Source: Unsplash

Researching and writing about companies is a strange one.

Many expect people to pick stocks for them. But I don’t believe in that. I believe that it’s easier and better to do your research on them.

What I will do here is outline the research process I take to identify stocks that are worth researching.

Then, I will do an objective analysis of their pros and cons.

2 weeks ago, I did a deep-dive into US rate cuts here. My takeaway from there was that the information technology, real estate and utilities sectors were worth researching about.

Disclaimer: This is only meant for educational purposes and should not be construed as financial or investment advice. I take no responsibility for any decisions made.

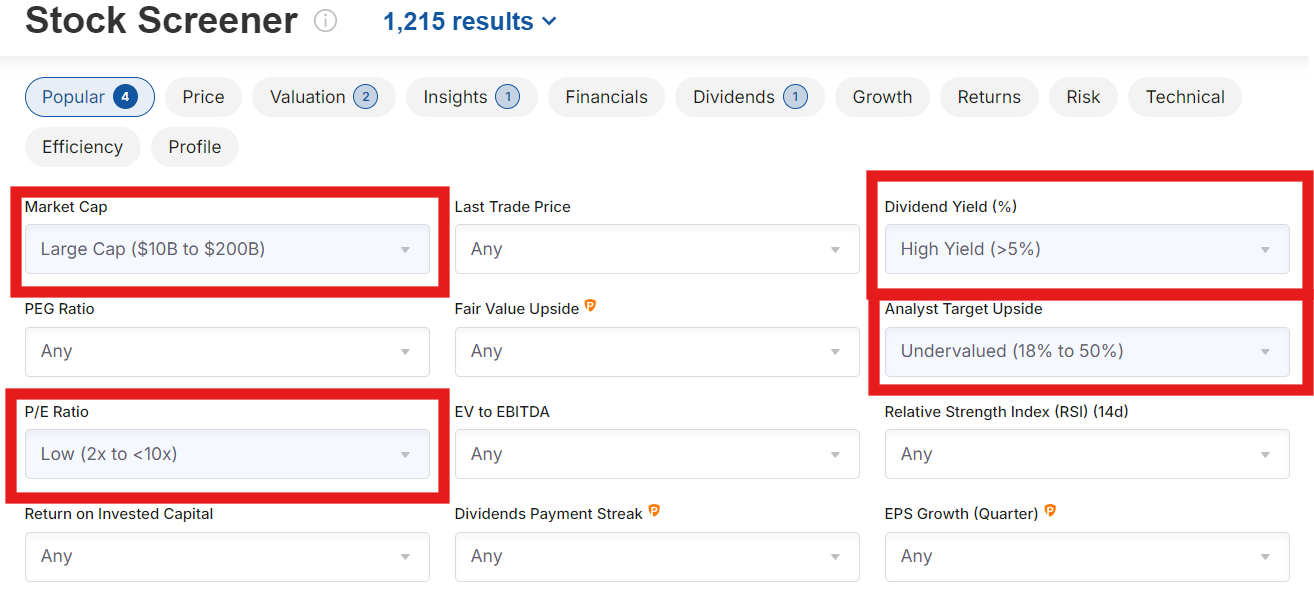

Filtering for Criteria through a Stock Screener

There are many stock screeners out there that you can use. For me, I prefer using investing.com’s one here.

I have four main criteria:

- Price-to-earnings ratio that is below the historical average or generally 10 times.

- Dividend yield that is ideally above 5.0% (but if not, just more than 0 is fine)

- Market capitalisation of large to mega

- Analyst target upside of more than 10% (best case) or 5%

Here’s what it looks like from investing.com.

From here, I will select the sectors of technology, real estate and utilities from the stock screener to see the results.

Results of the Stock Screener

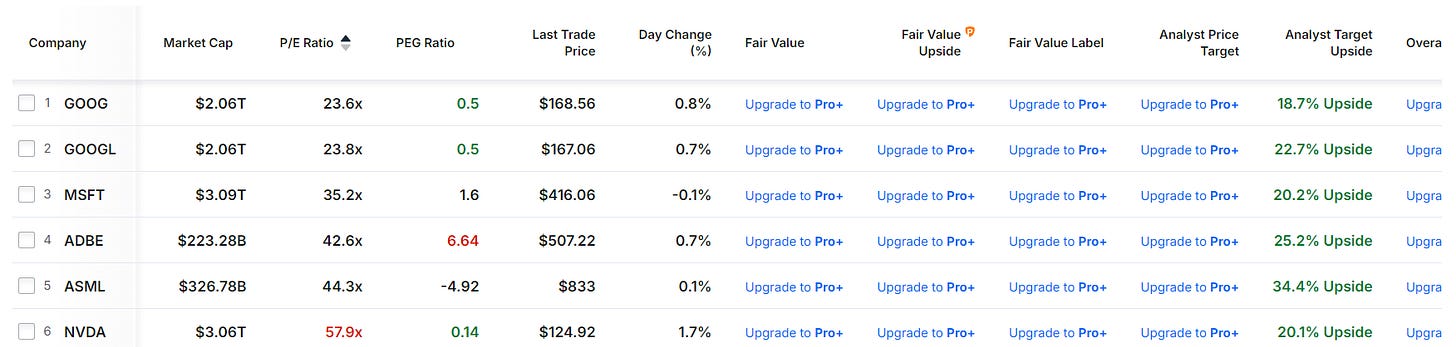

Technology

Let’s look at the technology sector first for mega-cap (more than US$200 billion in market cap). I had to tweak the price-to-earnings (PER) ratio to be more than 0 as most tech companies trade at an average of 39 times.

From here, Google is trading at the lowest PER of 23.6 times with a target upside of 22%. The other companies have high upsides also, but I chose Google to research considering that they have higher than the industry PER.

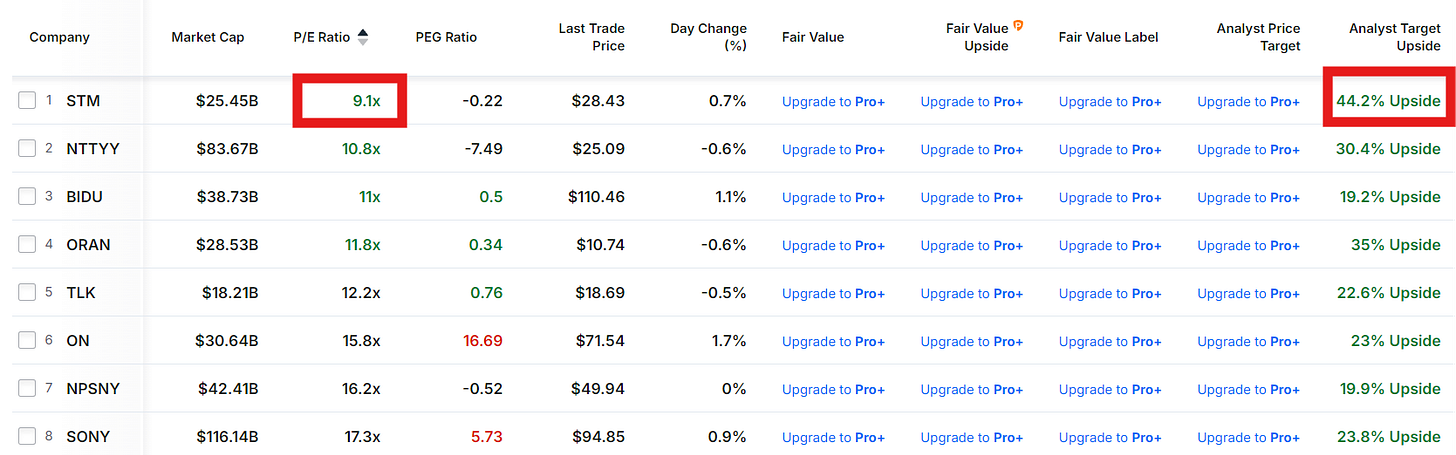

I then switched over to large cap (US$20 billion – US$200 billion) and determined that ST Microelectronics was trading at a low valuation with a high upside.

Real Estate

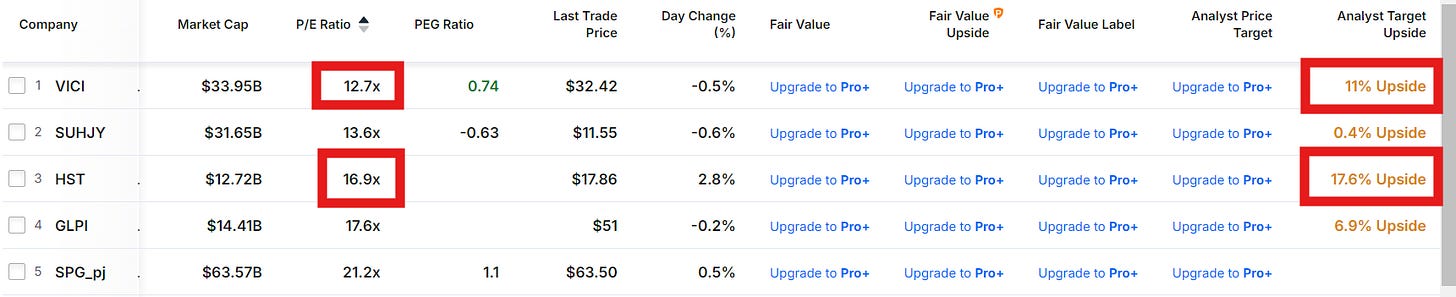

Switching over to the real estate sector, here is what I got.

Vici Properties and Host Hotel Resorts stand out here with high potential upside and relatively cheap valuations.

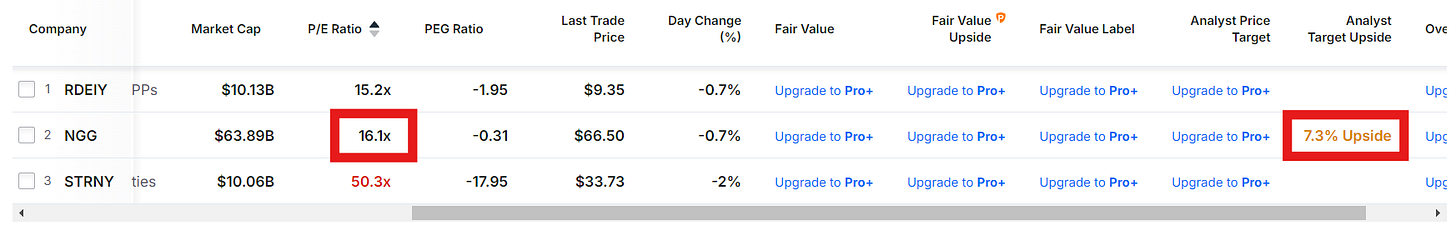

Utilities

From the utilities sector, National Grid stands out with a potential upside of 7.3%.

The Pros and Cons of Each Company

Here is the in-depth research into the pros and cons of each company.

Google (Tech)

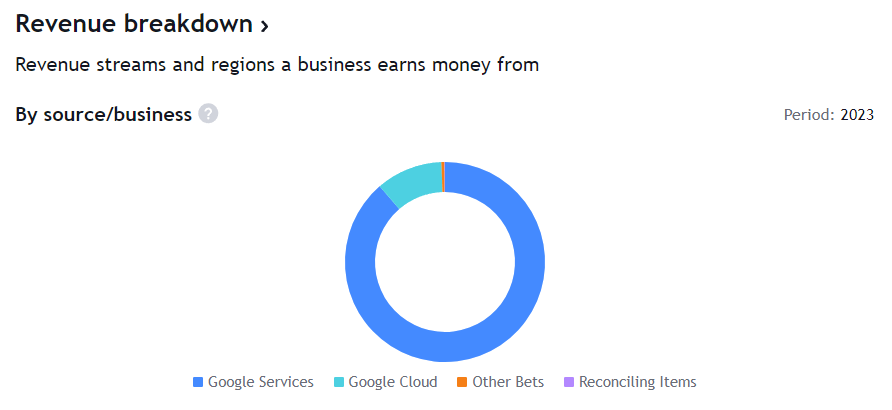

Google lets you search for things on the internet quickly and reliably and sells advertising services to companies so that their products reach your eyes. Meanwhile, it’s also involved in cloud services where you and other businesses can get storage solutions.

Advertising is its biggest revenue contributor at 88% of revenue.

Source: Trading View

Here are the pros and cons:

- Financial performance has been solid

In the past four quarters, Google has registered an average revenue growth rate of 13.8%. Meanwhile, profits for the latest quarter grew by 28.6% to US$23.6 billion. - Relatively cheap valuations

It is trading at a PER of 23.8 times, slightly lower than the historical median of 27 times. - Low dividends

Very low at 0.5%. - Outlook stable but AI trend is not that positive

The advertising business has a stable outlook since it is a market monopoly. However, its ventures into AI have not been fruitful. It may lose out in the AI competition to Microsoft in the long term. - Regulatory risksGoogle has recently lost an anti-trust lawsuit by the U.S. Department of Justice and was fined EUR2.6 billion by the European Commission.

Market analysts have Google at a target price of US$202, a potential upside of 20.2%.

ST Microelectronics (Tech)

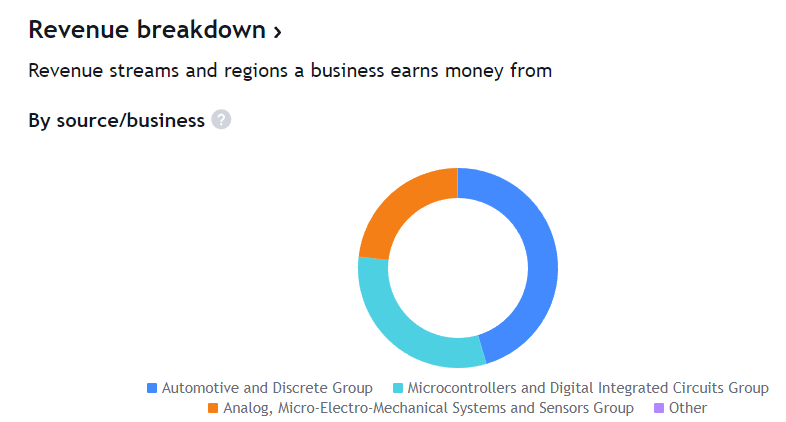

ST Microelectronics (STM) produces and sells semiconductors and other electrical and electronic components to the auto sector mainly.

Source: Trading View

Pros and Cons

- Weak financial performance

SMT’s revenue has been declining for three consecutive quarters. Even worse, profits have declined for 5 consecutive quarters. - Cheap valuations

PER is trading at 9 times compared to the 5-year historical average of 19.4 times. - Low dividend yield

Current dividend yield is only at 1.0%, but is higher compared to the historical average of 0.5%. - Outlook is good for EV

Since it services the automotive industry mainly, the rise of the Electric Vehicle (EV) markets in the US, Europe and China should be positive for SMT.

Analysts have SMT at a target price of US$40.5 with a potential upside of 42.3%.

Vici Properties (Real Estate)

Vici Properties is a real estate investment trust (REIT) that holds gaming, hospitality and entertainment properties. Its landmark assets include MGM Grand, Caesars Palace Las Vegas and Venetian Resort Las Vegas. Think of it as an all-in-one casino with hotels and entertainment venues.

All of its businesses are in the U.S.

Here’s what I am considering for its pros and cons

- Great financial growth in the past five yearsRevenue has grown by more than four-fold to US$3.6 billion in 2023 from US$894 million in 2019. Profits too – rising by five-fold to US$2.5 billion from US$500 million over the same period.

- Decent dividend yields

Vici gives about 5.2% currently, where dividends averaged 4.7% in the past. - Cheap valuations

PER is at 12.8 times compared to its historical average of 22.2 times. - Steady outlook for tourism in VegasThe number of tourists visiting Las Vegas increased by 5.2% to 40.8 million in 2023. There is still room for it to recover to the 42 million yearly average before the pandemic.

- Sensitive to the state of the economyVici is in a high-roller sector which is casinos. It is very much dependent on whether consumers have the cash to come.

Analysts have Vici at a target price of US$35.94 which implies an upside of 11.2%.

Host Hotel Resorts (Real Estate)

Host Hotel Resorts manages luxury and upscale hotels mainly in the United States. It has brands like Four Seasons, Marriot, Ritz Carlton, and Hilton.

Here are its pros and cons

- Ok financial performanceAt least its revenue has recovered to US$5.3 billion in 2023, close to its 2019 level of US$5.5 billion. Its latest financial quarter shows that its revenue grew by 5.2% to US$1.5 billion.

- Recovering profit margins

Its net profit margin for the latest quarter has risen to 16.8%, similar to 2019’s 16.8% also. - High dividend yield

The dividend yield is currently at 6.1%, with a historical average of 6.5%. - Expensive valuation

PER is at 16.4 times, much higher than the historical average of 11.6 times and the industry’s average of 6.8 times. - Sensitive to the state of the economyHotels are dependent on tourism in the U.S. and whether Americans have disposable income.

Analysts have it at a target price of US$20.5 with a potential upside of 18%.

National Grid

National Grid provides electricity mainly in the UK but has extensive operations in Massachusetts and New York.

Pros and cons

- Declining financial performance

Revenue has declined in the last two quarters. Profit went down a whopping 82% to GBP1.2 billion in the latest quarter. - Strong dividends

Dividend yield is at 5.7%, with a historical average of 5.2%. - Ok valuationsPER at 21.8 times is lower than the historical average of 22.2 times, but is much higher compared to the industry’s average of 9.0 times.

- Boring but stable outlook

The utilities sector doesn’t see many exciting things happening. So share price changes are rare. This could be good or bad depending on how you look at it. - Exposed to volatility in commodity prices

Crude oil, natural gas, coal and other energy commodity prices will change the company’s profit margins in an unpredictable manner.

National Grid’s target price is at GBP1,127 with a potential upside of 14%.

Disclaimer: This is only meant for educational purposes and should not be construed as financial or investment advice. I take no responsibility for any decisions made.