Uncle Pooh be bringing us in a merry-go-round

I still remember a fond memory of taking the merry-go-round with my parents in a fair in town. I was young, still clinging on to the sleeves of my mom. But as I ascended to the top, the lights flickered first into the corners of my eye, then to the centre. The town below was in full view, like big fireflies.

But as I descended, a sinking feeling emerged from my stomach. The lights slowly go out and I am left with a dark car park view.

That’s how I feel about China now.

The Hang Seng China Enterprise Index (HSCEI) declined 6.6% in the past week to 7,620, reversing most of its gains.

The main reason? The Chinese government didn’t promise more concrete policy support for the economy.

So, investors noped its way out for the week. Since then, the HSCEI declined further for this week, leaving an opportunity to find some undervalued companies.

This week, we will go through the five big news hitting the markets, and also the stock market and economic reviews. Then, we will look at the trends that we can take advantage of.

The Big 5s in Economic and Market News

Here are the 5 big news that hit the markets last week

- Tesla Robotaxi: Tesla has unveiled its long-awaited Robotaxi which is self-driving. However, it seems that the markets were quite disappointed as

- It is only a two-seater. Families and bigger groups can’t take it.

- It will only start production in 2027

- China stimulus lacklustre: China has struck again. First, it sent our hopes up. Then, it shot it down with lacklustre news on its government support again.

- Some are saying this might backfire on them.

- While some are still bullish on the market.

- Google break-up: The Department of Justice wants to ‘break-up’ the Google monopoly.

- It has bragging rights now because it won the anti-trust case against Google.

- And Google is seeing another anti-trust case in its ad-tech business.

- Chicken and egg: Malaysia is considering removing the subsidy on chicken and eggs in the upcoming budget.

- Poultry stocks such as Teo Seng and Leong Hup fell.

- However, in the long term, this will have little impact on earnings.

- Upcoming Budget 2025: Malaysia’s Budget 2025 will be held on 18th August 2024 at 4 pm. Stay tuned for it!

Markets Fresh from the Oven

The down-low to the performance of the U.S. and Malaysia markets

The U.S.: The S&P 500 rose by 1.1% for the week as inflation has once again eased slightly to 2.4% in September 2024 from 2.5% in August 2024.

It seems investor interest is coming back to the U.S. after many were caught with their pants down in China last week.

Malaysia: The FBMKLCI only rose by 0.4% for the week as investors are keeping track of the upcoming budget and closing their purses.

Market Trends for the Week

Here are the market trends that I will be keeping an eye out for the week.

Short crash in China stock market: The short respite in the Chinese stock market has presented an interesting opportunity in the market. We know that the market has a catalyst to go up, which is the support of the government.

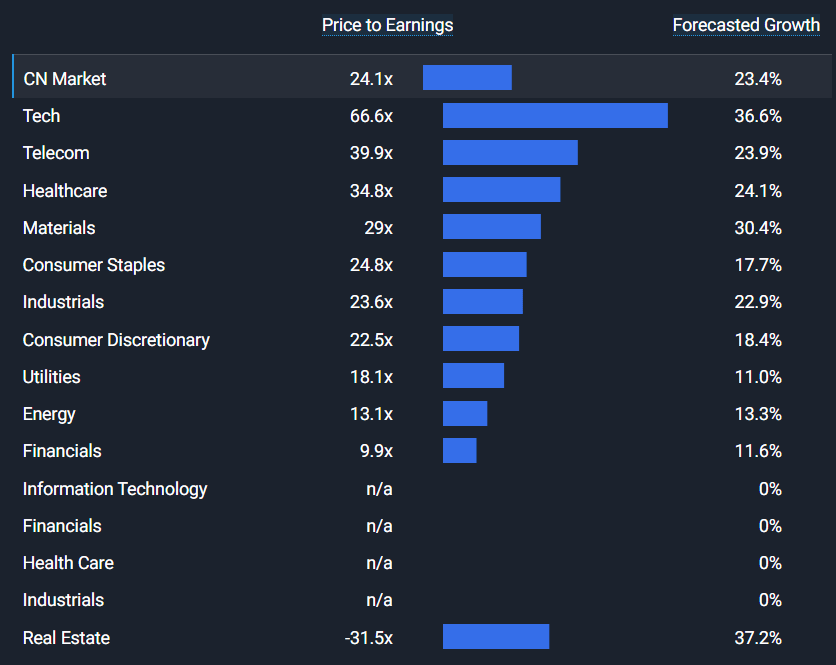

Chinese stocks have traded downward back to their average price-to-earnings ratio of 23.9 times after rising to 25.3 times over the past two weeks. Here is a quick snapshot of the sectors valuation.