Always the eternal optimist.

The Budget 2025 has just concluded. And there is one big fat elephant in the room. Can the FBMKLCI regain 1,700 by the end of the year?

Prime Minister Anwar Ibrahim seems to think so as he blows his foreign investment horn loudly by declaring that it has attracted more than RM230 billion in investments.

But blow me.

I have never believed in foreign investment numbers. They are a convenient political PR tool that politicians tut their horns and then forget the next year.

The market wasn’t fooled. The FBMKLCI was essentially flat at 1,646 on Monday after the Budget 2025. Good for investors, at least they weren’t hoodwinked by the Budget 2025.

I have my thoughts on the budget but that will have to come later after the politicians sort the details out and I can give my full analysis.

Until then, I will be doing in-depth research into the Malaysian sectors that are affected by the budget announcements by the end of the week.

For this week, I am giving a recap of the five big news for the markets, and giving my thoughts on the expansion of SST scope in the ‘Infographic of the Week’ section.

Then I will recap the market performances from last week, and finally detail what the Malaysian research houses are saying about the budget.

Disclaimer: This is not investment or financial advice. This is meant for educational purposes and we take no responsibility for anyone’s decision.

The Big 5s in Economic and Market News

Here are the 5 big news that hit the markets last week

- Cap on AI chips by US: The U.S. is once again, considering imposing a ban on AI advanced chip exports to other countries.

- Specifically, Nvidia, Intel and AMD will be affected.

- Nvidia has commented that two AI chips will be affected — A800 and H800. And, it is considering moving its operations to countries that will not be affected by US export controls.

2. Boeing to seek funding: Boeing will be looking to raise about US$25 billion in funding to avoid running out of cash.

- It is worried about the prolonged strike by Boeing employees for 1.5 months.

- But the union is set to vote on the latest deal this week.

3. Pony AI IPO: Pony AI is a Chinese robotaxi company, and is filing for an IPO in the US markets.

- It was valued at US$8.5 billion in 2022.

- Details of its IPO are here. I will cover this company next week.

4. Targeted fuel subsidy in Malaysia: Malaysia has announced its targeted fuel subsidy system and it will be implemented by the middle of 2025.

- RON95 prices will remain the same for 85% of income earners, while the top 15% (more than RM13,000 per month) will not enjoy the subsidised prices.

- Further announcements indicate that income will not be the only criteria for this and that a MyKad system might be used to filter Malaysians when they go to the pump.

5. Minimum wage increase: The minimum wage for Malaysians has been increased to RM1,700 per month from RM1,500 previously.

- It will start in February 2025, with some exemptions for companies with less than 5 workers.

Infographic of the Week

I got this from the Budget 2025 speech by Anwar Ibrahim.

TLDR: Malaysia has low taxes compared to other countries in Southeast Asia, so it’s trying to tax more things through the Sales and Services Tax (SST). This affects consumers aka us, the regular Rakyat.

If you judge a book by its cover, it does seem like we need more taxes. But this is an oversimplification. And politicians love to muddle the waters by presenting you with things that they want you to see.

So, I am going to dive deeper into this based on objective facts and data.

This chart is misleading. It delivers the message that Malaysia’s tax revenue to gross domestic product (GDP) is low, so it’s good to tax more.

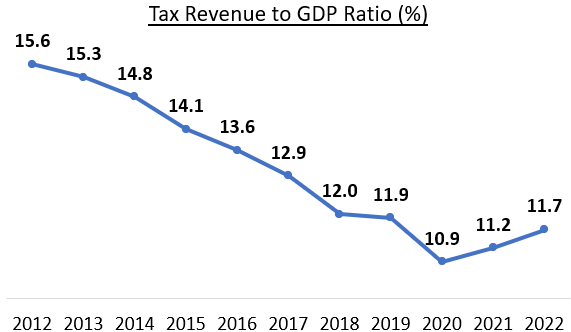

This is half the story. Malaysia’s tax revenue to GDP ratio has actually been declining since its peak of 15.6% in 2012 according to data from World Bank.

The reason? GDP growth outpaced tax revenue growth.

Between 2013 to 2023, GDP growth averaged 4.1% while tax revenue growth averaged 3.9% based on data from Bank Negara Malaysia and MacroTrends.

Mind you, between these years, Malaysia implemented the Goods and Services Tax (GST) which was highly controversial before it was repealed in 2018 in favour of SST again. And yet, the tax revenue to GDP ratio has consistently declined because GDP growth was much stronger.

But what’s that?

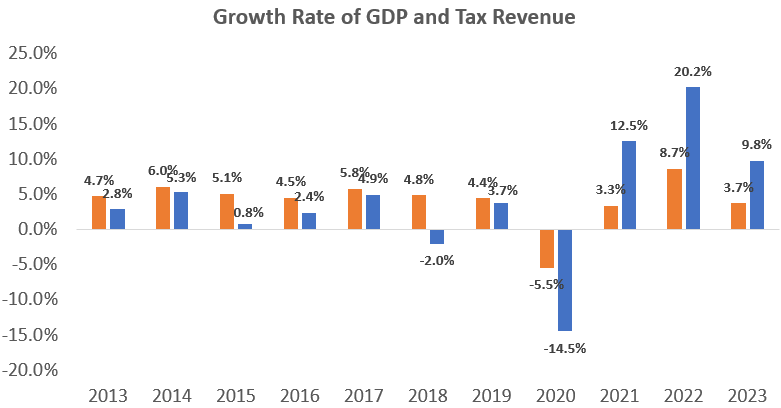

In the past few years (2021 to 2023), tax revenue growth has outpaced economic growth. Again, I want to draw your attention to the fact that

- Tax revenue declined a whopping 14.5% during the pandemic year of 2020.

- Most of the rebound in tax revenue growth (average: 11.9%) after 2020 was driven by business (average: 23.3%) and petroleum (average: 26.9%) taxes.

Just based on the cold-hard facts here, no, that is not the right reason to raise taxes.

- Tax revenue is already rebounding after the pandemic driven by business and petroleum taxes, and this has driven the increase in tax revenue to GDP ratio.

- Malaysia’s tax revenue to GDP ratio has been even higher in the last decade, but higher economic growth has driven this ratio down. Nothing wrong here and no reason to say ‘Time to raise more taxes”.

So, I am calling the government’s bluff on this.

Markets Fresh from the Oven

The down-low to the performance of the U.S., China and Malaysia markets

The U.S.: The S&P 500 rose by 0.8% to trade at the 5,865 level for the week. Not much news from last week, but retail sales came out higher at 0.4% month-on-month in September 2024, beating market expectations of 0.2%.

China: As fast as it rose, The Hang Seng China Enterprise Index (HSCEI) crashed by 2.0% again last week. As usual, there are no specific government announcements that inspired investors. It’s all bout the vibes (or the wind) now for China.

Malaysia: The FBMKLCI rose by 0.8% as investors awaited good news from the Budget 2025.

Market Trends for the Week

Since it’s budget time for Malaysia, this week’s edition will focus on what the research houses have said about the budget and their recommendations.

MIDF: No major surprises. Positive on construction and consumer sectors from the budget. Target KLCI at 1,750 by the end of 2024.

Maybank: Neutral. Made no changes to any calls and have maintained ‘overweight’ on banks, construction, consumer goods, gaming, oil and gas, real estate investment trusts sectors. Target KLCI at 1,720 for 2024 and 1,840 for 2025.

Public Investment: Positive. Construction sector to benefit. Target KLCI at 1,750 for 2024.

RHB: Neutral. It maintained its ‘overweight’ on banking, property, M-REITs, construction, technology, healthcare, basic materials, oil and gas, utilities, and rubber products sectors.

Kenanga: Only the consumer sector is the winner.

TA Securities: Target KLCI at 1,690 for 2024.

Apex Securities: Neutral. The construction, consumer, tourism-related, healthcare, gloves, property and technology sectors are likely beneficiaries from the budget.

CIMB: Neutral to slightly negative. Construction and healthcare sectors stand to benefit. Target KLCI at 1,732 for 2024.