retail industry.

A dominant position in the market allows it to corner its competitors, as it expands more outlets. Its negotiations with suppliers also get easier. After all, 99 will carry a lot of products from them.

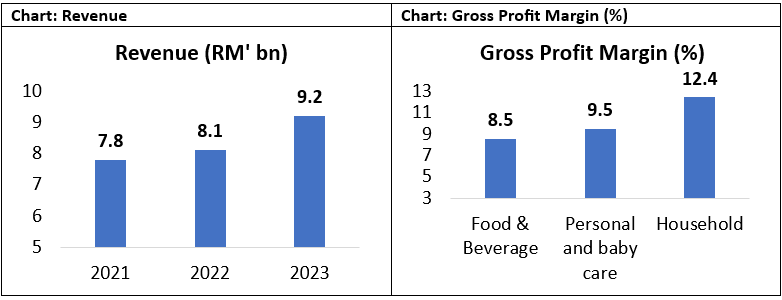

Pro 2: Strong Financial Performance

Two aspects here.

Firstly, revenue has grown by 10% every year from 2021 to 2023, and it now generates RM9.2 billion in annual sales.

Most of this growth is coming from household products, growing by 14% every year. And this is good as household products have higher margins compared to the other products.

Pro 3: High Dividend Payout

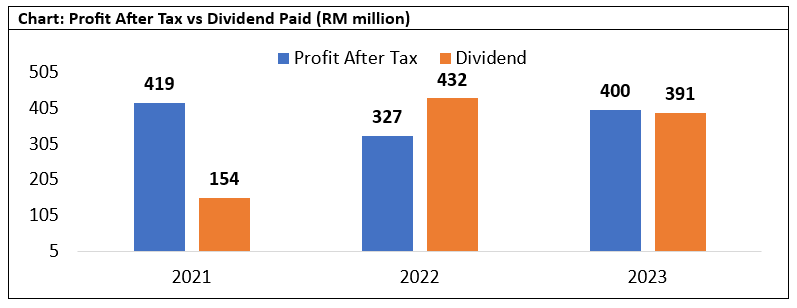

99 pays out a lot of its profits in dividends. In 2022 and 2023, 99’s dividend payout was 123% of its profit after tax.

Moving forward, 99 is targeting a dividend payout ratio of 50% of its profits.

Con 1: 99 is a Low Margin Business

Nothing against low-margin businesses.

But I just think that 99 is exposed to a lot of risks that could easily erode its profits.

Remember when we talked about the incentives and fees provided by its suppliers? Well, they constitute about 8.8%, 9.2% and 9.3% of 99’s revenue from 2021 to 2023.

99’s profit margins averaged around 4.0% to 6.0%. Without these incentives and fees, 99 could easily sink into a loss position.

While that is unlikely, other risks could affect this.

I am more worried about its raw product cost from its suppliers. 99 can only charge about 8% to 13% higher on the cost prices. We have seen that sudden inflationary pressures could easily cause supplier prices to drastically increase.

Furthermore, reputational risks are a REAL risk in today’s social media. KK Mart’s controversy in its socks could easily be 99’s problems too if it’s not careful in its product selection.

Con 2: Inventory Risks

I was quite worried when I saw that its inventory turnover days increased from 39 in 2021 to 52 in 1Q 2024. It means that 99 is taking longer to sell its products.

While it isn’t an issue for long-lasting products, it is for perishable ones. 99 has no control over the quality of the products delivered to them.

Hence, whatever issues its suppliers have will be 99’s problems too.

Financial Valuation

Both Hong Leong and Inter Pacific have valued 99 at a target price between RM1.75 to RM1.98, of which 99 is currently trading at RM1.95.

Here are the main assumptions that both research houses have taken.

1. Hong Leong

- Average growth of 13.1% and 15.8% for revenue and profits from 2023 to 2026

- Driven by the opening of 250 retail outlets

- Stable same-store sales growth of 2% every year

2. Inter-Pacific

- Target price-to-earnings ratio of 30 times

Conclusion

99 Speed Mart is undoubtedly the biggest mini-market player in Malaysia. It has a dominant position, gives excellent value to its customers, and has an efficient supply chain and logistical systems.

Its financial performance has been impressive while also giving a huge portion of its profits in dividends. However, one needs to be careful about 99 being a low margin business and having inventory risks typical of a mini-market.